Bloodgang,

Welcome to this week’s issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Sell in May and go away narrative picking up as shorts compile, hopes of any clear USA regulation go went down the drain and more..

Fundamental overview

Not much happened in TradFi last week, as the S&P 500 spent the whole week in an excruciatingly boring 1.3% range, closing the weekly candle just 0.1% below the open. This isn’t too surprising given that economic data and earnings have been very mixed, so there was nothing to give the market a clear directional narrative. On the other hand, positioning is even more excessively short than when I discussed it in the previous newsletter, as the “sell in May and go away” narrative seems to be convincing more and more people to click the red button.

There’s more to that narrative than simply the fact that it rhymes—seasonality is definitely a thing—but then again, there’s one piece of advice that seems especially relevant here: never short a boring market. With volatility incredibly low and a Fed rate decision coming next week, I know I wouldn’t feel very comfortable shorting when bears are this confident. Even if stocks do underperform in May, there’s still an opportunity for the overexposed bears to be squeezed out of their positions first.

Bitcoin

Bitcoin Weekly

Bitcoin Daily

Both the weekly and daily timeframes appear bearish right now, so let’s break them down and see where to bid.

The weekly was rejected at the May 2022 level, which had previously acted as support following the early May breakdown. It’s not surprising that Bitcoin didn’t break through this level on its first attempt. As mentioned above, the “sell in May and go away” sentiment seems to be gaining traction. Despite this, I remain optimistic from a weekly standpoint, as long as we stay above the short-term EMAs and the EMA 200.

Bulls will want the RSI to stay above the 50s as it was rejected at the 80 level and is now slowly approaching the 50s. The MACD still looks healthy, with the uptrend intact as long as we see green bars and the blue line remains above the orange one.

The daily timeframe, however, signals trouble, as it has lost short-term EMAs and is trading below them without showing any strength. Both the RSI and MACD confirm the bearish trend, with the RSI breaking below the 50s and the MACD printing a bearish crossover.

Despite this, bulls have defended the $26,600 level (indicated by the dashed line on the chart) a few times, so seeking longs around this level could be a viable strategy.

SPX, Gold and DXY

SPX

Gold

DXY

The weekly SPX looks healthy for the time being, and it’ll be interesting to see how it performs after the US markets open today. The weekly MA100 remains the level to monitor, as long as the price is below it we are not going anywhere. There’s concern about a double top pattern forming, which is of course a bearish formation.

Gold is clinging to the support level at 1,980, but with both RSI and MACD plummeting, I believe it won’t hold for much longer, so lower levels are anticipated. I’m not actively trading gold, but I might start to if the price continues to drop.

The U.S. Dollar Index is barely holding on at its last level before a major breakdown. There’s nothing bullish about this chart, and given the current macro situation with the dollar, I don’t see how DXY could rise. The USA has taken a backseat, letting BRICS countries take the lead for now. It’s intriguing to ponder their next move in this ongoing currency war.

Ethereum

Ethereum Daily

ETH/BTC

The Ethereum daily is pretty much the same as Bitcoin.

Bulls were euphoric once it reclaimed $2k, but that didn’t last for long as it was a fakeout. The staircase pattern that started in March was broken and short term EMAs were lost. Now the question is simple: where to place our bids?

There are two levels to monitor in my opinion: $1,784 and $1,653. Both levels are lower highs from October and November 2022 and I expect bulls to bid them. To be honest, those levels are not bad for accumulating with smaller sizes. Also, both the daily RSI and MACD are breaking down as well, indicating further downside.

ETH/BTC remains choppy around our key level at 0.065 BTC, but I’m staying in my position nonetheless. I thought that the Shanghai upgrade narrative would take it higher, but instead it just reclaimed the level after a breakdown. However, we are here to trade levels, not news, so I’m keeping the position open. I’ll adapt and chart lower levels in case there is another breakdown.

