Welcome to the fourteenth issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

Over the past week, we’ve seen how much markets can be influenced by events that traders don’t typically think about that much, namely geopolitical risk. With tensions flaring between Russia and Ukraine – and Biden urging Americans to leave Ukraine immediately on Friday – stocks and crypto plunged while gold and the US dollar rose. This is fairly typical behavior whenever there’s a threat of a potentially global conflict, with capital flowing away from investments that are seen as riskier and into traditional safe-haven assets.

The fact that Bitcoin is trading like a tech stock – and very much unlike gold, for example – tells us that it’s not yet seen as a safe haven asset, but this shouldn’t be too surprising at this point. At any rate, the geopolitical course of events will determine which way the markets will go, and in case push comes to shove, TA and on-chain data likely won’t matter that much, at least temporarily. But, while risk-on assets always suffer at the start of geopolitical turmoil, they tend to rally hard once people realize that it’s not the end of the world and that governments are pumping insane amounts of money into the economy. Besides, the headlines paint a much broader picture than the one you’d see in the Ukraine coverage, with Bitcoin’s hash rate hitting an all-time high and Russia moving to recognize crypto as a form of currency.

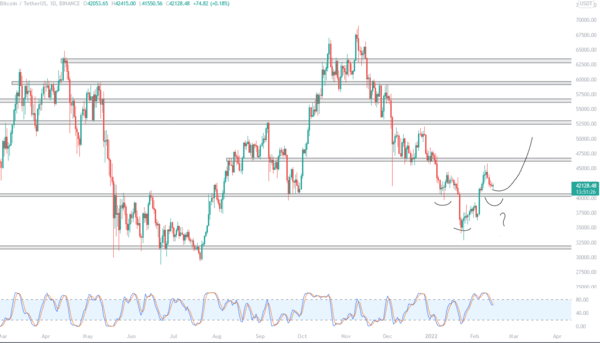

Bitcoin

Bitcoin closes above the key support level and prints a bearish candle formation.

At the time of writing, Bitcoin is trading at $42,128, slightly above the key weekly zone, which was the range high back in May 2021. After we got the previous weekly close above $40,500, Bitcoin rushed towards the next logical resistance at $46,000, and got rejected heavily, plunging back towards the breakout level. We cannot ignore the weekly chart and the weekly shooting star candle formation which is a bearish formation indicating we will revisit the sub $40k levels.

Looking to the upside, breaking above the $46,000 level is crucial for the continuation which is why the breakout level must hold if we want to see a continuation, and I am placing bids there with a tight stop loss. The daily Bitcoin chart is showing signs of a potential inverse head and shoulders which could result in another bounce towards the $46k resistance, meaning we could try to catch some short-term profits.

Weekly Bitcoin RSI is slowly breaking above the 20 level, whereas the daily RSI is just breaking below the 80 level exiting the overbought zone.

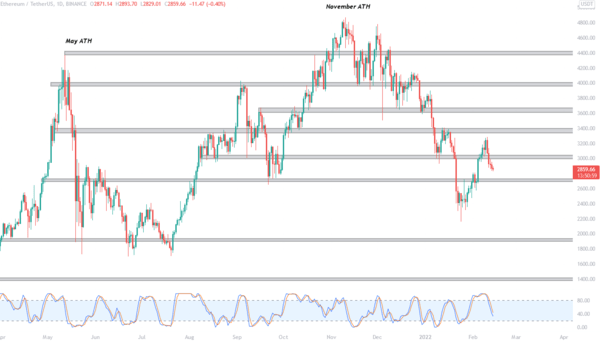

Ethereum

Ethereum fails to reclaim the $3000 level.

The previous week we argued that Ethereum performed better than Bitcoin, and eyed the next crucial level at $4000. However, over the last week Bitcoin performed better than Ethereum which can be seen on the ETH/BTC chart as a key level, as well as the 0.07 level, were lost.

At this point, Ethereum does not respect its levels and is glued to Bitcoin’s movement. Similar to Bitcoin, ETH is approaching the previous range high level which could provide us with at least a short-term bounce. Both ETH/BTC and ETH/USD RSIs are heading towards the oversold area which could once again result in a bounce.

I am not placing any bids on Ethereum at the moment and I will focus on Bitcoin until we get a clearer direction on both assets. Looking to the upside, we need to reclaim the $3050 level if we want any kind of continuation. On the other hand, if we drop lower we will be looking at $2700, upon losing it $1900 is the next logical level.

Blood’s content recap

Secret tip

#26

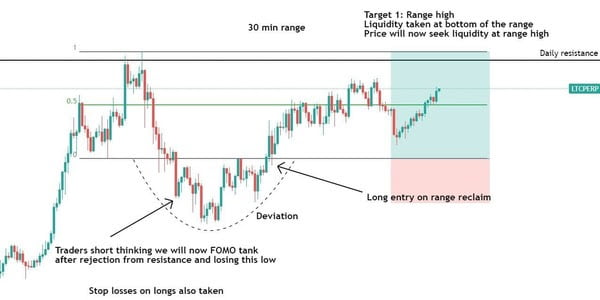

“Master Range Trading Now!

Want to be a profitable trader? Then do this.

That is the only way, recent price action is evidence that price will chop around in a range and trend traders will get rekt.

Read. Study. Implement.”

#27

“HOW TO BUY THE DIP of your Gems 101

Find tickers on Kucoin with a relatively low market cap and a decent project.

Separate charts that look like this. Follow the plan. Print money on small bounces.”

Concluding notes

The most important thing to monitor in the near future is what will happen with the Ukraine situation, but be careful not to be taken in by sensationalist headlines that make it look like the world is ending. Times like these will put your ability to stay calm and rational to the test, but if you succeed, you’ll be ready for whatever comes next.

Simply put, the way to make it is to stay consistent and not be swayed by greed or panic, and there’s never a bad time to work on this. Whichever way things go, it’s the people that remain committed and rational that will come out on top.