Bloodgang,

Welcome to the sixty-second issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

BTC and ETH stuck under key levels. Deutche bank is another victim of banking crisis, a comment on $ARB airdrop.

Fundamental overview

Time flies when you’re watching banks collapse all over the place, doesn’t it? I mentioned Credit Suisse (CS) briefly in the previous newsletter, but while this isn’t worth going into in too much depth right now, there are some important consequences to point out. The collapse led to more than $17 billion in AT1 (Additional Tier 1) bonds being wiped out. While AT1 bonds do have a relatively high yield and carry some risk, it’s still important to keep in mind that we’re talking about a category of Tier 1 bonds issued by an incredibly well-known bank in Switzerland. What effect will this have on trust in the banking system, especially among all the wealthy CS clients that essentially got rug pulled overnight?

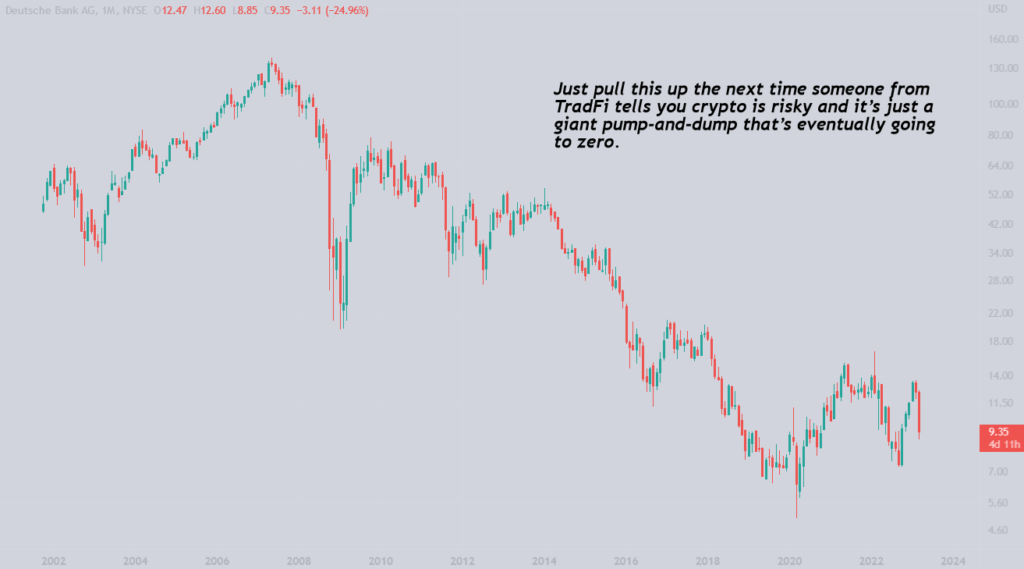

Among other things, the growing panic has led to Deutsche Bank (DB) shares plunging last week, as the market seems determined to stress-test every bank that has even the slightest rumors going around about it. Not that the recent dump is that important when looking at the long-term picture of DB, mind you:

Not to digress too much, but banks are really not in a good place right now. All the reassuring statements by regulators and governments across the globe are starting to sound like the famous “Steady lads, deploying more capital” tweet. The one difference is that central banks can always deploy more capital, but we all know what that leads to, don’t we?

Anyway, there will be a Senate and then a House hearing on banking failures in the next few days, so we’ll probably see more such statements soon. As for the FOMC, last week’s rate hike was in line with expectations at 25 bps, and all eyes are now on the next meeting in early May, as analysts are split between a final 25 bps hike and a pause.

Bitcoin

Bitcoin Weekly

Bitcoin Daily

Quite a boring week on the charts in terms of price action.

As long as Bitcoin holds the monthly breakout above $25,000, bulls should be happy. However, a retrace toward the monthly breakout level is to be expected sooner or later, especially since it was unable to break above the $30k zone. BTC has been trading slightly below the key level as well as inside the $28k CME gap for a week now and indicators are showing weakness.

The OBV has made a third lower high and the RSI is unable to break above the 80 level. Certainly not what you’re looking for when you want fast continuation.