Blood’s content recap

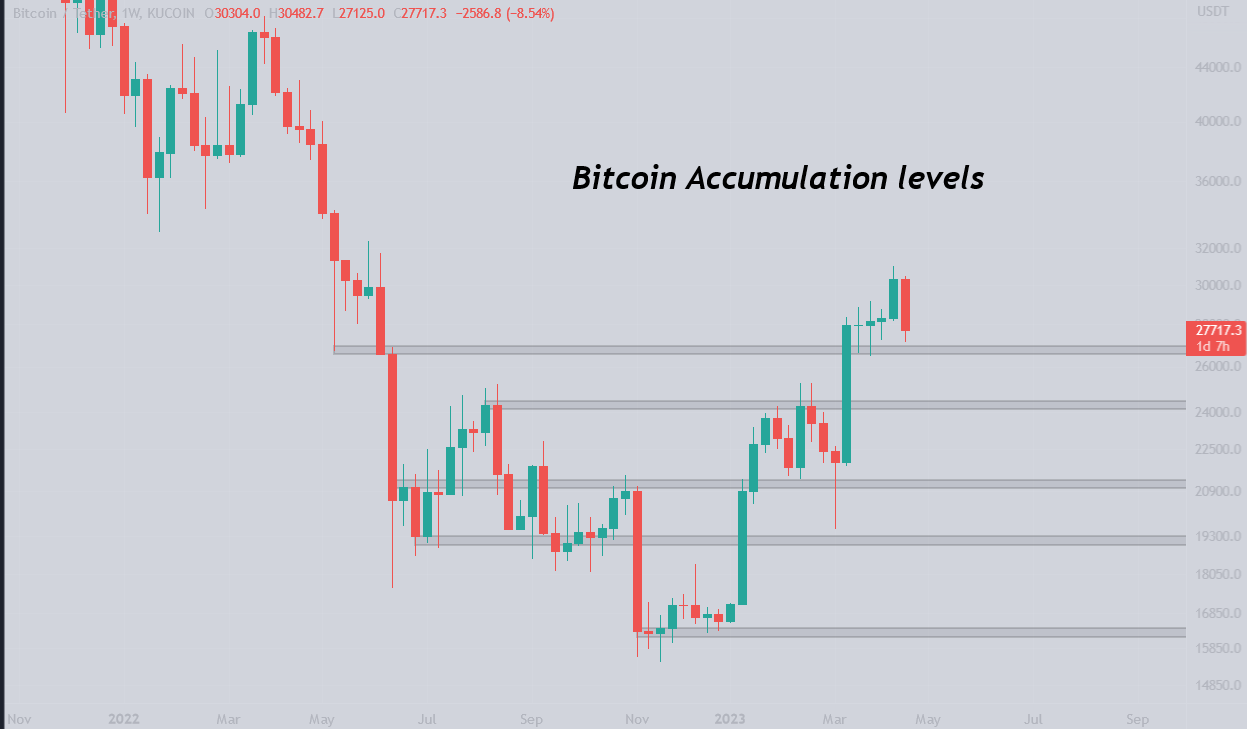

Bitcoin Accumulation levels

“We profited big time on the way up, so the lower we go the more I buy.

Playing the long-term game always pays off.“

New telegram group for Airdrops

“ I will open a dedicated telegram channel for Free Money.

Airdrops, giveaways.

For everyone that needs some Free capital to start their Crypto Journey.

Join on the link below“

Concluding notes

If you’re wondering whether crypto regulation in the US is becoming more sensible, Gary Gensler’s appearance before the House Financial Services Committee probably destroyed any hopes you might have had. The most interesting part of it was when he was asked whether ETH is a security: in spite of repeated attempts to get a simple yes or no answer, Gensler just kept on avoiding the question with a bizarre level of persistence. Not only that, but he said again and again that the regulations are all perfectly clear. So clear, in fact, that the head of the SEC himself can’t give an opinion on whether the second biggest crypto is a security or not! Overall, it seems unlikely at this point that Gensler will ever change his stance and his stubborn approach to regulation by enforcement, which is why our best chance at sensible regulation is a change of leadership in the SEC.

In other news, Trump announced—and promptly sold out—a second collection of NFTs. This was not that great for holders of the first collection, as the floor price fell by half shortly after the announcement, but it still remained well above its initial $99 mint price. In any case, whatever you think of Trump and his NFTs, this kind of move is setting an important precedent: maybe other politicians will use similar mechanisms to fundraise some day. If you think about it, it does make sense: the NFTs will almost certainly gain a lot of value if the politician that issued them gets elected, so backers would have some actual skin in the game financially as well, while on the other hand, royalties from secondary sales would be a good way to secure stable funding. Something like that might be possible, although it’s only scratching the surface of the potential interplay between crypto and (real-life) governance.