Bloodgang,

Welcome to the twenty-eight issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

After a very eventful news-driven period with the Luna crash, we got – unsurprisingly – a choppy and relatively uneventful week. On the one hand, Fed members have started to talk about potential rate cuts further down the road, but on the other hand, stocks still mostly closed the week lower, with the S&P 500 down by around 3%. It’s worth noting that the index tested the 0.382 Fib retracement level (measured from the March 2020 low to the ATH), so a relief bounce here – which would carry over into crypto – became significantly more probable.

Meanwhile in crypto, Luna announced a proposal for a hard fork of the chain, namely to create a new Terra chain without UST. This was not without controversy (as would be expected for any governance proposal in a protocol that suffered such a fate), but the main point is that LUNA and UST holders would be allocated a significant amount of the new token. Given how important UST was for Terra, it remains to be seen how successful the new chain will be.

Bitcoin

Bitcoin/Dollar Weekly chart

Bitcoin/Dollar Daily chart

The market became interesting for day traders as Bitcoin traded in a newly formed range between $28,800 and $31,300.

If you read my newsletter you know that I keep repeating myself like a broken record but this is the 8th consecutive red weekly candle close on Bitcoin, which is something I have never seen so far. I am expecting more bulls to start stepping in as this presents a good buying opportunity which should be followed by a relief rally.

Looking at the weekly level we got another weekly close below the important level at $31,500 which was defended well during the May downtrend, indicating that there is further downside potential. Due to this I have drawn a few levels which could be used to play bounces. Personally, I am not trading these levels as I am not expecting an uptrend until this fundamental macro shitshow fixes itself.

Looking at the daily level we can see that the range mentioned above is well respected and provided quite a few opportunities for both longs and shorts. Although we have pushed above $30000 at the end of the weekend we need to be careful as stoch RSI also entered into the overbought area which could trigger some short-term selling.

June is a way better month compared to May according to bitcoin historical annual returns so we might just get the long-awaited relief rally next month.

Ethereum

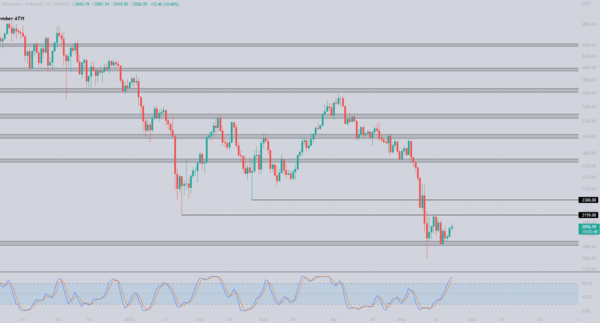

Ethereum/Dollar Daily chart

Ethereum/Bitcoin Daily chart

Ethereum fights to defend the $2000 level.

We can see that ETH has a very similar price action to Bitcoin and it was rejected by the MA100 on the weekly timeframe which suggests weakness. It has also formed a new range between $1900 and $2159 which is the previous low. I am not expecting any continuation until we break above the $2300 where the previous higher low lies.

Looking at the ETH/BTC chart we can see that Ethereum has been moving in the channel for almost a year excluding 2 fakeouts (1 to the upside and 1 to the downside). I am patiently waiting for either a confirmed breakdown or breakout to the upside and I will position according to the direction it goes.

The stoch RSI on ETH indicates that we could see some selling in the short term or until the RSI resets, which could bring us to retest the range low, providing some long opportunities. An important date to mention here is June 8th as that is when the Ropsten testnet merge is being integrated and we could see bullish price action before/around that date.

Blood’s content recap

Bloodcast is live

“I launched a podcast called BloodCast on Spotify

Every two weeks famous guests from crypto space will discuss:

– Adoption

– Trading

– Crypto world in general

There will be special episodes where I talk about my journey. You can find link in my telegram.

See you on the mic fam”

Say “NO” to paid groups

“As we enter tough trading conditions I expect more paid groups to emerge

Feeding on fear & uncertainty, taking your $ to accumulate more assets for Themselves

I’ll never have a Paid group

My goal is to help You become financially needless as should everyone with high following”

Concluding notes

Even though a relief rally is more likely than in the previous few weeks, don’t expect it to be too easy. In any case, I recommend watching stocks closely before trying to catch a bounce in crypto, as there’s every reason to think that BTC will follow legacy markets whichever way they go.

The worst scenario for most people would probably be continued chop with no clear direction in sight, but this isn’t that likely in my opinion. The global macro outlook is still bleak in the mid term, but short-term relief bounces are inevitable.

Hi Blood! Thanks for another newsletter! I hope we get a better month at June as you said!