Bloodgang,

Welcome to this week’s issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Banks in trouble again, BTC Ordinals in depth, HTF charts and more

Fundamental overview

Some of you are probably tired of reading about TradFi developments over and over again—speculations on rate hikes, news about banks, earnings etc.—and if that’s the case, today you’re in luck. Even though these not too exciting data releases drive the crypto market through its correlation to stocks (and especially tech), there’s been way too much going on in crypto itself for us to focus on TradFi too much. With that in mind, here’s everything you need to know about the non-crypto side of things in two sentences:

The Fed hiked by another 25 bps as expected, and Powell was characteristically ambiguous in saying that they probably won’t hike any more, unless they do. Powell also said on Wednesday that banks are resilient, just an hour and a half before yet another bank (PacWest, $PACW) announced that it’s essentially screwed and its shares had a slight 60% correction before bouncing on Friday for some reason.

Okay, now let’s get to the fun part. A couple of days ago, PEPE, a memecoin on Ethereum that’s been around for less than a month, reached a market cap of $1.8 billion (yes, you read that right), and it’s still sitting close to $1b. This is interesting on its own, but what sets it apart from other memecoins is that it helped lead to an absolute frenzy of NFT and memecoin activity on Bitcoin (yes, you also read that right). While Bitcoin NFTs (specifically something called Ordinals) have been around for a while, it’s BRC20 tokens that are grabbing all the attention right now. Not to get too far into the technical details, BRC20 tokens were obviously inspired by the ERC20 token standard on Ethereum—of which PEPE is one example—but the similarities with ERC20 tokens don’t go far beyond the name.

BRC20 tokens are built on Ordinals, which means they’re technically NFTs, but they’re still fungible in practice because all the individual tokens of a single type store the same information, namely a 4-character token ticker. All that defines a BRC20 token is the ticker, the max supply, and the maximum amount that someone can mint in one transaction. Minting tokens has no other cost than the transaction fee, and tokens can never be altered in any way after they’re deployed (so it’s impossible to change the supply, make them non-transferable etc.). There are no Uniswap-style DEXes for BRC20s, but they can be traded in a similar way to NFTs (e.g. offering 1000 tokens for 1 BTC, at 0.001 per token, in a single NFT-style listing on a marketplace).

As you can tell so far, BRC20s are extremely rudimentary, but that’s more of a feature than a bug. Unlike complex DeFi protocols or IDOs on Ethereum and other EVM chains, BRC20s can’t be rugged by removing liquidity or slipping a backdoor hack into the code, precisely because they’re so incredibly basic in their design. A BRC20 token is just a ticker that lives immutably on the Bitcoin blockchain, and minting them is available to anyone – there’s no team allocation, sell tax, inflation etc. In many ways, they reflect the spirit of Bitcoin itself, which is why it’s no surprise that they’ve caught on (the first BRC20 token is currently sitting at over $500m market cap), although they’re undoubtedly only an experimental first step into the world of building tokens on Bitcoin. They might end up becoming completely worthless as they’re replaced by something more mature, but their significance is hard to overstate. I’ll get into some consequences that they have for Bitcoin—and the reason why Ordinals in general are so controversial—in the Concluding notes, but for now, let’s take a look at the charts first.

Bitcoin

Bitcoin Weekly

Bitcoin Daily

Another boring week on the charts as Bitcoin is still unable to break $30,000.

The market evidently recognizes this key level, having rejected it for multiple weeks now, and we should exercise caution. I’m not trading at this point unless we reach lower levels ($25k), as that’s the level I’m monitoring for a healthy retrace. A decisive break above $30,000 would shift my bias to bullish; however, in the short term, I’m expecting a retrace. Given the current macro situation, I expect Bitcoin to range in the 20s for some time.

The daily timeframe confirms the $30k resistance and looks bearish. The level was retested multiple times and got sold into heavily. As seen below, the MACD line attempted to break above twice but was unsuccessful, and the RSI has fallen back below the 50s.

For now, it’s reasonable to consider the push to $31k a few weeks ago a failed breakout, with a retrace likely to follow.

