Bloodgang,

Welcome to the forty-ninth issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

The CPI headline last week wasn’t too good, but not too bad either: annualized inflation came in at 8.2%, while the forecast was 8.1%. Interestingly, while stock futures and crypto at first seemed to react the way one would expect—with quite a meltdown—everything bounced back extremely quickly. There are multiple reasons for this, and I’ll mention some of these below, but it’s also important to keep in mind that market positioning was heavily on the short side. Given that there were plenty of shorts that absolutely needed the S&P 500 and Bitcoin to follow through on the dump, it’s not surprising that the bounce led to quite the squeeze.

This week, legacy markets will be largely focused on earnings reports, as the likes of Tesla, Netflix, Bank of America Corp and more will release these all-important numbers. If these figures surprise the market—one way or another—that might be an important catalyst. Meanwhile, the GBP is recovering a bit, as their finance minister announced that most tax cuts will be dropped in reaction to the turmoil in the bond market (and, while this may have saved the GBP at least temporarily, the same can’t be said for the government’s credibility).

Bitcoin

Bitcoin/Dollar Weekly chart

U.S Dollar Index

S&P 500

Surprise surprise, Bitcoin is still glued to support.

As expected, DXY has almost reclaimed its previous high due to the inflation data coming out 0.1% higher than expected, although, as I mentioned on Twitter before the event, the producer price index was at 0.4%, instead of the expected 0.2%. This means that the cost of produced goods and services is UP which results in businesses increasing prices and that drives CPI higher. So anyone who understands this, knew that inflation will be higher a day earlier. This is also an important reason why Bitcoin and S&P 500 pumped right back up after dropping on Thursday.

Speaking about the S&P 500, it seems that it’s trying really hard to reclaim the previous local low, but so far unsuccessfully. Bears are on the winning side as they managed to push it to a new low and made a lower high, but let’s see the reaction today as the markets open.

Bitcoin is holding really well considering what’s going on with DXY and the S&P 500, but keep in mind that the volume has decreased for the second week in a row. The Stoch RSI has also been showing weakness and slowly falling towards the midline, while also making a series of lower highs in the last few months.

Ethereum

Ethereum/Dolar Daily chart

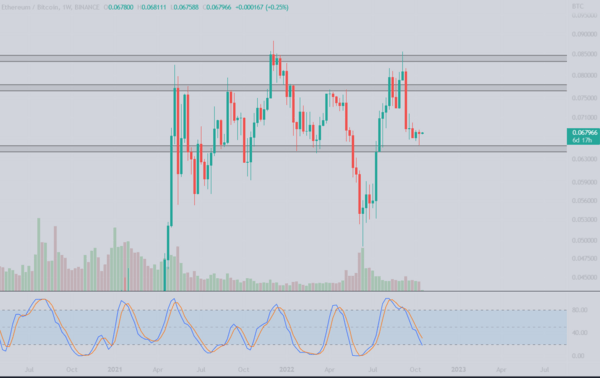

Ethereum/Bitcoin Weekly chart

Ethereum trades below the key support at $1350.

Not much action seen on Ethereum this week, as it is glued around the resistance level with daily volume decreasing which is what you don’t want to see when an asset trades right below the key level. In case we get a breakdown, the first level to monitor is $1150, which was already tested with a wick, and the next technical level is $1000.

The ETH/BTC chart has finally reached the support level at 0.065 BTC which we have been monitoring all the way after the Merge happened and said we will bid. Currently, however, I am not confident in bidding this level due to volume dropping on both USD and BTC pairs, but I will monitor it closely and as soon as I see some movement and interest in Ethereum, I will flip some BTC into it.

Blood’s content recap

New exercise

“Bear market trading exercise.

- Choose a few different chart patterns (Eg. S/R, Trendlines, triangles etc.)

- Monitor charts and find these patterns

- Observe and journal how assets react at these patterns

Monitoring charts is the only way you will Master price action.”

We celebrated 1 year of Discord, join us!

“Our discord celebrates 1st anniversary.

Annual progress:

- Reached 18k members

- Giveaway of 100+ of my books

- Gave our 15k in rewards, 100k in charity

- Amas with spicy topics and competitions

- Met amazing people

Everything for free

Goal is to x3 these numbers in y.2”

Concluding notes

Apart from recent escalations in Ukraine, it’s worth keeping in mind that the so-called culture war in the US is also becoming more and more pervasive. A couple of days ago, the banking giant JP Morgan Chase cut ties with Kanye West over some controversial comments he made; regardless of what you think about Kanye, the fact that a bank can close your account if they disapprove of your opinions is not to be taken lightly.

Recently, we’ve seen plenty of events that should drive people to crypto: from banking restrictions during Covid lockdowns (e.g. Canada), to war, yield curves going all over the place, inflation and the growing realization that fiat money couldn’t be further from a “safe haven” in the bigger picture. But, just like the breakout of the conflict in Ukraine, this process isn’t that straightforward. It will take a while for people to realize that there is an alternative, it’s just that now, the glaring unsustainability of the current system is more obvious than it has been in a long time.