Bloodgang,

Welcome to this week’s issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Bitcoin faces monthly resistance, Ethereum breaks the magic line, CPI and everything quiet on the ETF front

Fundamental overview

Lately it can feel like no one is talking about anything other than ETF news, but that still remains the main driving force in the market as BlackRock filed for a spot Ethereum ETF on Friday. When it comes to the spot Bitcoin ETF, all eyes are on the SEC this week: while there’s no telling exactly when they’ll make their decision, the period from last Friday until the end of this week is especially important. This is because an ETF can’t be approved while it’s in a comment period, and those periods for current applications ended on November 9, while new ones haven’t started yet. If the SEC wants to approve all applications at the same time, which is what most are expecting because there aren’t any substantial differences between them, it can do so in the time window from November 9 to 17. Again, that’s mostly just speculation at this point, but even if the process gets dragged out into Q1 2024, that’s just a couple of months away now.

In any case, don’t get too caught up in the ETF hype and forget about all the other things that can move the market this week, especially the CPI for October that will be released after this newsletter hits your inbox. Expectations for headline inflation are at 3.3%, down from September’s 3.7%, largely due to the drop in average gas prices in the US. As always, hotter inflation is bearish and vice versa.

Bitcoin

Bitcoin Monthly

Bitcoin Weekly

Bitcoin is facing an important resistance on the monthly time frame.

The monthly has been in up-only mode since September as it’s up over 40% but, not to be on Capo’s side, it wouldn’t be impossible to get a red monthly candle. November’s monthly returns for BTC since 2018 were all in red numbers except for just one year, so I’m staying cautious here as we trade under resistance.

On the other hand, the weekly paints a completely different picture. Bitcoin has reclaimed the weekly resistance level which was also the CME gap. A weekly close above the level was of key importance, the next task for bulls now is to defend it.

A weekly close below would indicate a fake breakout and a possibility of going back to the $31-$32k zone. Another weekly close above the CME gap would indicate that we are reaching $40k before $31k.

SPX, Gold and DXY

S&P 500

Gold

U.S. Dollar Index

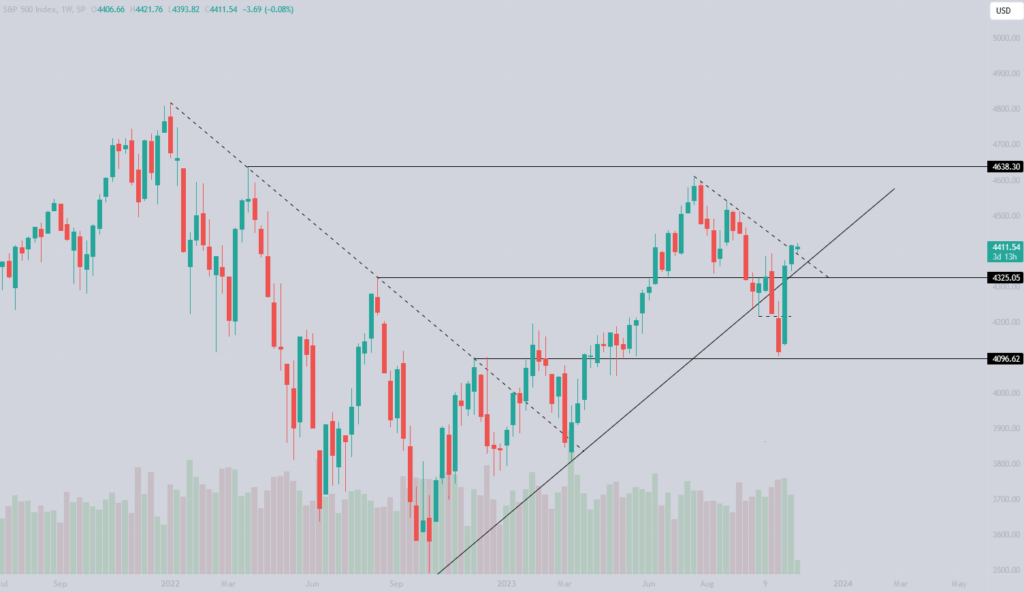

Stocks are on a roll.

A bullish start of the month has led SPX up 7% since forming the local bottom, breaking through levels without a problem. The weekly candle has closed above the downtrend line which is the first sign of a bullish structure. The series of lower highs is over, so now we need to see if it will follow through with some momentum.

Keep an eye on this week’s price action, as it’s of key importance for both stocks and crypto.

Gold prints a fake breakout.

After weeks of huge weekly green candles, which were largely a result of geopolitical instability in the Middle East, gold falls back towards the infamous 1916 level. A fake breakout is bearish, but it has already played out. The key levels that must hold right now are the downtrend line as well as the 1916 level. Breaking below those levels would be extremely bearish and I am confident we would retrace the whole pump and drop back to 1810.

The Dollar Index fights back

After a 2% red weekly candle was printed, bulls stepped in to defend the 105 level, although the structure remains bearish as long as DXY is trading below the March high which is still too strong to break. Bearish DXY means bullish risk-on assets, so as long as it doesnt smash through the March highs we should be fine.

Ethereum

Ethereum/USDT

Ethereum/BTC

Ethereum woke up as the pump is confirmed with volume.

ETH bulls are euphoric as it finally broke the magic $2000 line after 7 months. The last time ETH broke above this level, it printed a fakeout which resulted in months of pain for ETH fanatics. At the time the volume was slowly decreasing, meaning the pump didn’t have that much momentum behind it, but this time the volume seems to be on the bulls’ side.

Closing above the $2k level was the first task for bulls, next on the to-do list is keeping this weekly candle above that level and going for the April highs. Breaking the highs would lead ETH towards $2500. In case we print another fakeout here, we could be in for another couple of months of pain.

ETH/BTC is also showing signs of strength.

Ether finally woke up against the orange coin as well, breaking the 0.055 BTC level and printing a fake breakdown which, being the opposite of a fake breakout, is bullish. The macro low was defended for now so things are looking good for those who bought at the level.

I’ll keep updating this chart, for now we want to see ETH/BTC remain above 0.055.

Blood’s content recap

The stakes were never higher

“The importance of gettin rich with Crypto was never higher.

Blackrock, State street and Vanguard own everything and they are interested in going after family homes.

The “Great Reset” is in progress and the idea is: You will own nothing and be happy.

Study crypto, get rich and invest as much as possible in out of crypto businesses.”

Concluding notes

With all the ETF hype, it should come as no surprise that there’s a dark side to it as well: yesterday, fake news about BlackRock filing for a Ripple ETF sent XRP flying 15% in a matter of minutes. That might not sound like a lot, but XRP isn’t exactly a microcap coin, and the complete retrace when the rumor was revealed to be fake wiped out close to $100 million in open interest. The whole drama played out in just over half an hour; after it, the price was right back to where it was, leaving behind nothing but a wick and a whole lot of liquidation notices.

On that note, one point that we should keep in mind is that having an ETF for a ton of altcoins wouldn’t be as bullish as it sounds. At this point, as crypto is only just starting to regain the trust of people outside of the industry after a less-than-fortunate 2022, it’s probably a good thing that BTC and ETH are the only assets that will be available through spot ETFs anytime soon. Once having retirement savings in those two coins becomes mainstream, altcoins can start to gain broader adoption too, but for now, it’s good that the focus is only on the assets that most of us can unite around.