• Fed holds rates steady, upgrades assessment of economic growth

The Federal Reserve on Wednesday again held benchmark interest rates steady amid a backdrop of a growing economy and labor market and inflation that is still well above the central bank’s target.

In a widely expected move, the Fed’s rate-setting group unanimously agreed to hold the key federal funds rate in a target range between 5.25%-5.5%, where it has been since July. This was the second consecutive meeting that the Federal Open Market Committee chose to hold, following a string of 11 rate hikes, including four in 2023.

The decision included an upgrade to the committee’s general assessment of the economy. Stocks rallied on the news, with the Dow Jones Industrial Average gaining 212 points on the session.

• PayPal Secures Crypto Registration in the UK

Payments firm PayPal yesterday achieved registration with the U.K.’s Financial Conduct Authority (FCA) as a crypto service provider, as confirmed by the FCA’s official site.

The registration of “Paypal UK Limited” now allows the firm to offer crypto-related services and products to British users.

Before offering such services in the U.K., businesses must first gain approval, aligning with FCA’s regulations against money laundering. PayPal’s registration comes a few months after the firm temporarily paused crypto purchases for British customers, citing “new regulatory requirements.”

• There are now nearly 40M Bitcoin addresses in profit — A new record

Bitcoin may be nearing 18-month highs, but its recent gains were already enough to spark significant changes in investor profitability.

Per Glassnode data, the number of addresses in profit as of Oct. 30 was 39.1 million.

This is the highest number ever recorded for Bitcoin and beats the previous peak of 38.1 million seen in November 2021.

At that time, BTC/USD itself traded at all-time highs, and thus 100% of addresses in existence with a non-zero balance were in profit.

While the current spot price remains 50% lower than those levels, total non-zero addresses now number 48.3 million.

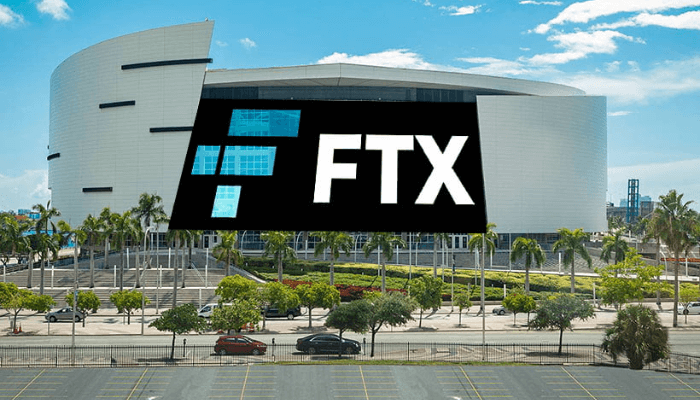

• Sam Bankman-Fried found guilty on all 7 charges in FTX fraud trial

Former FTX CEO Sam Bankman-Fried was found guilty of all seven charges by a jury in his criminal trial in New York after about four hours of deliberations.

Bankman-Fried was found guilty of two counts of wire fraud, two counts of wire fraud conspiracy, one count of securities fraud, one count of commodities fraud conspiracy and one count of money laundering conspiracy.

He will return to court for sentencing by New York District Judge Lewis Kaplan on March 28, 2024. Government prosecutors will recommend a sentence, but Judge Kaplan will have the final say.

Bankman-Fried’s crimes each carry a maximum sentence of between five and 20 years in prison with the wire fraud, wire fraud conspiracy and money laundering conspiracy carrying a maximum 20-year sentence.

• Top Swiss bank launches Bitcoin and Ether trading with SEBA

Switzerland’s St.Galler Kantonalbank (SGKB), one of the largest banks in the country, is moving into cryptocurrency by introducing Bitcoin and Ether trading to its customers.

SGKB has partnered with the global cryptocurrency-focused SEBA Bank to offer its clients digital asset custody and brokerage services.

Announcing the news on Nov. 1, SGKB and SEBA said that the new crypto service is immediately available to select SGKB customers following a short period of testing earlier in 2023. Starting with Bitcoin and Ether support, SGKB plans to expand its offerings to additional cryptocurrencies based on client demand.

• Ripple to power Georgia’s central bank digital currency, the digital lari

The National Bank of Georgia (NBG) has selected blockchain payments network Ripple Labs as the official technology partner for developing digital lari, its central bank digital currency (CBDC) project.

In a statement, Ripple said the partnership would include implementing and deploying the digital lari pilot initiative through the Ripple CBDC Platform. The NBG will utilize this innovative CBDC platform to evaluate potential applications of the digital lari, determining its advantages to the government sector, enterprises and individual retail users.

Before being designated as NBG’s technology partner, Ripple underwent a thorough and meticulous selection procedure. In September, the NBG disclosed its intentions to advance its CBDC project by introducing a limited access live pilot environment.

Concluding Notes:

- Fed holds rates steady

- PayPal Secures Crypto Registration in the UK

- There are now nearly 40M Bitcoin addresses in profit

- Sam Bankman-Fried found guilty on all 7 charges

- Top Swiss bank launches Bitcoin and Ether trading

- Ripple to power Georgia’s central bank digital currency