Bloodgang,

Welcome to the thirty-ninth issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of Contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

Over the past couple of months, I spent a lot of time writing about interest rates, economic data, CPI numbers and other things that most crypto-natives find a bit less exciting than watching paint dry in HD. However, as we’ve seen, this has been by far the biggest driver in the market, whether we’re looking at stocks or crypto, so keeping track of TradFi is absolutely essential. But now, we can take a bit of a break from this, as the Fed looks to have loosened up, in order to look at a catalyst that comes directly from crypto: the long-awaited Ethereum 2.0 Merge.

So far, everything looks to be on schedule for the Merge to happen in September. When it occurs, the current Ethereum blockchain will be merged with the Eth 2.0 beacon chain and the network will transition to Proof-of-Stake, which has already been live for a while on the beacon chain itself. This brings with it a host of changes, but let’s just look at two: supply shock and a potential new network after the fork.

Firstly, ETH is currently being issued to Proof-of-Work miners of the existing network as well as those that are staking on the Eth 2.0 beacon chain. After the merge, the PoW rewards will stop, and this will have a similar effect on ETH issuance to three Bitcoin halvings in one (which is why it’s sometimes called the “Triple Halving”). Second, it’s likely that some miners will want to continue with PoW Ethereum, meaning that the “old” version of Ethereum will still exist as a separate fork, similarly to what happened with Ethereum Classic. Here’s where this gets interesting: if you’ve got 1 ETH right now, after the fork you’ll still have 1 ETH on Eth 2.0, but you’ll also have 1 “PoWETH” (no one knows what it will be called) on the other fork, the one still running on Proof of Work. These two will be completely separate blockchains from then on, but all your token balances from Ethereum pre-Merge will exist on both chains.

When it comes to other tokens, they will in most part become worthless: if a stablecoin issuer decides to only consider the tokens on the PoS network as legitimate, then your duplicated stablecoin balances on the PoW fork won’t be worth anything. On the other hand, things are much less predictable with PoWETH: could that become the main PoW Ethereum chain, outcompeting Ethereum Classic? Some do think so, but in any case steer clear of speculating on this at the time of the merge, since many huge players have started buying spot ETH and hedging with futures, so that they can get the potential PoWETH token and dump it immediately.

Bitcoin

Bitcoin/Dollar Weekly chart

Bitcoin/Dollar Daily chart

Another week, another weekly close above the WMA 200.

After the previous weekly only just managed to close above the MA 200, we now got another one. Although we can see that a wick went below the MA which only proves that this is an important level, what we really want to see is a full weekly candle above the line, which we could get this week, but let’s not get ahead of ourselves.

Looking at the daily chart we can see that the ascending triangle structure was tested and bulls stepped in to defend it. The Stoch RSI tested the midline on this retest and currently it is still trading below the overbought zone, indicating that there could still be some upside potential. There is no real resistance before $28,000 in my opinion, meaning that as soon as we get bullish momentum, there is nothing stopping Bitcoin before it hits that level.

Ethereum

Ethereum/Dollar Weekly chart

Ethereum/Bitcoin Weekly chart

Ethereum once again prints a green weekly candle, the 5th in a row.

Besides the fact that we got another green weekly candle, not much has changed in terms of structure. Ethereum is still stuck between the $1350 and $2000 levels although it is slowly approaching the resistance. My plan here remains the same as the previous week, we either wait for another potential drop into $1350-$1450 or wait for short opportunities around $2000.

The ETH/BTC chart has closed another candle above the 0.07 BTC level, even though we got a wick below the level, bulls stepped in to defend it. I guess they are all about cheap ETH before the merge. As the merge is about to happen (in just over a month) I suggest not to leverage trade ETH as it is going to be volatile, especially a few days before the event. It could be a sell the news type of event, or super bullish if everything goes right.

Stoch RSI on the USD pair is about to enter into the overbought area which could be in line with the $2000 USD resistance, meaning that we could actually see a retrace there, but let’s wait and see how this week goes.

Blood’s content recap

Book announcement

“Wrote and published a book recentlyThe book contains knowledge I got from 2016-2022 which helped me earn millions.

Book is not for sale. Hard copies are exclusive for Our community.

I started writing a new book that explains how to reinvest profit and get lasting passive income”.

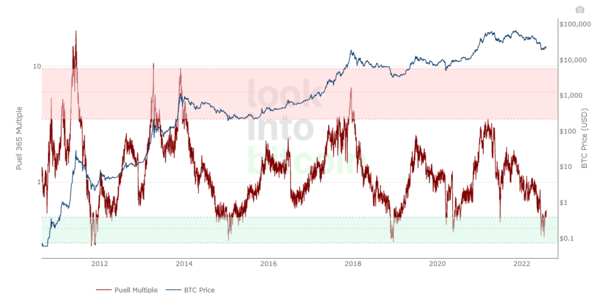

Puell multiple giving us BUY signals

“The Puell Multiple signaling we are in the buy zone on #Bitcoin again?

Tweeted this back in July 2021 when Bitcoin was trading at $32700 and ended up making new highs to $69k.

Not saying it’s a bottom, but it’s a zone where you MUST accumulate.”

The Puell Multiple

Concluding notes

Not to get too deep into the Merge, there’s still one more thing to keep in mind: whatever happens—whether there’s a ton of activity and value on the PoW fork or it mega-dumps immediately—we’ll be in for an extremely interesting experiment. In an instant, there will be an Ethereum chain without major stablecoins being backed by anything, and also without much of the key infrastructure for DeFi, including the biggest oracle providers.

What will happen in that environment, when DeFi on the PoW chain—like a cartoon character over a cliff—keeps running even when it loses the ground under its feet? Will we see governance takeovers and utter chaos lasting for months or will things wind down quickly as everyone heads for the exit? In any case, I have a hunch that we might witness the most interesting episode in the history of crypto.