Bloodgang,

Welcome to the eleventh issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

The past week was a lot of things, but boring definitely isn’t one of them. The Fed’s hawkish turn is getting priced in across the board on equities and crypto, with both tech stocks and Bitcoin (followed even more dramatically by alts) taking a hit. By now, many of the best-performing tech stocks from 2021 are down double digits from the monthly (and yearly) open, with some bleeding even 15-20% or more (and if you want to see a depressing breakdown, just look at Coinbase stock).

None of this is too surprising on the macro scale: when the Fed gets concerned about inflation and starts tapering or raising rates, the outcome is predictable: risk-on assets down and dollar up. The real question, however, is how long this will last and when we can expect things to change. Sure, things may look pretty grim now, but it’s not like the US government (or, by extension, the Fed) will be happy to let the S&P 500 chart look like a rug pull. When there’s a lot of fear in the equities markets – and we’re already seeing some – the Fed will typically become less hawkish rather than let the economy suffer, which might be very soon. In general, it’s all part of the usual pendulum between being worried about inflation and trying to keep the market happy, but that deserves its own article.

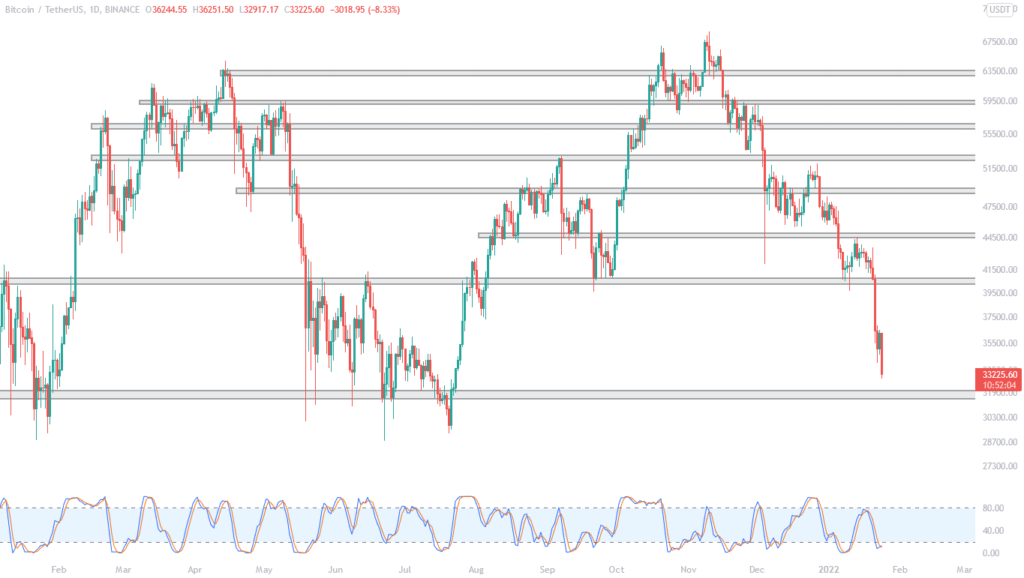

Bitcoin

Bitcoin lost the $40,000 support and plunged to the range low.

The support that lasted for quite some time and we argued to be a strong support was lost the previous week. What we have learned in this crash is that cryptocurrencies are still heavily correlated with S&P 500 which resulted in Bitcoin crashing almost 20% since the last newsletter.

A few newsletters back we argued that once we see a weekly breakout rejection, we could get a drop to the weekly support level which was the previous range low at low 30s, yet i did not expect to really happen. Looking at the weekly chart, it all makes sense. After losing $60,000, Bitcoin traded in a heavy downtrend, constantly making lower lows.

How to trade it? In my opinion, this is where swing traders step in, so if you are looking for spot entries, this could be the place to buy. However, keep in mind, crypto is correlated with stocks, meaning if stocks keep bleeding here, we could see sub $30k levels which you will want to buy if it comes to it.

