Bloodgang,

Welcome to this week’s issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

CPI and PPI cooling down leads to a good week for stocks, shorts getting wiped out as predicted and explanation of recent Ripple partial win over SEC. Why is Bitcoin not trading above $35k?

Fundamental overview

Last week, the CPI came in a bit below expectations (headline 3.0% vs. 3.1% forecast), and this—combined with a similar cooldown on the PPI—led to a really good week for stocks. Apart from inflation coming down, there’s one more important factor that I kept mentioning in Q2 this year, namely the positioning data on the S&P 500. Talking about it over and over as it continued getting incredibly skewed sounded repetitive, but that has now clearly played out (and paid out if you were acting on that datapoint). For much of Q2, shorts were piling on like mad, but then, as soon as the macro picture started to improve, they got wiped and fuelled the rally in equities. In fact, speculative net positions on the S&P 500 have fallen by more than half since early June. Long story short, bears got rekt.

As fun as the price action in stocks might be, you’re probably just waiting for the real bombshell that hit last week, namely the court decision on XRP. To get right to the point, the court ruled that Ripple’s sales of XRP on exchanges weren’t securities. When a team sells tokens directly to institutional investors, that still constitutes a security, but in the case of Ripple, buyers couldn’t know whether they were buying from Ripple or from someone else, which is why the transactions can’t be considered investment contracts.

This might sound a bit complicated, but the main point is that transactions, not tokens in themselves, may or may not be securities. A token on its own is just a string of code on a blockchain; what makes it a security is when an investor buys those tokens from the people that created them, hence investing in the project similarly to how one can invest in a company by buying shares. Crucially, this court ruling shows that sales on the secondary market don’t constitute securities transactions—even if the sellers are the project founders themselves—because buyers on an exchange can’t know who they’re buying from. I’ll write more on this in future issues as the whole SEC drama continues to play out, but for now, this is a huge victory for crypto and another one in a series of embarrassing failures for Gensler.

Bitcoin

Bitcoin Daily

Bitcoin Dominance

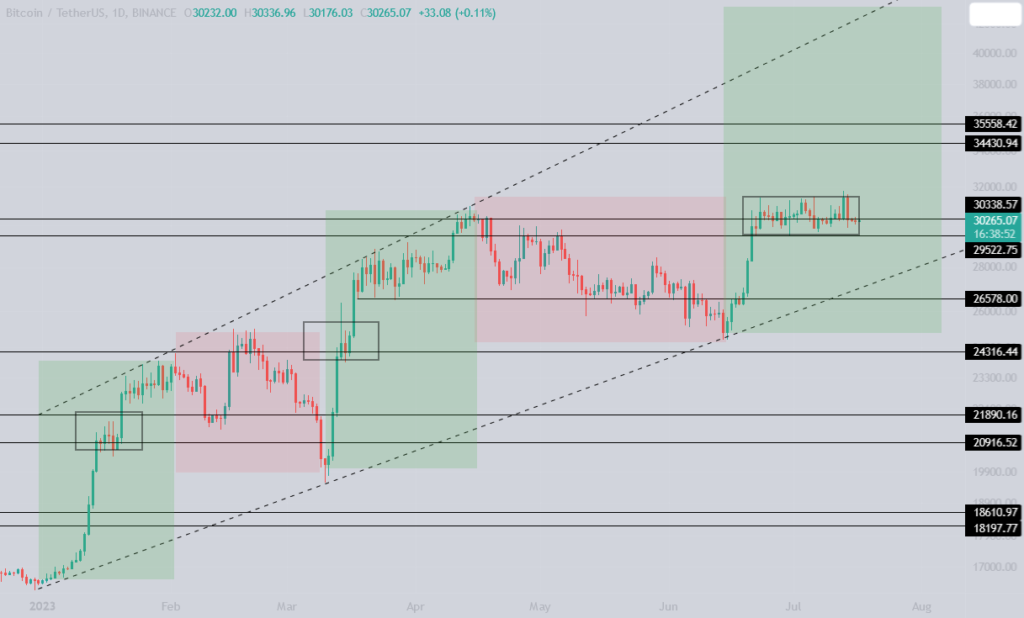

Bitcoin remains range-bound, after printing a new high at $31,800.

It’s been another great week for day traders as there was a clear fake breakout above $31,500. The breakout occurred after news about the SEC and XRP, pushing the market higher. After the fake breakout was confirmed, Bitcoin dropped towards the range low and bounced a bit off $29,900. Apart from being in a range, not much has happened.

