Bloodgang,

Welcome to this week’s issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Bitcoin and Ethereum tease breakout, DXY in freefall, CZ steps down, Altman returns to OpenAI and more

Fundamental overview

Those that were hoping for a break from the almost endless stream of ETF-related news finally got what they wanted. Instead of the bureaucratic intricacies of how the SEC handles ETF requests and what that could mean for Bitcoin, last week all the attention was elsewhere: on Tuesday, the headlines on the Binance and CZ plea agreement dropped, sending shockwaves throughout crypto and beyond.

The gist of the deal is simple: Binance will pay a total of $4.3 billion for violating U.S. anti-money laundering and sanctions laws, while CZ himself stepped down as CEO along with having to pay $50 million himself. This might sound like a devastating outcome—4 billion isn’t exactly pocket change, and there’s still the possibility that CZ might go to prison—but in reality, it’s extremely good for the whole industry, mainly for two reasons. First, the fine is something that Binance can very easily survive, and even if CZ goes to prison, the maximum sentence would be 18 months, while he can still keep his shares in the exchange. CZ is a huge public figure, of course, but it’s hardly impossible for Binance to thrive with someone else as CEO.

Second, and most important, is the matter of what exactly Binance pleaded guilty to. The exchange essentially admitted that it failed to implement anti-money laundering and sanctioned entities controls—not that it misused customer assets or was insolvent. In other words: the problem is that CZ failed to prevent people from sending payments to illegal organizations, not that he ‘misplaced’ billions and billions of user funds like SBF did. The possibility of Binance being insolvent was always the biggest systemic risk in all of this, so the fact that they don’t seem to have any holes on their balance sheet is a huge relief for the industry.

Bitcoin

Bitcoin Weekly

Bitcoin Daily

Bitcoin teases the resistance days before the monthly close.

While indicators showed that the Bitcoin local top is in, the chart tells a different story. At the time of writing Bitcoin is trading right below the local high and teasing a potential breakout. $38,500 is the level to break if we want to see full send into mid-40’s territory. On the other hand, I will accept this as a local high if it loses $35k, which will lead to a retrace towards $30k region.

Looking at the bigger picture, things look pretty good: FTX is down, Binance is solvent, CZ has left and with a spot ETF close to being approved, the biggest TradFi giants will soon have a lot to gain from Bitcoin mooning, hence they will probably do something to nudge things in that direction.

The weekly remains the same as last week, above and ready for a leg higher, but since the monthly is at resistance we cannot trade purely on the weekly timeframe being bullish.

Looking deeper into the daily timeframe we can see that the mini-range which we drew a few weeks ago still hasn’t been broken. Although there was a moment when BTC was above the range high, it was quickly rejected. As long as it’s trading in the upper part of the range I am comfy.

