Bloodgang,

Welcome to the twelfth issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

On Wednesday, the Fed meeting caused a selloff with an indication that rates could be raised very soon, for the first time in over three years. Briefly put, this makes capital more expensive and decreases the value of future profits, which are the main driver behind company valuations. As is often the case, the Bitcoin – S&P 500 correlation tends to show up more when it’s to the downside, but there’s still a lot of uncertainty as to the timing and extent of the Fed’s policy shift.

Importantly, stocks didn’t sell off too hard: the low on the S&P 500 was put in on Monday, and the week ended up closing almost 5% above it in spite of Wednesday’s selloff. Here, there are two main scenarios: either stocks give a convincing bounce, which could be quickly cut short by more hawkish Fed meetings, or this week shows more weakness, in which case the Fed will be more careful with how their policies could influence the market. At the end of the day, what they definitely don’t want is for stocks to go into freefall, and they’d probably rather err on the side of allowing more inflation if that does become a real possibility.

Bitcoin

Bitcoin is still trading inside the range low zone.

On January 24th Bitcoin reached the lowest point of $32,917, since then we had multiple higher lows as well as being rejected by the $39,000 level twice. There are no drastic changes from last month, so my trading plan stays the same, keep buying as much Bitcoin as close to the $30,000 level as possible.

Buying near the $30,000 level should provide at least short-term profits as we should see some kind of a bounce. The first level we are looking to reclaim is $40,500 and then in order to resume a bullish trend, we should wait to reclaim $46,000.

As mentioned above, the S&P 500 has stopped dropping and may have found a bottom for now and is currently almost 7% up from the lows. We closed the 3rd consecutive red monthly candle on Bitcoin, and the interesting thing is that after the 3rd consecutive red monthly candle in June, we saw a bounce to the $50,000 area.

Could this be a higher low or are we looking for a 4th consecutive red monthly candle in February?

Ethereum

Ethereum/USD is retesting the range high for a second time.

Ethereum looks to be in better shape than it did the previous week when it looked like we are going for a retest of the range low that’s around $1900. Since then we have pushed straight to the resistance where we first got a nasty rejection and a wick back to 2300s. At the moment Ethereum is once again breaking through the resistance and if you bought the lows, here is a good idea to derisk.

The NFT hype has been picking up lately which could result in Ethereum outperforming Bitcoin in the short-term. We can see that by looking at the ETH/BTC chart where we bounced off the 0.0655 support and we are already breaking through the key level here as well.

am not saying that we should focus on Ether now because Bitcoin is still heavily in control, but you should watch it closely in case we reclaim key levels on the ETH/BTC pair. If you are looking to trade the reversal, I would still rather do it on Bitcoin as it will be more predictable than ETH.

To sum up, ETH is trading below the range high, meaning there are no good entries at the moment as we are sitting below the resistance, however due to the NFT hype keep monitoring ETH/BTC in case we reclaim key levels and enter on retests.

Blood’s content recap

Secret tip

#24

“Every crypto trader & investor has one goal = to outperform $BTC

Most alts exist only to help you stack more sats.

This is why BTC pair for every alt is the most important chart imo.

Shut off complicated TA.

Here are a few meme lines to nail EVERY trade”

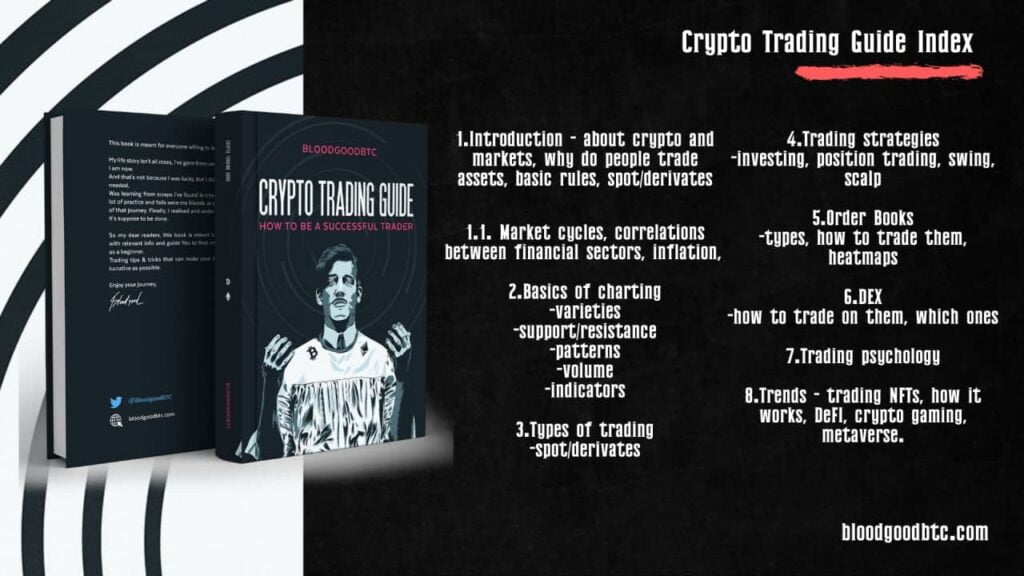

Bloodgood’s book index

“An Index preview of my Book

I’m finalizing the last chapters so that everything will be updated and actionable to the current market.

Volatility brings opportunity if you can play it well enough. This will help you.

All for free. Giveaway coming soon.”

Concluding notes

Obsessively tracking any minor shift in Fed policy may not be everyone’s cup of tea, but luckily it’s not that necessary – all you need to do is to keep the S&P 500 chart on your watchlist and take it into account when trading crypto. Unfortunately, the correlation with Bitcoin mostly happens to the downside, so that a drop in the S&P 500 is very likely to lead to a dip in BTC, while good performance by the S&P 500 isn’t that likely to spill over to Bitcoin.

Of course, this means it isn’t the most exciting time for many types of traders right now, but if that’s the case for you, then make the most of it by honing your skills and getting ready for the next time the market is favorable for your trading style. Capital preservation always needs to be at the top of your list of priorities, as that’s the only way to make it in the long run – whatever happens right now

I don,t see a genuine trader like you all doing it for free. Respect 1000%

Started just beginning of freedom in 2022 and looking forward. Hope that best will happen. IA