Bloodgang,

Welcome to this week’s issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Great week for risk-on assets, Bitcoin breaks major resistance, Ether follows, possible soft landing for U.S. economy and more

Fundamental overview

It’s been a great week for risk-on assets, with strong seasonality, bond yields plummeting, and the growing likelihood of a soft landing in the U.S. While December is a good month for stocks in general—largely because fund managers will want to make sure they own the hottest names in AI and big tech, even if their entries are often ridiculously high—it’s the possibility of a soft landing for the U.S. economy that’s getting people excited for more than just a Santa rally.

Simply put, a soft landing means that inflation would come down without any major crisis or recession. That way, the Fed would be free to slowly start cutting rates simply because the war on inflation would have been won, rather than having to cut in order to prop up a dumpster fire of an economy. The equation in this soft landing scenario is simple: lower rates, more capital sloshing around in the system and risk-on assets offering some juicy returns. A lot can still go wrong here, from geopolitical risk to another structural problem in the banking sector popping up, but if things stay more or less on course, 2024 could be a great year.

Bitcoin

Bitcoin Monthly

Bitcoin Weekly

A bullish monthly close leads to a breakout!

Many eyes were glued to the monthly resistance waiting to see the reaction after the monthly close. Bitcoin bulls managed to get a close above the major level which triggered a run above $40k, as predicted a few letters ago. The next monthly resistance level lies slightly above $47k and that’s where we’ll look towards now.

December’s candle close will be as important as was November’s. Closing above the $38k level is important for continuation as since a close below would make this look like a major bull trap (not that I consider that particularly likely).

The weekly timeframe is hitting resistance, hence the move upwards is slowing down. Lately we’ve had a few situations where one timeframe was hitting resistance right as another was in the middle of an impulse move, which can be confusing for traders. In any case, if BTC retraces here, we will want the monthly (38k) or at least weekly (36k) level to hold. Losing both levels will lead Bitcoin back to the 30k region.