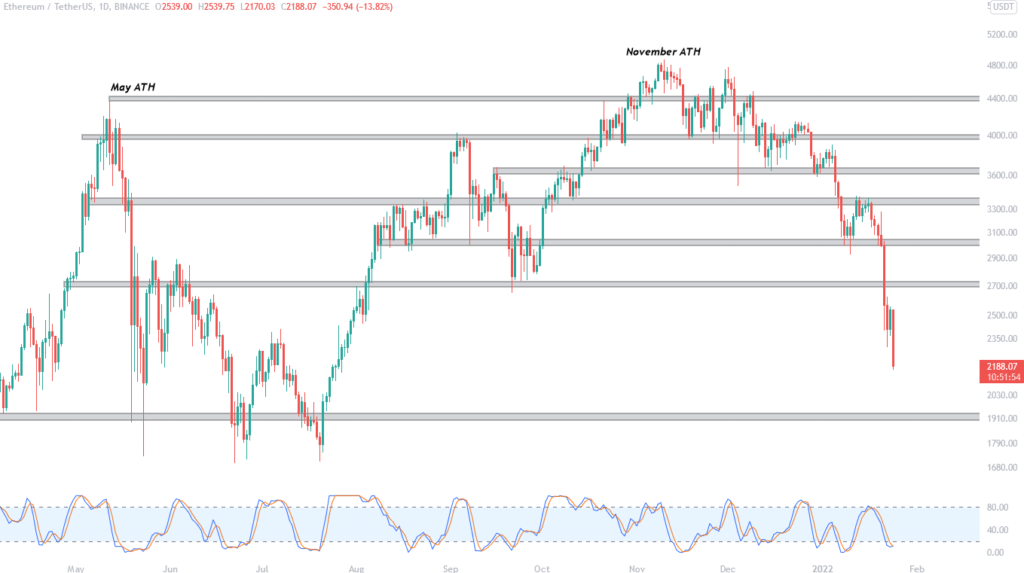

Ethereum

Ethereum/USD lost the range high and plunged towards the $2000 level.

Similar to Bitcoin, Ethereum also lost its “strong” support at $2950-$3070 and it is currently drifting towards the range low that acted as a strong weekly support back in May. At the moment there is zero interest in trading Ethereum or any other alts and I would suggest focusing on Bitcoin, however if you are focusing on Eth and still want to trade it, I would suggest bidding in the $1700-$1900 zone.

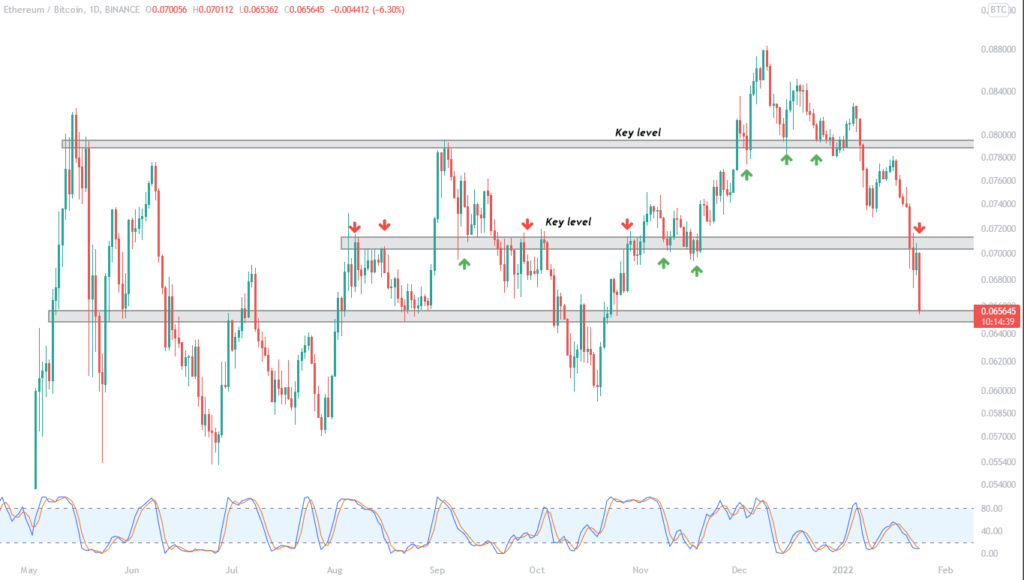

Looking at the ETH/BTC chart, we can also see that another key level was lost and rejected when trying to reclaim it. Currently, we are trading at the 0.065 level which is a must-hold level.

Blood’s content recap

Secret tip

#23

“The trick to a high probability entry

Trading is a game of how much confluence can you add to a set-up without giving yourself analysis-paralysis.

-Draw S/R lines

-Seek confluence

-Snipe those entries

HTF opens are great to do this with liquidity on either side of them”

Profit-taking tip

You get a huge dip and you do a good job building positions during it.

What now? When to take profit?

Use this pattern to predict when pullbacks will occur after an accumulation range

Can also use for short triggers for day trading”

Article

“Here is an article on Web 3.0

Read about:

– why it matters and its benefits

– what it means for our future & crypto

– good projects and how to invest”

In this market environment, you need to be much more careful than usual, and keep in mind that it’s never a good idea to knife-catch with leverage. On the other hand, if you’re thinking about very long-term spot buys, the situation is much clearer: buying Bitcoin close to $30k is way better than buying at $60k.

In terms of short-term trades, the situation is tricky because we haven’t really seen a typical capitulation move with extremely negative funding, an open interest flush and all-around chaos (often with exchanges going down too). That’s why it’s a good idea to wait either until that does happen or until the price action starts to give us some more certainty. In the meantime, it’s best to take it level by level if you want to do some scalping, otherwise there’s nothing wrong with waiting for clearer trending market conditions.