Bloodgang,

Welcome to the twenty-third issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

We’ve had yet another news-driven week in the markets, with quite a few impactful headlines this time. The US Consumer Price Index numbers for March were published on April 12th: slightly above most expectations, inflation was at 8.5%. Naturally, this leads to expectations of a further hawkish turn in Fed policy, but it remains to be seen just how hawkish they can get before the threat of an economic nosedive becomes too great.

Another thing that’s finally behind us is the US tax deadline – at this time of year, there’s often a bit more selling with many traders being forced to cash out some of their crypto to pay their taxes. Now that the deadline for that is over, the extra supply finally disappeared, which should help the markets become somewhat easier to navigate than in the previous weeks.

As for crypto, one important headline is yet another delay to the Ethereum 2.0 merge, that is the point at which the current Ethereum blockchain will transition to the Proof-of-Stake 2.0 version. This has been a highly anticipated event for quite some time now, and many expected it to come in the first half of this year. Those expectations were squashed, however, when Ethereum devs announced that it has been delayed until the second half of 2022.

Bitcoin

Bitcoin/Dollar Weekly chart

Bitcoin/Dollar Daily chart

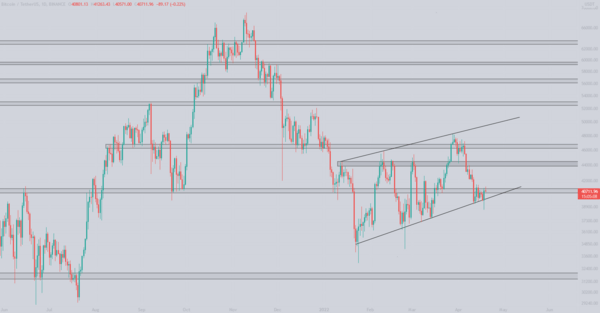

Bitcoin reclaims $40,000 after volatile Easter price action.

We saw some interesting price action during the three-day holiday weekend with Bitcoin making a low at $38,500. In hindsight, it seems that it was a bear trap as Bitcoin closed above the trendline at the end of the day with an almost 7% candle. From the TA perspective this looks a good level to place some bids as we have a confluence of the $40,500 level and a trendline. Upon closing below this level and confirming it as resistance I would look towards the $34k level and then towards $30k.

Looking to the upside, there are 3 levels i would monitor as resistance: the first one would be the $44k level which was confirmed as resistance 4 times before breaking above, the second one would be the key weekly level at $46,500 and then the third resistance lies around $50k which is the trendline that has been forming since we first broke below $40k in January.

Looking at the weekly level, not much has changed; the range high is not being respected and it’s currently trading right on that level. A weekly close below the level does not mean anything good and we need to see the next weekly close above the $40500 level or we will see more downside.

Ethereum

Ethereum/Dollar Daily chart

Ethereum/Bitcoin Daily chart

Ethereum holds onto $3000.

Similar to Bitcoin, Ethereum quickly reclaims a key level after volatile Monday price action which led ETH to drop to $2880. On the ETH/USDT pair we can see that we are trading right above the $3000 level where buyers are stepping in. It’s important to mention that volume is dropping daily (Monday being an exception) which is not a good sign if you are looking for the support to hold. On the other side, lowering volume means we could look for a breakdown and enter into a short upon retesting this level. Upon losing that level I will bid $2700 as there are no major levels before that.

Looking at the ETH/BTC pair, there are no major changes since last week. We are trading in the middle of two major levels, but it looks like it’s slowly turning to the downside. I would not make any rash decisions here before clearer direction is seen.

Blood’s content recap

How to preserve your capital

“1. Start slow, spot. Min Risk

2. Put 50% profit back as working cap

3. Take 20% profits and lock it in usdt

4. Put 5% of profits in risky shitcoins

Transfer the rest of profit to your mom’s bank account. Repeat”

New trading environment coming soon

“Working a new Trade learning environment for all of you

Live experience trading simulator connected with Binance, executed from my Discord

No subscriptions, no trading capital needed, all for Free for you to Learn

Top 10 traders will get monthly rewards in USDT”

Concluding notes

What are we likely to see going forward? Apart from the obvious question of how the Fed will react to inflation, one thing that’s likely to influence the markets in a new way is an interesting headline from Russia: the Russian government has apparently agreed to treat crypto as a fully legal means of payment. What’s more, they might even start taking payments for gas in Bitcoin. Of course, this looks insanely bullish on the face of it, but the current geopolitical situation complicates matters quite a bit. If Russia starts using Bitcoin more extensively, this could give the US and other Western countries another excuse to restrict and regulate crypto as much as possible.

In the long run, this won’t impact things too much – it’s unlikely that the West will shoot itself in the foot over payments for Russian gas – but any news about increased regulatory pressure in the US would be extremely bearish in the short term. Keep an eye on this and manage your risk accordingly.