The general rule is, the longer we stay in the range, the larger the move we’ll see in either direction.

This week, I’m also sharing a Bitcoin Dominance chart that bears a striking resemblance to the Wyckoff redistribution pattern.

It seems like it has finished printing the UTAD phase, but this will be confirmed if it drops back into the 2-year-long range. The XRP news breathed life into altcoins, hence this is a logical reaction from BTC dominance.

My point is, even if it looks like Wyckoff, it’s not confirmed yet, so don’t rush into altcoins too quickly. However, if it is confirmed, altcoins will have their time to shine.

SPX, Gold and DXY

S&P 500

Gold

U.S. Dollar Index

Stocks break the previous swing high and pump higher.

Last week, we suspected a swing failure pattern, but a higher low was printed and stocks continued to climb, making a new high and continuing their journey towards the last resistance at 4638 before reaching all-time highs.

Given the bullish CPI numbers, a strong performance from SPX was expected. Crypto is lagging and not keeping pace with the impressive performance of stocks lately, but this isn’t too surprising given the Binance situation and some other factors that I’ll mention in the Concluding notes below.

Gold defends the 1916 level.

Finally, we’re seeing some strength from gold, but will it hold?

I’m not yet convinced about Gold’s strength as it could be merely printing a higher low and reacting to the bullish CPI numbers. As mentioned last week, the structure remains bearish and I’m not interested in trading it at this moment. I’ll let you know when the structure changes. The first step is breaking back above the 1981 level.

The U.S. Dollar Index breaks a significant level.

A strong breakdown was seen last week after the CPI event, breaking the crucial 101 level as traders expect the Fed not to hike rates this month.

The next level to watch is the range from 89 to 99.2, which seems like a good place for DXY to find some relief.

Ethereum

Ethereum Daily

Ethereum briefly tests the breakout zone at $2,032.

Lately, Ethereum’s structure has been looking bullish, forming higher lows and printing new highs. At the time of writing, ETH is sitting on the support level at $1,930, which must hold if we want to see the $2,000 level broken soon.

Breaking back down below $1,900 would be a bearish sign, and we would look towards the trendline that sits slightly below $1,800. In my opinion, the levels are clear. Both BTC and Ethereum are trading on the breakout zones but lack strength.

ETH/BTC is attempting to push back above the resistance for the second time after the breakdown. A new low was printed and a higher low at that, which gives some hope to traders, but there are a bunch of resistance zones before I will become bullish.

The first step is to break above the last lower high, then we can talk.

Blood’s content recap

Change Your Strategy!

“Bitcoin Average Annualized return is 40% for last 5 years

If your yearly return is less than that you are either:

– Greedy

– Uneducated

Either way, you should Stop trading with the current system

Start again , invest your free time and I promise I’ll prepare you for Next Run”

My Comment on SEC vs. XRP

“XRP opened a gate to clarification of all Crypto.

This is a huge step and even though I will never buy this shitcoin I’m kinda grateful that they played David vs Goliat part.

With all things to come, I’m very bullish and sincere congrats to all who believed in Crypto.

Now everything will pay off for all.”

Concluding notes

Given all the good news and the fact that stocks are close to going vertical, you might well be wondering how Bitcoin isn’t above $35k at least. Well, the whole Binance thing is still very much relevant, and combined with bear market trauma (the FTX collapse happened only 8 months ago), it’s enough to make a lot of would-be bulls very cautious. The fact that Binance recently laid off over a thousand employees right after some of its top executives quit is also concerning, along with reports that it’s cutting all of its extended benefits programs for their remaining workforce.

When a company looks desperate to cut costs, that’s never a good sign, but it doesn’t necessarily mean that it’s got an Alameda-sized black hole in its balance sheet. At any rate, all you can do now is speculate, and there are much more productive ways to spend your time. Besides, it looks like the biggest reason for the lackluster price action last week was something else: the US government moving $300 million in seized BTC. Whenever they make a transaction with those funds, it immediately sends the market into panic mode, even if they’re just moving the coins around without actually selling them. One could even get the impression that the people responsible for the custody and liquidation of the seized BTC could just load up on max-leveraged shorts before rotating the coins to a different wallet for some nice guaranteed profit. In any case, the fact that BTC isn’t pumping that much isn’t necessarily such a terrible sign: normally, when BTC is lagging behind equities, it tends to catch up later in a single monster candle (unless the feds just decide to market dump into thin books, that is).