Bloodgang,

Welcome to the fiftieth issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

A big week is coming up in terms of the macro environment, with everything from the US PMI (Purchasing Managers’ Index), which gives an overview of how trends are shaping up in manufacturing, to various earnings reports and the US Q3 GDP report. On the other side of the Atlantic, the European Central Bank will also release its rate decision on Thursday, with most expecting a 75 bps hike.

It remains to be seen whether 75 bps will be enough to save the Euro from its current predicament—in any case, the big question is how the Eurozone economies will cope with higher rates given their less than enviable position in terms of supply chains and yield spreads between different EU countries.

- US manufacturing PMI, estimated 51

- Microsoft, Alphabet, Meta, Apple, Amazon earning reports

- Consumer confidence report, est 105.3(Wednesday)

- ECB rate decision est. 75bps and US Q3 GDP est. 2.3% report (thursday)

- Musk twitter deal deadline (friday)

Bitcoin

Bitcoin/Dollar Daily chart

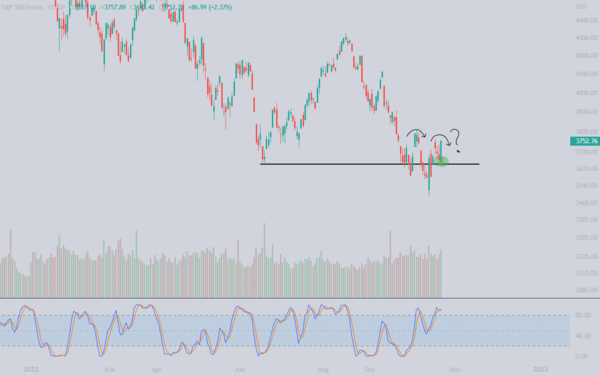

S&P 500

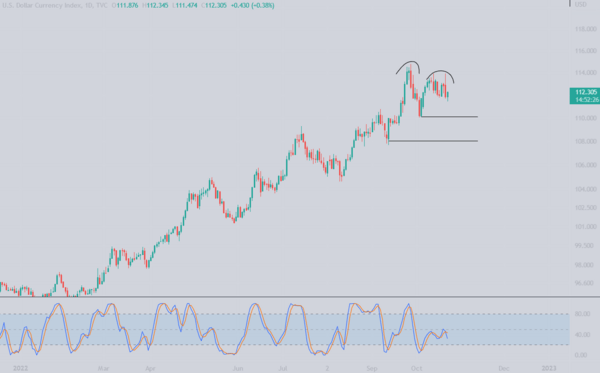

U.S. Dollar Index

Bitcoin on the daily timeframe is showing a series of lower highs with decreasing volume which is what you don’t want to see as we trade right above the support. But, at least for now, it seems that traders are very interested in buying Bitcoin if we start approaching the black line at $17949. This will be an interesting week as we will see how fucked the big companies are (Apple, Microsoft, Google etc.) due to earnings reports coming out. If earnings are not good, S&P 500 will drop and crypto with it. In case we get a drop I suggest scooping some BTC near the black line.

After a long time, the S&P 500 actually doesn’t look bad. Even though it’s an important week due to earnings reports and we will probably see some volatility, from a technical standpoint it looks better than previous weeks. It once again pumped above the line which marked the local bottom in June, and retested it as support. This is a good sign, however i am worried that we might be making a lower high, but let’s wait and see what this week brings.

The U.S. Dollar Index fails to make a higher high, instead makes a lower high, which leads to stocks and crypto finally getting a breather and a short term bounce. The only logical levels I would look at for a bounce on DXY are the lines I drew, first at $110 and the second one at $108. In case we go lower (perhaps driven by a bounce in EUR), even better for crypto and other risk-on assets.

Ethereum

Ethereum/Dollar Daily Chart

Ethereum/Bitcoin Daily chart

Ethereum is still trading in the narrow range that it had formed in late September.

Even though we have been in this range for some time and the price did not break up or down, we can still see that it has been in a similar situation to Bitcoin. The volume has been decreasing each day, but the price is not moving. In case we want to see a move in either direction we will probably need to see a breakdown first. The reaction will tell us everything, either traders step in and push it back above, making a false breakdown, or we get a confirmed breakdown and head towards the $1000 level. Before a breakdown happens I don’t see us going higher, unless the macro environment improves suddenly, which I don’t see happening any time soon.

Looking at the ETH/BTC chart, we can see that traders defended the 0.065 BTC level and the Stochastic RSI has been in an uptrend for quite some days now. I did not swap any BTC for ETH as we retested this, because I didn’t feel confident with volume dropping all over the board. Will still be monitoring this level in case we get another retest.

Blood’s content recap

My view on paper trading

“Paper trading is a good approach, but you won’t learn how to trade with it You need to feel the pain of losing money. Instead

- Choose a pattern & asset

- Backtest the pattern 100 times

- Wait for a pattern

- Trade with a low $ amount

Increase size as you get a higher win rate.”

New scalping exercise

“Guten Morgen

Scalping exercise #5: Long with MACD

- Open a 5min naked chart

- Turn on MACD & EMA200

- Condition 1: blue line crosses over orange line

- Cond. 2: crossover must happen near 0 line or below

- Cond. 3: price must trade in an uptrend & above EMA200

Lets go”

Concluding notes

In the midst of all the grim news out there, there’s one interesting note that we can wrap this up with: Elon Musk has until this Friday to complete the $44 billion deal to buy Twitter. Regardless of what you might think about him, I think we can all agree that the one thing he won’t do is make things boring. Also, it’s clear that getting rid of bots, which are becoming more and more unbearable, is a priority for him, so we can only hope that some kind of a solution can be implemented as quickly as possible—not to mention that whatever he does could be extremely positive for crypto as well. As a side note, it’s worth keeping in mind that this could have interesting implications for TSLA: their earnings report was decent, and any sell pressure from Elon in order to pay for the Twitter deal will be over soon. What this will translate to will, of course, depend on the global macro environment.