SPX, Gold and DXY

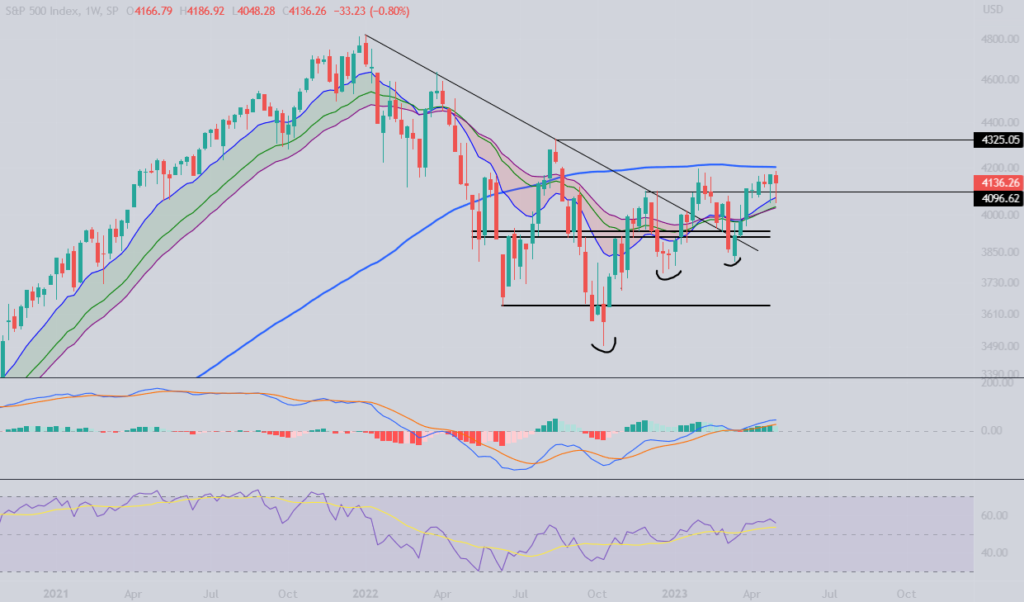

S&P500

Gold

U.S. Dollar Index

S&P 500 finds trouble at the weekly 100 MA once again.

Although there is an uptrend formed by three higher lows, the S&P 500 is still unable to form a higher high and break above the MA for further continuation. Everything looks shaky to me and red “CAUTION” signs are everywhere.

Gold stands out as it has bounced off the support after trading there for about two weeks. However, gold pumping implies only one thing: the market anticipates trouble ahead and seeks a safe haven.

The U.S. Dollar Index is breaking down as anticipated. The Fed cannot save the dollar and combat inflation without wrecking the economy. They are expected to pause rate hikes next month, which will likely bring further downside for the dollar index.

Ethereum

Ethereum

Similarly to Bitcoin, Ether has formed a failed breakout at the $2,000 level.

The failed breakout is clearly visible on the chart, and Ether has dropped back into the range. The range low is at $1784 and the high at $1986. I’m not planning to trade Ether at the moment, as choppy price action is how you lose money. Waiting for Ether to either break out of the range or break down seems like the best idea for now.

Failed breakouts are strong signals, and trading them can be challenging. We either reclaim the failed breakout area at $2000, or we wait for a deeper pullback into the range lows.

I won’t be sharing the ETH/BTC chart this week, as it is choppy around support and there isn’t much of interest happening.

Blood’s content recap

Interested in seeing an article on Debt Ceiling? Comment under this tweet.

“Debt ceiling is a good example of some of the fundamental flaws of the fiat monetary system.

Even if your bullish theory is right, you still need to survive the short term crashes.

Want to see an article/thread on how debt ceiling impacted crypto and stocks in the past?“

Link to tweet.

New Scalping exercise

“Scalping strategy #8: Trade crossovers on 5 min

1. Open high liquid coin, Eg. #BTC

2. Add EMA100 and EMA50 to chart

3. If 50 EMA crosses below 100 EMA, go Short

4. If 50 EMA crosses above 100 EMA, go Long

5. SL set at swing high/swing low

6. Take profits at 3 RR

Easy.”

See chart examples:

Concluding notes

Now that you know the basics on what tokens on Bitcoin are, you might be wondering why they’re so controversial in the Bitcoin community. Already the first ordinals set off a lot of very polemical debate, but now with BRC20s (which were created in March, but only took off recently with the memecoin hype following PEPE), this is reaching new levels, and so are Bitcoin transaction fees, causing issues with BTC withdrawals on some exchanges. This, in fact, is one important reason behind the controversy: as the Bitcoin network is being used in completely new ways, the demand for NFTs and BRC20s means that people have to pay more and more for transactions, even if they just want to send BTC from one wallet to another. Those in the Bitcoin maximalist camp unsurprisingly hate these new developments—not just because they hate everything in crypto that isn’t BTC, but also because they view Bitcoin-based NFTs and BRC20s as “wasting” block space and driving up fees for those who want to use the network in a “legitimate” way.

Regardless of what you think about BRC20 memecoins, one thing is for sure: by using up a lot of block space (BRC20 transactions currently make up 70% of all BTC transactions), this trend is only highlighting problems that Bitcoin would in any case have to tackle sooner or later. If BTC does reach global adoption, the increase in activity will be orders of magnitude higher than what we’re seeing now, which is why scalability solutions (e.g. something like the Lightning Network) will become absolutely crucial unless we expect people to pay a $100 transaction fee for buying a $10 drink with Bitcoin. Having this kind of surge in transactions will only incentivize people to start building such solutions now, so that the network can be ready for adoption to go exponential.

Finally, one thing that bears keeping in mind is that Ordinals might be the best argument in favor of Bitcoin being sustainable in the really long term. Ever since the launch of Bitcoin, people have debated whether it would really be possible for the network to maintain itself once all 21 million BTC have been mined, arguing that it will be impossible for transaction fees alone to provide enough of a subsidy for miners. Well, just yesterday BRC20 transactions accounted for 245 BTC in transaction fees (in one day), whereas the total network fee for all transactions averaged around 30 BTC per day before the Ordinals hype, so that argument looks to be settled.