SPX, Gold and DXY

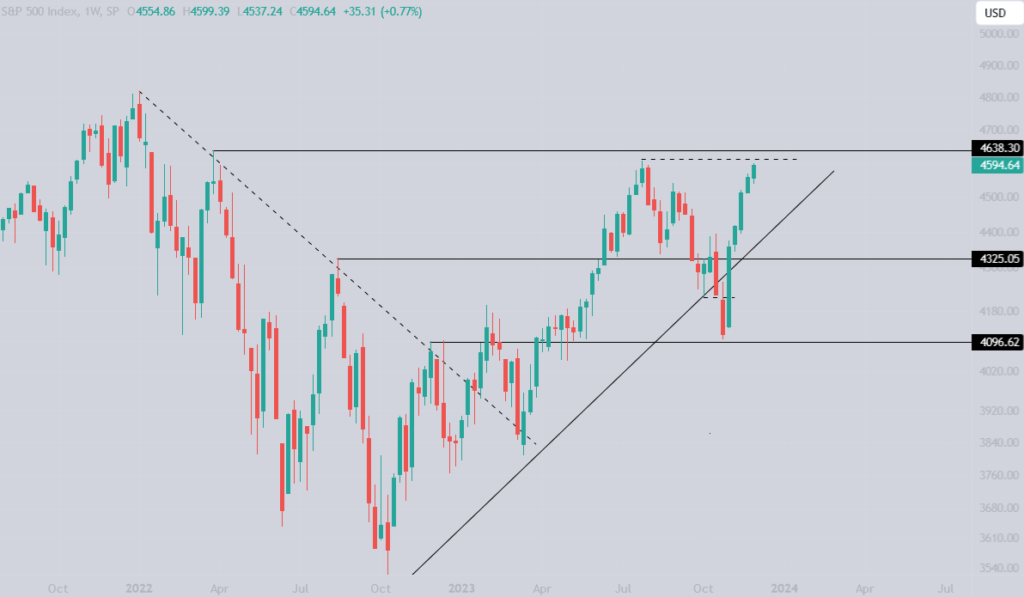

S&P 500

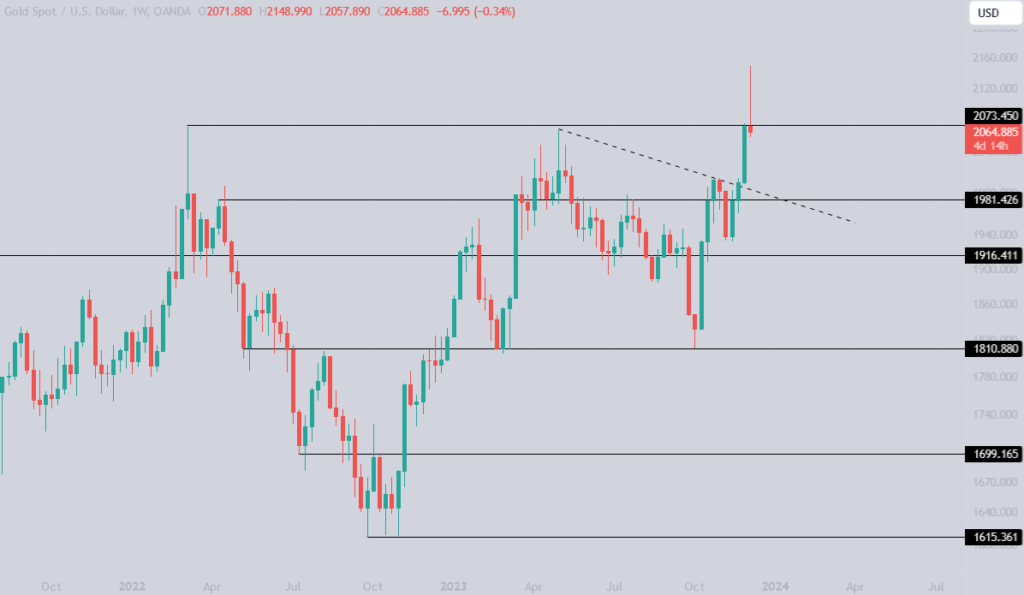

Gold

U.S. Dollar Index

SPX prints its 5th consecutive green weekly candle.

Bulls are euphoric, but now the real test is here as SPX is trading under the local high. Breaking the local high and the lower high from March 2022 will lead straight to all-time highs. While a retrace would be healthy here, the uptrend line must be defended if we want to see continuation into 2024.

Gold makes a new All-Time High!

Even if just briefly, gold managed to create a new high, but it was quickly rejected, currently trading right below the previous highs. I’m waiting to see how this week develops, but gold, similarly to Bitcoin, has been on a roll lately, and I would pay attention to breakouts as you don’t want to miss it.

Dollar Index downtrend is slowing down.

After the 103.66 level was broken, the DXY has started slowly ranging below the level. In spite of that, risk-on assets seem to be moving higher without any problem. Next week we have CPI and FOMC events in the U.S., so we could see some strength in DXY depending on the outcome, but it should be smooth sailing until then.

Ethereum

Ethereum Weekly

ETH/BTC Weekly

Ethereum finally breaks the April highs.

After three weekly candles got rejected at the $2100 level, ETH bulls finally managed to break higher and push Ethereum toward $2500. There should be no problem for Ether to reach this level as there is a big gap and many sidelined traders that were waiting for this to happen.

In case of a retrace, the $2100 or $2000 levels have to be defended or this will be considered a fakeout and the bullish setup would be invalidated.

Ethereum/BTC is still struggling.

Even though the USD pair is breaking levels, the BTC pair is having a hard time staying above the 0.055 BTC level. Some downward wicks were printed, which isn’t too surprising given that Bitcoin is grabbing all the attention right now.

Blood’s content recap

Bitcoin bull signals all over the place

“#Bitcoin bullish monthly close.

Price Action in December will play a key role for 2024 Bull run.

Get a yearly close above $38000 and then the real party starts.”

My Crypto Trading Guide Book is finally available

“Crypto Trading Guide books are now available on my Website.

I will personally sign every copy of the book.

Study it in detail, just in time for Bull Run.”

Order your Book here.

Concluding notes

It’s hard to imagine a week going by without ETF speculation, and this time it’s no different. If you remember the November 9 to 17 window that I mentioned three weeks ago, in which it was possible for the SEC to approve all the applications—well, that one clearly didn’t work out, but now we have a new window to mark on our calendars: January 5 to 10 (or, since the fifth will be a Friday, essentially January 8 to 10). If we finally get the approvals, be prepared for a lot of volatility on BTC and consequently everything else in crypto. While I still don’t think the ETF is priced in (let alone its longer-term impact in terms of capital flows), it shouldn’t be surprising to see a sell-the-news dump, even if it’s just a brief one. But then again, since the news would be so unprecedented, maybe those expecting a dump would be caught offside, leading to an even more violent squeeze upwards—long story short, keep your risk tight and your mind sharp during the approval window.