Bloodgang,

Welcome to the thirty fourth issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

The first half of 2022 hasn’t exactly been kind to U.S. stocks, with the S&P 500 closing its worst first half since 1970, down a whopping 21%. Sure, that might not sound like much in crypto terms, but for an index of that magnitude it’s devastating. To top things off, Google searches for the term “recession” in the U.S. just hit a fresh all-time high, meaning that the fear isn’t at all confined to professionals and investors.

And what about crypto? Simply put, things aren’t going great here either: the Three Arrows Capital situation is now crystal clear, with an official liquidation order and the appointment of a liquidator to take control of their assets. While some are worried about the impact this could have on the market – the liquidator has permission to sell any and all of their assets for fiat or stablecoins – it’s not likely that there’s that much left to sell. Given the way these things typically work, it’s almost certain that 3AC sold everything that they could well before going insolvent.

Bitcoin

Bitcoin/Dollar Monthly chart

Bitcoin/Dollar Weekly chart

Bitcoin closes below the 200 week MA for the third time.

After some kind of a bounce last week we argued that the 2017 all time high was defended, however the weekly 200 MA seemed too strong for bulls to push above it. At the time of writing we are once again trading right at the 2017 ATH, and there is no sign of strength at the moment.

We also got one of the biggest red monthly candles since November 2018 when Bitcoin dropped to $4000. In case of a breakdown, the next technical level that makes sense can be seen on the monthly chart and it lies around $13000. This will be my next accumulation level in case we go that low.

Both the monthly and weekly stoch RSIs are heavily in the oversold area which could indicate a bit of relief soon as sellers are exhausted.

Ethereum

Ethereum/Dollar Weekly chart

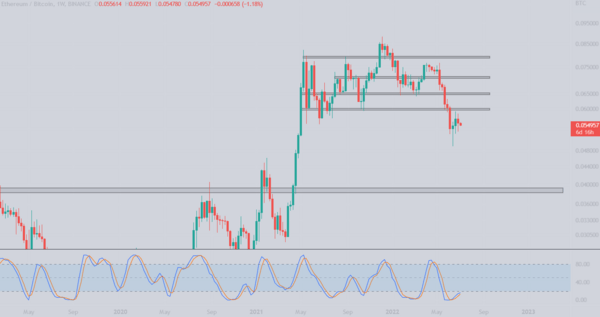

Ethereum/Bitcoin Weekly chart

Ethereum stays in the range.

The range high at $1350 and the range low around $900, which we discussed in the previous letter, remained intact in the past week. Personally, I will not open any new trades on ETH as long as these levels are not reached. Even though Ethereum is currently following Bitcoin’s movement, we can expect that to change as the merge is getting closer. The merge is fundamentally the most important upgrade for Ethereum and surely some of that is already priced in, but investors will probably react as the upgrade gets closer.

Looking at the ETH/BTC chart, we can see that the 0.059 BTC level was tagged twice already and it seems it was too hard to break for now. If you derisked at that level then you sold the top, congrats. Other levels remain the same as the previous week and I am not acting unless those levels are reached/broken.

The Stoch RSI on the USD pair looks similar to the one on the weekly Bitcoin/Dollar, but the ETH/BTC stoch looks like it’s aiming for a breakout from the oversold area which could lead to another test of the 0.059 BTC level.

Blood’s content recap

Bloodgood platform announcement

“I have been quiet on Twitter lately for a good reason

I am launching a FREE Platform where You can

– Learn & Train

– Find and communicate with friends

– Earn $$ to be the best

– Compete in esport competitions

I will choose a few of my followers to become beta testers

Ready?”

Concluding notes

Catching falling knives is never a good idea, and the past few weeks and months gave us plenty of great examples of just why that’s the case. Like I said previously, there’s still every reason to believe that these levels are decent for slowly averaging into some very long-term spot positions, but using leverage in these market conditions is just about the most reckless and dangerous thing for the vast majority of traders. For every trader that will be bragging on Twitter with a bottom leveraged long once there’s an uptrend again, there’s at least a dozen of them that will be completely rekt. And most of those that are bragging will be using fake screenshots.

Finally, keep in mind that we’re currently at the end of a holiday weekend which coincides with the end of Q2. There could hardly be a worse time to have a clear idea of the direction the market is taking, with investors rebalancing their portfolios in preparation for the second half of 2022. If we don’t get any major macro headwinds, then the forced selling could wind down quickly and we could see less unforgiving conditions. There will always be opportunities to take, so make sure to have some dry powder ready.