⦁ In the last time news, Federal regulators closed down the 16th-largest bank in the US on March 10, 2023.

But!

⦁ On March 27, 2023. First Citizens to Acquire Most of Silicon Valley Bank at a $16.5 billion discount, assuming $72 billion in loans and $56 billion in deposits.

The failed Silicon Valley Bank, a business that catered to tech startups, including cryptocurrency firms, announced late Sunday that it had reached an agreement with Raleigh, North Carolina-based First Citizens Bank to buy its deposits and loans. This deal could be worth up to $500 million, according to the Federal Deposit Insurance Corp.

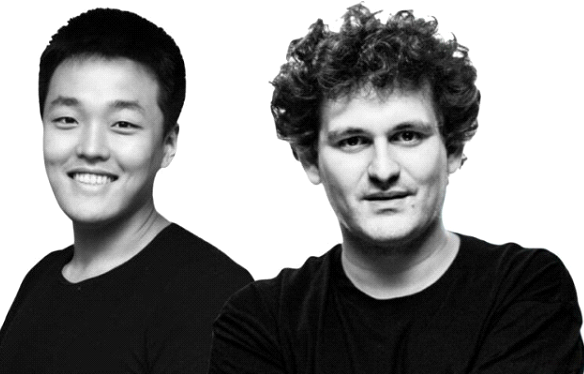

Wait what? Terra Luna’s founder is now arrested!

Last time it was SBF now Do Kwon.

He is wanted in South Korea in connection with a $40 billion (€37 billion) crash of the firm’s cryptocurrency that devastated retail investors around the world.

Terraform Labs founder Kwon was arrested in Montenegro on Thursday for document forgery.

Arresting these two big figures in the cryptocurrency market brings good news to investors of the cryptocurrency market.

⦁ One of the latest technology right now “Polygon”, Mainnet is now live!

zkEVM = Zero Knowledge Rollup plus EVM is a very impressive technology.

It is a virtual machine that executes smart contracts in a way that is compatible with zero-knowledge-proof computation. It is the key to building an EVM-compatible ZK Rollup while preserving the battle-tested code and knowledge gained after years of working with Solidity

⦁ Polygon zkEVM Mainnet is live!

Here’s the Beta Tutorial:

- Go to: https://bridge.zkevm-rpc.com/

- Add Network

- Connect Wallet

- Click “Continue” to bridge funds

- Type “I understand” to proceed (Please read risks if you’re unsure of what you’re doing)

- Click “Bridge” to initiate the bridging process

(Ethereum Mainnet to Polygon zkEVM Mainnet Beta)

Other companies like Consensys launched zkEVM public testnet called Linea.

⦁ Microstrategy buys $150M of $BTC over the past month and repays a $205M Silvergate loan at a 22% discount.

This company did it again!

MicroStrategy has recently gained attention for its significant investment in Bitcoin. In August 2020, the company announced that it had purchased approximately 21,454 bitcoins for $250 million, making it the first publicly traded company to use Bitcoin as a primary reserve asset. Since then, MicroStrategy has continued to invest in Bitcoin, with its holdings now exceeding 100,000 bitcoins.

MicroStrategy is listed on the NASDAQ stock exchange under the ticker symbol MSTR. As of September 2021, the company had a market capitalization of over $7 billion. Its CEO is Michael Saylor, who has been a vocal advocate for Bitcoin and cryptocurrency.

Despite the banking crisis last time, Microstrategy made a loan, buy bitcoin they pay the loan at a discount price. What a great move!

⦁ Ethereum core devs confirm Shapella Upgrade for April 12

The Shapella upgrade combines changes to the execution layer:

1.(Shanghai)

⦁ EIP-3651: Warm COINBASE

⦁ EIP-3855: PUSH0 instruction

⦁ EIP-3860: Limit and meter initcode

⦁ EIP-4895: Beacon chain push withdrawals as operations

⦁ EIP-6049: Deprecate SELFDESTRUCT

2.Consensus layer (Capella):

⦁ Full and partial withdrawals for validators

⦁ BLSToExecutionChange messages, which allow validators using a BLS_WITHDRAWAL_PREFIX to update it to an ETH1_ADDRESS_WITHDRAWAL_PREFIX, a prerequisite for withdrawals

⦁ Independent state and block historical accumulators, replacing the original singular historical roots

- The Engine API

Changes to the Engine API can be found in shanghai.md file of the execution-apis repository. In short, a WithdrawalV1 structure is introduced and added to relevant structures and methods. Changes to execution layer APIs since The Merge has been bundled in the repository’s

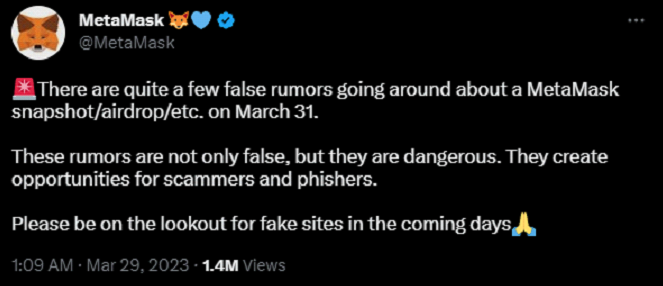

⦁ After discovering reports of an impending MetaMask snapshot or airdrop on social media, the company published a warning on its Twitter account.

What is Metamask?

Metamask is a cryptocurrency wallet and browser extension that allows users to interact with decentralized applications (dApps) on the Ethereum blockchain. It was launched in 2016 by ConsenSys, a blockchain software company founded by Ethereum co-founder Joseph Lubin.

There is no Airdrop confirmed of Metamask on March 31, 2023.

My take:

Most of the news and reactions this week are bullish, and I’m expecting more bullish movements coming next month.

The meltdown in the banking industry narrative is actually good news a way to inject more money into crypto and more accessible from the fund industry.

SBF is arrested last time now it’s Do Kwon giving positive sentiment in the crypto market.

Microstrategy one of the big believer of Bitcoin repays the Silvergate loan at discount and bought more Bitcoin these past few months.

Ethereum’s upcoming Shapella upgrades are on the way.

Matic zkEVM mainnet is now live. Other zkEVM technology is also along the way.

Arbitrum airdrop last time made a Metamask Airdrop humor hype and people transact more in their metamask app but Metamask confirmed on its tweet that they are not giving Airdrop on March 31, 2023.