Finding a good crypto gem is not an easy task. You need to test, investigate and check interesting project as deep as you can.

GEM RESEARCH MANUAL

1.INTRODUCTION

Everyone in crypto will tell you that diversification is important, but this should apply to your trading and investing strategies as well as the tokens you hold. Even if you’re all about TA-based trading of larger cap coins, you still shouldn’t neglect FA and gem research, since the upside is simply too big to ignore.

At the end of the day, it’s extremely unlikely for a top 20 coin to pull a 100x or even a 10x in a matter of weeks or months, and this is exactly why smaller cap gems are such a great opportunity. But that doesn’t mean that you can just buy any random token you find on DEXes and expect huge profits. You have to do it right – having the right skills is all the difference between doubling your portfolio by investing 5-10% in small caps and getting caught in a rug pull.

The first thing you have to keep in mind is not to start with TA. That will be what you’ll use for finding a good entry only after you’ve already decided that the project you’re researching has value. Instead, start with the fundamentals – remember, there’s a reason why they’re called that! Learning how to recognise them and investing in projects that have them correct will make you a lot more profits than trading in the beginning. If you find relatively small cap coins with good fundamental asymmetric potential is insane because it has a lot of room to grow and once big boys starts investing in it all around hype kicks off. I’ve seen this with countless coins in every bull run.

Now let’s start with the process.

2.FIRST STEPS

The first step is the basic data you can find on CoinGecko or a similar site: market cap, volume, how long the token has been around and where it’s listed. That’s also where you’ll find the relevant links to the project’s website and socials, and this is where the real research begins.

One of the things you’ll find on the project’s website is a list of partners and backers. That’s probably the biggest piece of information that most people miss, but it can tell you a lot about the token. Simply put, if SBF or Zhu decided to invest in it early on, you can be sure as hell that they did much better research than you could possibly do on your own. They’re expecting it to moon, and you better believe they have a good reason to think that.

Apart from the backers, the crucial thing is to see what the project is doing. What are its use cases, does it have any competition and are their plans realistic? There are plenty of projects in crypto with nothing but empty promises to drive hype, but these won’t help you in the long run. What you need to do is figure out if the project is actually building something or is just there to grab some money.

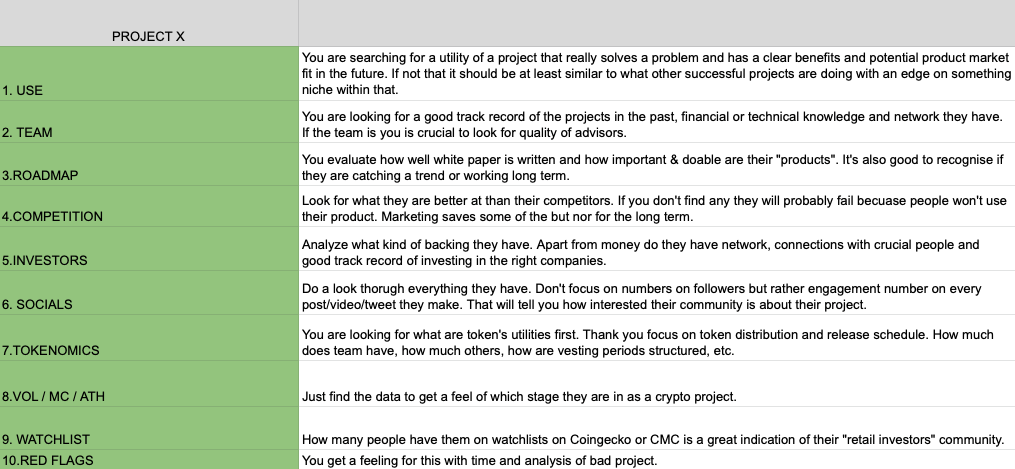

So I basically always create an excel sheet in which I start writing things down for each “category” that I mentioned above. Here is an example and explanation for what to look for.

3.GOING DEEPER

Also, not many people do it but I highly suggest you read the project’s documentation. If you’ve got enough technical knowledge, you can figure out if it makes sense, and even if they’re doing something super advanced that you haven’t got a clue about but you’re considering a large investment, it’s even a good idea to connect with some devs to get good feedback on the project. That might seem like a lot of work, but trust me, it’s worth it for a 100x.

I also always do in depth research of the team because that’s the biggest variable of overall performance, but the problem is that many projects nowadays are built by anonymous devs. The thing is, that’s perfectly fine if you’re researching a DeFi protocol (as long as they have some audits!) or privacy coin, but if you see an anonymous team doing something that has no reason to be anonymous – think fiat gateways, integrations with stuff outside of crypto etc. – that’s a huge red flag right there.

Now the fun part – Market Making

Since I have a lot of funds at this point I can do some testing on the chart to see how the coin behaves. How do I do that? I basically do some market making for them. Of course, this isn’t something that just anyone can do – and it’s not something absolutely essential – but I like how it gives me a feel for the coin that I can’t get any other way.

Practically speaking, I do this by buying and selling large amounts to see what happens. If you’ve got enough capital, you can do a test pump on a lower volume coin without spending that much money, and it’s a very useful piece of information to have. What I’m looking for when I do that is to see if the project uses bots on the exchange, whether the team or large investors start selling immediately as the price goes up a bit etc. This is because just the orderbook isn’t enough: many teams won’t have large limit sell orders at all, but when the price starts pumping they’ll put up sell walls immediately. That way, I can see what the mood among the team and biggest holders is, so I know how easy it is for the coin to pump.

4.LOAD YOUR BAGS, SIT BACK AND RELAX

Finally, if everything above checks out, decide how much you want to invest and have a look at the chart. Now is when you need to do some TA to find an entry, but this also depends on how liquid and how new the project is. If the token has only recently been listed on DEXes, there’s no point in trying to make sense of a chart with a handful of 4H candles, but if it’s been around for a while and is listed on CEXes, then looking for good entries is a must. Sure, you can buy some immediately if you’re really confident in it, but keep in mind that small caps can have crazy wicks and set some lower bids too.

When you’ve got your bag, you can relax. Just make sure to check up on it regularly, but don’t overthink the chart: if you believe it can do a 10x, why would you consider selling it after a 10% gain (or a 5% drop)? When it does start putting in multiples, then sell some of it in different phases, but this will be the topic of another manual on taking profits. Sometimes it takes a while to do couple x so don’t give up on it too quickly in a bull market.

That’s it for now – enjoy the Altseason and make some money!

My Timeline bloodgoodBTC