The daily timeframe on the other hand looks a tad more bullish.

We’re seeing some sideways price action while BTC is still trading above the short-term EMAs, which confirms that it’s still in an uptrend. Although the RSI has been rejected at 80 a couple of times, it’s still hanging on there, as the OBV is almost flatlined, but above the downtrend breakout zone. If the short-term EMAs are lost on the daily timeframe I will consider opening a short to hedge my spot positions.

To sum up, the weekly looks more bearish than bullish, but as long as we stay above $25k the uptrend is intact. Acceptance below the summer range high would make this a fakeout and further downside would be expected. The daily looks a bit more bullish, but I wouldn’t enter into any new trades at the moment.

SPX, Gold and DXY

S&P 500 Daily

Gold Daily

U.S. Dollar index

Not much has happened with the S&P 500 except that it got rejected by the EMA 200 that we mentioned last week, which is an indicator that you must monitor. Support is still holding and price is above the downtrend line, meaning bulls are doing a good job defending it for now.

Gold is taking a breather after a crazy run.

The $1981 level for gold is acting as a resistance for now, but the more unstable the economy gets, the more gold will pump. I am not a fan of gold, but I believe that everyone should have 5%-10% of their net worth in it as an insurance policy in case things get really crazy (geopolitically or financially). If you are trading gold, $1916 is a support I would buy and $2049 is the level to derisk some and rebuy if it breaks above.

The US dollar index is breaking down, as expected.

No wonder if new money printing is the topic of the day. The key level to monitor is the low at 101 and if that level is broken… Well, all hail risk-on assets.

Ethereum

Ethereum Daily

ETH/BTC weekly

A new week and Ethereum is still under $2000.

On the daily timeframe, ETH/USD is in a similar position to Bitcoin as it’s trading above short-term EMAs as well as under the key resistance. Bitcoin’s $25k breakout zone is Ethereum’s $1700, so as long as that holds, ETH bulls should be happy and comfortable in their longs.

Both the OBV and RSI are showing no real movement, however; they are both slowly bleeding down which again is not something you want to see if you want to break this level soon.

We finally got to see a long-awaited level on ETH/BTC, but it’s not looking too good.

My bids were filled as it crossed the 0.065 BTC level, but it seems that support did not hold. I am still confident that accumulating ETH at that level was not a bad idea, so I will stick with it for now, but I am also ready and placing bids in case we drop to 0.054 BTC, which will be a key level to hold.

Blood’s content recap

Want new Guide?

New words, old solutions

“ The Fed is coming up with new words to print money.

To save banks they came up with Bank Term Funding Program (BTFP).

The program gives banks the full value of their bonds in cash to meet withdrawal requirements.

New words, old solutions -> more money printing.

Buy #Bitcoin“

Concluding notes

Apart from banking and overall macro shenanigans, the biggest event of the past week was definitely the Arbitrum airdrop. This was one of the most anticipated token launches recently, and as it turns out, that was for a good reason. Users of the network—especially those that used it often and with more funds—got between around $1k and $15k worth of tokens at current prices. This isn’t exactly life-changing if you’re already an experienced trader, but if you’re new to crypto and/or are working with a smaller portfolio, hunting airdrops can be incredibly lucrative.

If you think about it from a broader perspective, the fact that such opportunities exist is absolutely mind-boggling. If you had managed to get a decent number of airdrops over the past few years—even just the ones where there’s no staking requirement (so essentially no capital requirements except for gas fees)—with a couple of wallets, that could easily have amounted to six figures of free money, simply for using new networks and DeFi protocols. If you’re familiar with DeFi, then even the time investment is practically negligible: all it takes is a bit of bridging and trading on different protocols. If you want to learn how to become eligible for future airdrops, a good strategy is to check the eligibility conditions of previous airdrops (such as Arbitrum) and do something similar on new networks and protocols. And all it takes is spending less than an hour a week doing some transactions (which is also useful on its own as you’ll do a lot of hands-on learning about DeFi that way).