Bloodgang,

Welcome to the sixth issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

Overall, this wasn’t the most action-packed week in crypto, but there are still some important events to look at to get a sense of what the broader market situation is like. First of all, the Federal Reserve had another meeting that led to mixed effects in crypto. On the one hand, they decided that interest rates will remain unchanged until the end of tapering (the process by which a central bank reduces asset purchases and thus decreases the amount of money entering circulation), but on the other hand tapering itself was accelerated quite a bit. In case you’re not that into traditional finance, the bottom line is that this is nothing surprising, as they’re now well aware that inflation isn’t transitory and that something needs to be done about it.

Looking at the crypto side of things, one really positive event was that German savings banks are working on giving their customers the option to buy crypto directly from their bank accounts. Given that these banks – which form the German Savings Banks Association – have 50 million clients in total, this is quite the headline, but its effects will take time to become noticeable, since each bank will have to decide on whether and how to implement this for their customers. Still, this is incredibly important, as even the oldest and biggest institutions are clearly entering crypto in a big way.

Bitcoin

At the time of writing BTC is trading at $45880 and we are still in a downtrend. These are generally the market conditions you want to avoid unless you are an experienced scalper. Looking at the weekly chart we can see that we got a weekly close below the 50 MA, which is a bearish signal, however we need to keep an eye on it as it could also be a bear trap. In this case we would be looking at a weekly close above the 50MA.

On the daily timeframe we have a clear rejection of the ~50k resistance and the EMA21 is just about to cross below the EMA200 which is again a bearish signal. The next daily support zone is just below the current price at the $44-$45k level and that could be a good price to place some bids with stops below of course. Breaking below that daily support would indicate that we will retest that nasty wick from Dec 4th or the range high from the May crash which lies at $40000

Ethereum

ETH/USD is trading at $3793 at the time of writing. ETH has lost the key support level at $4k. Currently it has found a new range from $3650 to $4000 and so far it has been respected. EMA 89 has acted in confluence with the range high and was too strong to break above. If you are looking for a place to long, the range low is a good zone to place bids, target would be range high or EMA 89. RSI is positioned right above the oversold area, meaning we could see some relief to the upside.

ETH/BTC looks bullish and it will remain so as long as the weekly breakout holds. In addition, the EMA21 is also acting as a support and there is no sign of weakness.

Blood’s content recap

Secret tip#18

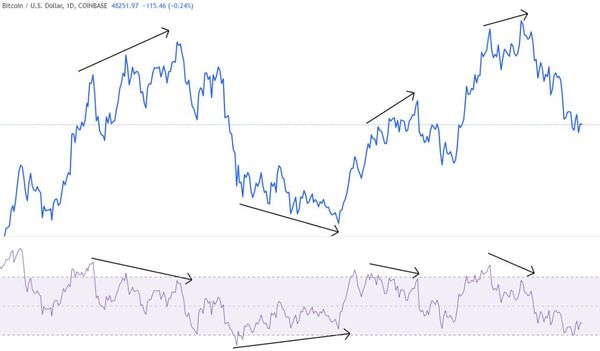

“Do you think RSI doesn’t work?

-Stick to the line chart

-Look for HTF confirmed give divergence

-Almost nails the top and bottom

Will you Swing and chill while you shut the choppy noise?”

Scalping exercise

“Trade pullbacks on 15m.

Open a chart.

Find a coin with a strong uptrend or downtrend.

Turn on EMA 20. In the uptrend, long every EMA touch.

In the downtrend, short every EMA touch.

Practice until I post another workshop!”

Concluding notes

This is not a great time to get over-leveraged on swing trades, but it’s great for scalping and playing low-risk, less exciting setups which in reality means playing level to level. There are also some outliers that have performed well (JEWEL), but there’s fewer and fewer of them these days and they are really niche. For Altcoins stick to hype narrative ones, they will be the first one to do a reversal (AVAX, LUNA).

Apart from that, this is also the perfect opportunity to improve your game with TA if you’re a swing trader, so that you’ll be ready when the market makes up its mind and starts providing good setups.

And of course, don’t be afraid to unwind a bit and take some time off the charts for the upcoming holidays. The market isn’t going anywhere – nor is it doing anything that interesting right now – so spend some time with your loved ones and enjoy yourself!