Bloodgang,

Welcome to the twenty-first issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Fundamental overview

One hugely publicized event, one that shows how stocks can sometimes be just as wild as crypto, happened just before I started writing this newsletter. So, instead of going into yet more predictions on what might happen to interest rates this year, let’s get to the juicy bits: a regulatory report revealed that Elon Musk has taken a 9.2% stake in Twitter.

Why is this so juicy – and what does it have to do with crypto – you might ask. Well, in a display of the manic forces of sentiment, Twitter shares jumped 26% in pre-market trading as the news came out. Pre-market might not be the most liquid time for stock trading, but this kind of an instapump is still extremely rare. We’ve all seen something like this in crypto – especially with news relating to Elon Musk – and it’s now obvious that he can have a similar impact on huge companies, although we’ll need to wait for the end of the trading day to see how much this pans out in a more liquid market.

As for crypto, this event is significant because Twitter is by far the most popular social media platform for all things crypto, while Musk has done more than most people to make crypto mainstream (in spite of his comments on Bitcoin and sustainability). Whether he continues to acquire a bigger stake and influence the future of Twitter or just decides to build an alternative platform (which is, of course, much less likely at this point), this will probably be a net positive for crypto in the long run.

Bitcoin

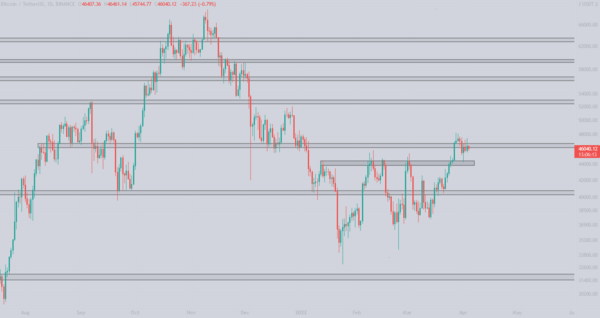

Bitcoin/Dollar Weekly chart

Bitcoin/Dollar Daily chart

Bitcoin’s key level at $46,500 rejected?

The previous weekly candle closed above $47,000 which indicated that we have reclaimed an important level for continuation, however we got proven wrong when Bitcoin made a retest of the $44,500 level soon after the March monthly close. The current weekly structure does not look bullish and I have closed all my longs just in case and will stay on the sidelines to see how this plays out. There are lots of altcoins currently on 4H resistances which provides good short entries. In order to see continuation we need to reclaim the $47,000 level, otherwise this is seen as a fakeout and could result in Bitcoin retesting $44,500 and, if this is lost, $40,000.

Looking at the daily level we can see that we are currently accumulating right below the key level. Accumulation under resistance is usually bullish but don’t bet on it. With volume decreasing we definitely don’t want to get stuck in new long positions. The Stoch RSI is also in the middle of heading towards the oversold area, meaning that we could see some more downside.

To sum up, reclaiming $47k is bullish, losing $44,500 will take us once again towards $40k. I have closed all my longs and will be looking to bid at both of the levels mentioned above.

Ethereum

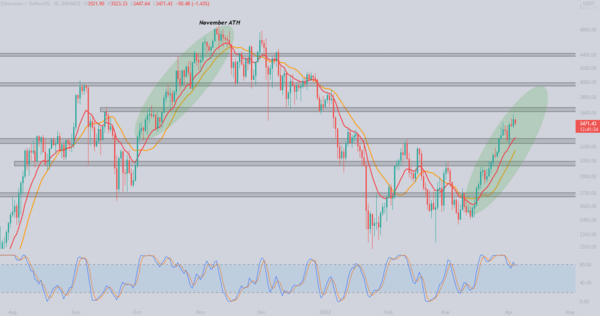

Ethereum/Dollar Daily chart

Ethereum/Bitcoin Daily chart

Ethereum outperforms Bitcoin.

Lately, Ethereum has been climbing in a staircase pattern which reminds me of the October-November Ethereum move, where it climbed from $3200 all the way to the ATH at ~$4800. This is a very bullish structure, usually accompanied by the MA20 and EMA13. In such a structure every touch of one of those moving averages is a good long opportunity. A break of this structure is seen when both these EMA’s are lost, and when the trend turns bearish you can use them for short entries.

Ethereum reclaimed important levels, such as $3300, which resulted in a move higher (above $3500). The next key levels to keep your eyes on are $3700 and the psychological level $4000. In case the “staircase pattern” is lost I will be looking to bid $3300 which is a confluence of support and EMA13 and, if we don’t get a bounce there, the $3000 level.

Etheruem outperformed Bitcoin, reclaimed the 0.07 BTC level and made a move higher towards the next key level 0.08 BTC. For a few weeks, Ethereum was not interesting as it was trading around 0.07, simply following Bitcoin’s movement, however, we are now seeing some first signs of decoupling which also provided some good bounces on other altcoins.

To sum up, Ethereum is bullish as long as it maintains the staircase structure, so monitor the $3700 and $4000 level. In case the structure is lost, the first support is $3300 and then $3000.

Blood’s content recap

Scalping exercise #3

“Perform well under pressure

1. Prepare for the worst. “What-ifs” are ur frens

2. Remember your winning trades

3. Focus on the process not the reward

4.Listen to music

5.Think of a pre-scalping routine

Try at least 3/5 things and I promise you will improve”

Free alpha

“When buying hyped altcoins there is a Simple rule.

You must see if pamp is organic or fake (made by project MM).

Organic starts with strong accumulation – volume increases before pamp.

When exit?

Price mooning & volume decreasing = big crash incoming.

Easy.”

Concluding notes

Apart from the hype about Musk’s stake in Twitter, the past week has been far from uneventful within the crypto space itself (if there ever is such a thing as an uneventful week in crypto). The Ronin bridge, which is operated by Axie Infinity, suffered an exploit with $625 million in funds lost. Meanwhile, a whole drama has been unfolding within the Waves ecosystem, leading to a governance proposal which, if passed, would liquidate some huge wallets that are shorting WAVES on-chain, unless they repay their loans.

While these hacks and shady dealings are generally far removed from the life of most traders, you should use them as a reminder to keep your security and risk management top-notch. No matter how good a trader you are, having all your funds in a risky protocol or a hot wallet on a malware-ridden computer can cause you to lose everything overnight. Stay safe out there fam.