Bloodgang,

Welcome to the forty-sixth issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

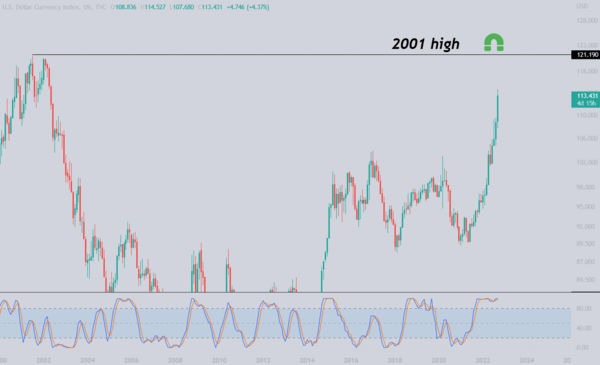

Well, at least one asset had an incredibly good week—I have in mind the USD, of course. The Dollar index gained over 3%, and the 2001 high of 121.02 looks to be anything but unreachable, as the Fed hiked by 75 basis points and remains committed to fighting inflation for the time being. A 3% increase in one week might not seem like much, but in macro terms it’s not something you see that often. To put things in perspective, the British Pound just hit its all-time low against the dollar, while the S&P 500 retested its June low.

None of this sounds good for risk-on assets, but remember that there’s one very important date coming up: the US midterm elections on November 8. Inflation hurts the average Joe more than falling stock prices do, so there’s every reason for the Fed to talk (and act) tough leading up to the elections. When that’s over, we will have the first real opportunity for a significant change in monetary policy—a change that will be heavily demanded by those in the US that are exposed to financial assets more than the price of eggs at the local supermarket, as well as by European countries which are severely impacted by the verticality of the DXY chart.

Bitcoin

Bitcoin/Dollar Weekly chart

US Dollar Index

Another week above the 2017 ATH zone.

Monitoring the current local bottom didn’t pay off as Bitcoin dropped to a weekly low of $18,125, making a higher low. The Fed announced a 75 bps hike rate as expected, markets were volatile and ended up liquidating both shorts and longs. The weekly volume is still increasing which still means that it is a good sign for bulls and it shows they are interested in Bitcoin at current levels. The weekly Stoch RSI is still trading right below the 80 level and could use a reset before going higher.

As Bitcoin hangs above support, the DXY has been making new highs, not allowing risk-on assets to grow as the focus is on fighting inflation rather than saving economic growth. I have shared a tweet on Bitcoin and DXY correlation, which is included in the Blood’s content recap section below. It’s a really good indicator to predict the movement of Bitcoin if DXY moves. Eg. If DXY starts pushing heavily, you can expect Bitcoin and other riskier assets to dump. See the tweet to get a better understanding.

As you can see on the chart, DXY is fairly close to reaching 2001 highs, which in my opinion would break the current BTC support level and push it lower. I keep repeating myself, but DXY is a MUST monitor chart.

Ethereum

Ethereum/Dollar Weekly chart

Ethereum/Bitcoin Weekly chart

The Ethereum Merge is over, now we wait?

Since the Merge we did not see much interesting action on ETH. Our bids were filled after a long time at $1350, but we are not getting the reaction we wanted. Losing the current level could lead us back to 3 digit Ether (below $1000) and would once again provide a golden opportunity to accumulate it. The Merge was successful, meaning we are one step closer to the full capabilities of Ethereum 2.0 and the technology behind it is insane. To be honest, I do not expect any real growth before 2023, but we could see Ethereum rise close to $5000 by the end of 2023 if the macro situation picks up, for example with a Fed pivot right after the midterms.

As discussed in the previous letter, ETH/BTC is closing in on its 0.065 BTC level, which is a great place to swap some bitcoin into ether and see if we can get a bounce. Besides that not much has changed, the levels remain the same.

Blood’s content recap

Sharing my full portfolio soon

“Becoming a crypto millionaire is easy, preserving your capital is a masterpiece. You need to diversify crypto profit in real-life business and build an empire to stay wealthy during macro shifts. I will share my portfolio and show you which industries are easiest to start with.”

DXY and Bitcoin correlation

“$DXY showing some weakness and #Bitcoin has room to grow. These two charts are correlated almost perfectly. As one retraces the other pumps. Been saying for a while this has been a money maker for me lately.”

Concluding notes

In order for the Fed to pivot, they need a very good reason—simply saying they want financial assets to moon isn’t going to cut it, of course. Put differently, something needs to break—and threaten to continue breaking beyond repair—for that to be on the table. (Un)fortunately, there’s no shortage of things that could indeed break, with everything from the bond market to EU economies all standing by to provide that much needed excuse.