SPX, Gold and DXY

S&P 500

Gold

U.S. Dollar Index

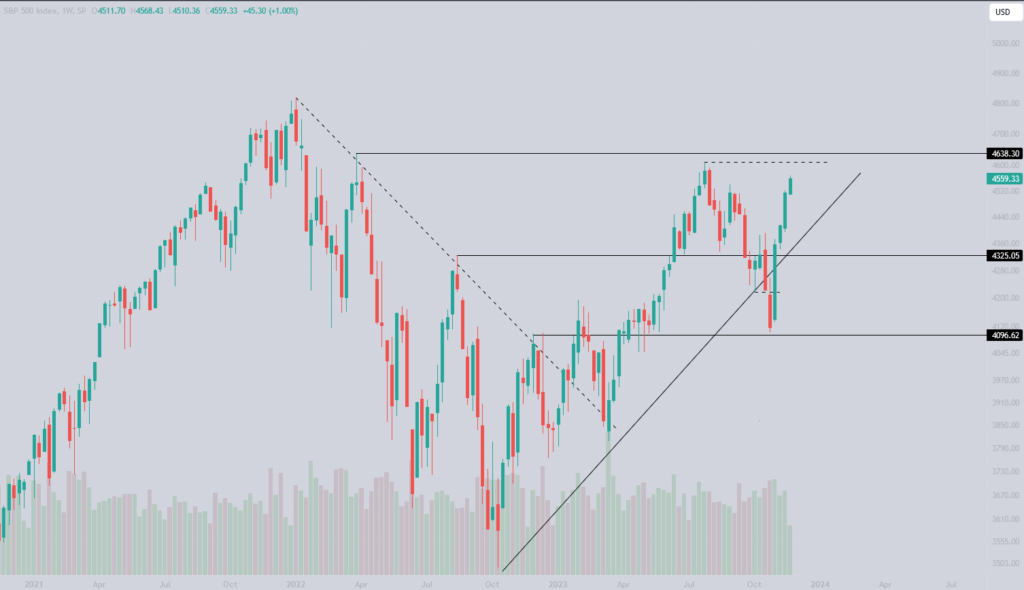

S&P 500 prints another green weekly candle.

Stocks are having a blast lately, breaking levels like a hot knife through butter. However, the real test will come at the local highs, as the reaction there or at the historical 4638 level will give us a clear direction of where SPX will go by the end of year. A rejection means it will be a tough start of the year, whereas a breakout could mean that the bullish momentum could accelerate in 2024.

Gold showing signs of strength.

It closed above the $2000 level as well as breaking above the trendline, which gives quite a bit of hope to bulls. The stage is now set for all-time highs to be reached in December and that wouldn’t surprise me. If it’s rejected here and the weekly candle closes below $1981, this whole idea is invalidated and there will be no hope for ATHs in 2023 (unless we see some major geopolitical catalysts, that is).

The U.S. Dollar Index is breaking down

The daily level at 103.66 has been broken without any struggle and the reaction can be seen on risk-on assets as SPX, crypto and others fly higher. There is a big gap from 103 to 101 which, if this isn’t a fake breakdown, will be filled. We have CPI and FOMC events coming up on Dec 12th and 13th, so keep that in mind.

Ethereum

Ethereum/USDT

Ethereum is stuck!

It has been slowly pushing up with weekly candles printing higher lows, but still unable to break the $2144 April high. This is the last level that is keeping ETH from teleporting to $2500 and it has done a good job so far.

While accumulation under resistance is usually bullish, I am worried about the decreasing volume which indicates that bulls are getting exhausted. Both Bitcoin and Ether are under important resistances and Bitcoin, as always, will lead the way.

Ether/BTC is still fighting to stay above the 0.055 BTC level with the USD pair under resistance. I will update the chart when anything changes.

Blood’s content recap

Black Swan avoided?

“Biggest Crypto Fear was Binance collapsing.

DOJ will allow Binance to flow operations under its supervision to stay compliant

Attacks are obvious, Blackrock doesn’t want Binance to be #1 when ETF is accepted.

Binance doesn’t collapse, Blacrock is happy and we avoid Black Swan”

My Crypto Trading Guide Book is finally available

“Crypto Trading Guide books are now available on my Website.

I will personally sign every copy of the book.

Study it in detail, just in time for Bull Run.”

Order your Book here.

Concluding notes

The more the market becomes exciting again, the more important it will be to keep track of everything, but there are only so many hours in a day. This is why I’ve always believed that allocating your time properly is key to thriving as a trader, and the mistake I see people making the most is spending way too much time worrying about the latest breaking news, even if it’s irrelevant to their trading decisions.

Don’t get me wrong, it’s important to stay on top of the latest developments, but not to spend too much time analyzing every possible detail of a developing story. A good example can be found in the recent events with Sam Altman: he was fired as OpenAI’s CEO before last week’s newsletter, but I decided to only briefly mention that story towards the end, instead of speculating on the details of why and what might happen. Now, it’s easy to see why that was a good idea: Altman returned to OpenAI just four days later, after more than 700 employees threatened to quit.

There are still a lot of interesting stories about what might have been behind it all, so if you’re interested in that, it’s worth researching. But if not—if you’re just trying to stay on top of the news as a trader—then your time is better spent elsewhere. This, after all, has always been part of the motivation behind this newsletter: to give you the best overview of TA and the biggest market-moving stories in the quickest format possible, so that you have more time to implement and practice what you learn on the charts.