Bloodgang,

Welcome to the fortieth issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

Last week, the CPI numbers for July were released, with inflation at 8.5%—a notable cooldown from the previous 9.1% print. As could be expected, risk-on markets rallied across the board, since this is further confirmation that the Fed can say they’ve done enough to bring inflation under control and stop crashing financial assets. Keep in mind that the CPI means that prices are still rising, it’s just that they’re rising slower than the previous month.

In more crypto-specific news, the Ethereum merge will probably happen a bit sooner than previously expected: while most were predicting the date to be September 19th, it will most likely fall on the 15th. In fact, the merge has already been scheduled and everything is good to go, but the reason why we don’t yet know the exact time is the way this was implemented. Instead of using a set block height (i.e. total number of blocks produced), which is typically used to schedule on-chain events—and tends to be extremely predictable—it will be triggered by the terminal total difficulty or, in other words, the cumulative hashrate of the network. This choice was made to prevent miners from knowing which exact block will be the last to be mined by Proof-of-Work, as that could enable malicious attacks. And, with hashrate set to be especially unpredictable in the final days and hours of PoW mining, this means we’ll only keep getting better and better approximations as the merge approaches, rather than knowing the exact time.

Bitcoin

Bitcoin/Dollar Daily chart

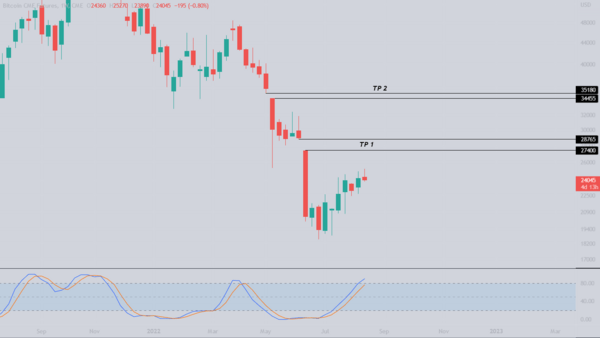

Btcoin trade with CME gaps

Bitcoin weekly closes green and makes a high above $25,000, is our CME trade call going to hit targets soon?

Another good week for Bitcoin as a new high was made and we have no big resistance ahead. We could expect higher levels although we are now stuck below the MA100 which is the only level I am monitoring at the moment. The Stoch RSI has been jumping between 50 and overbought since June and it was a good signal for retraces and bounces. Currently it indicates that it will leave the overbought zone and retest the 50 level before going further, meaning I am not entering any new positions at the moment in case this pattern continues.

If you have been following me for the last couple of months you know that I have only given a few trade calls, one of those was the trade call with CME gaps as targets, now many were in disbelief but it was a longer term swing play which is playing out really nice. I added the chart with targets again and I expect them to be reached fairly soon even if we retest lower levels first.

Bitcoin trade with CME gaps

Bitcoin Macro Trading

twitter.com

Ethereum

Ethereum/Dollar Weekly chart

Ethereum/Bitcoin Weekly chart

Ethereum reclaims $2000 for a moment as the merge approaches.

The USD pair is stuck at resistance and I was derisking all the way from $1900 to $2000. That’s the only smart play here if you entered at $1400 or lower. Even if we go higher you made a 50%+ trade which is crazy good for such a short time. Even though the merge is approaching we could see a small retrace, a reset in the Stoch RSI and revisit lower levels or we just pump straight to $3000, who knows. However, as a swing trader, you MUST play levels or else you will get rekt because when trading such big events it is hard to predict the outcome.

I have updated the ETH/BTC chart to show you how respected the 2017-2018 levels are. More importantly, ETH had another crazy week if compared against Bitcoin and it tagged the 0.08 BTC level. As discussed previously, the mentioned level is a technical resistance which should be monitored. As soon as that level is cleared, we have one more level before the moon mission starts, that is 0.085 BTC. After reclaiming that level, which is the December 2021 high, as well as resistance in May 2018 and August 2017, we can see 0.1 BTC and higher.

Of course it all depends on how the merge goes and whether that’s priced in or not.

Blood’s content recap

Useful stuff on the web which I use

“ Stuff on the web I use thats Free and Should Not Be.

- I dont take notes during meetings, Otter ai does that

- Without Jenni AI, articles would take forever to write and I dont spend hours googling, Axiom ai can automate it

- And I use My 90s TV, to watch old shows

Want more?”

New Blood Trading League starts today!

“New Free-to-join trading competition starts this Monday.

More rewards this time: - $3000 prize pool with 1st place getting $1000

- Top traders will get BG Book

- First 300 traders that join get $50 airdrop each

Ready fam?”

Blood’s content recap

Useful stuff on the web which I use

“ Stuff on the web I use thats Free and Should Not Be.

– I dont take notes during meetings, Otter ai does that

– Without Jenni AI, articles would take forever to write and I dont spend hours googling, Axiom ai can automate it

– And I use My 90s TV, to watch old shows

Want more?”

New Blood Trading League starts today!

“New Free-to-join trading competition starts this Monday.

More rewards this time:

- $3000 prize pool with 1st place getting $1000

- Top traders will get BG Book

- First 300 traders that join get $50 airdrop each

Ready fam?”