Bloodgang,

Welcome to this week’s issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fitch downgrades US credit rating, DoJ and Binance drama continues, SEC&Ark spot Bitcoin ETF deadline on August 13 and upcoming CPI

Fundamental overview

August started off with a bang when it comes to headlines in both TradFi and crypto. On the very first day of the month, Fitch Ratings (one of the “Big Three” US credit rating agencies) downgraded the US long-term credit rating from AAA to AA+. This isn’t exactly a bombshell on its own, since credit ratings don’t actually do anything, but it reflects—and further intensifies—the loss of confidence in US fiscal policy and governance in general, especially following the recent debt ceiling drama.

Stocks took a hit in the wake of the downgrade, but the biggest impact could happen the next time there’s a major economic downturn, potentially leading to a major loss of faith in the US dollar as well. In the age of Modern Monetary Theory (if you’re not familiar with this, I highly recommend reading up on it), no one seems to care how much governments borrow as long as the markets are doing okay, but when a crash comes, that’s when people will start thinking about how feasible it is for governments to repay their ever-growing mountains of debt. At that point, if the dollar is no longer seen as the safe haven it once was, it’s easy to guess the potential implications for gold and crypto.

Speaking of crypto, there are reports that the DoJ (Department of Justice) is considering serious charges against Binance. While that’s not surprising unless you’ve been living under a rock for the past few months, the big news there is that the DoJ is hesitating due to potential losses that could be suffered by Binance customers, which means a fine or a similar compromise solution is likely. If this turns out to be true, it could be read in one of two radically different ways: either the DoJ is aware that Binance has a massive hole in their books, so they want to avoid an FTX-style bank run situation, or they haven’t really got a solid case against Binance, so they want to save face by looking like the good guys here.

In any case, watch out for the upcoming headline risk this week: the SEC has its first deadline in the Ark spot Bitcoin ETF application on August 13 (although they can decide to extend the deadline), and we’ve got the CPI and PPI coming out Thursday and Friday.

Bitcoin

Bitcoin Weekly

Bitcoin Daily

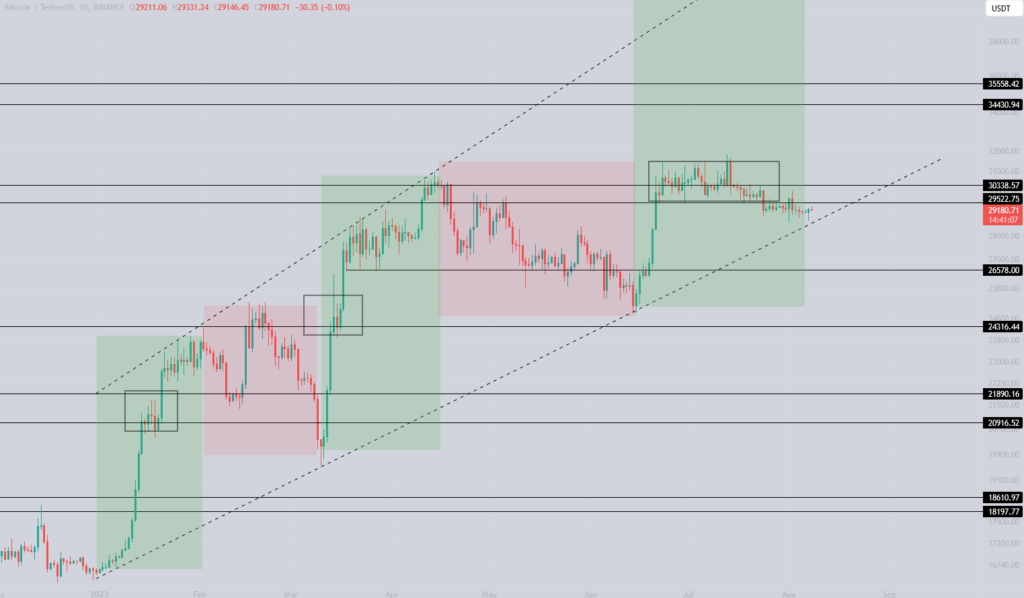

New week, but still the same boring price action.

On the weekly chart, there’s a potential swing failure pattern, with the $29,500 level yet to be reclaimed. There’s a huge gap between the $29,500 weekly level and the $26,500 mark. From a weekly standpoint, if we want to see continuation, we either need to see a break above or at least have the previous low at $24,500 defended.

Delving deeper into the daily chart, Bitcoin is hovering just above its long-term trendline. This slow bleed has taken a toll on many, but a bigger move seems imminent, especially as the trendline converges with the weekly $29,500 level.

Stay on the safe side and trade the trend.

SPX, Gold and DXY

S&P 500

Gold

U.S. Dollar Index

SPX retraced after the news mentioned in the fundamental part of the newsletter.

For now, the index has managed to hold above its previous highs at 4457, but this week’s price action will be crucial. Structurally, not much has changed. A break above the 4638 resistance could pave the way for new all-time highs. On the other hand, if the 4325 support is breached, we might revisit levels below 4000.

Gold’s affair with the 1916 level continues.

As touched upon last week, gold faced a rejection at the 1981 resistance and has since been gravitating back to the pivotal 1916 mark. It remains to be seen if this level will hold once again. Still, the prevailing structure has been bearish for a while, and I’m not interested in trading it, as we could see lower levels.

The U.S. dollar index is showing strength.

As mentioned last week, this chart has become increasingly important, especially after the Fed’s rate hike breathed some life into it two weeks ago. While it’s yet to paint a new higher high, the 103.66 level will be the key point. A rally past this level could trigger a big move in risk-on assets.

Ethereum

Ethereum/USDT

ETH broke the trendline.

Ethereum, while still mirroring Bitcoin’s price action, has already seen a structural shift with the break of its long-term trendline. The weekly/daily level at $1784 is becoming more and more important. If Bitcoin drops towards $28k, I’m inclined to believe that Ethereum will have a hard time holding the $1784 level, so I’m more keen on bidding at $1665.

While I haven’t included the ETH monthly chart here, I’d recommend checking it on your own, because right now it’s fairly simple. There are only two pivotal levels to monitor if we drop. The $1581-$1603 range stands out as a key point; a breach here could see Ethereum retracing back to its 2022 range. Further down, the $1150-$1290 zone is the range bottom. If this doesn’t hold, we might see three-digit ETH again.

Blood’s content recap

I derisked in DeFi

“Derisk positions in DeFi.

Even if protocols are unrelated to $CRV, its smart to step back.

If a protocol is paying 80+% APY for stables deposits, there is a good reason for that

Also, being early on new networks pays off, but investing more than a bit of spare ETH is insanity.”

BG Swing indicator catching 50% move

“Bloodgood Swing Indicator prints 50% again.

Caught the $SOL move at $17.

A clean reclaim of the Indicator with confirmation and a “LONG” signal.

Indicator is FREE and works best on H4.

Study it and Use it.”

Concluding notes

One long-awaited document has been published last week, namely the FTX draft plan for reorganization, but it leaves many key questions open. One of the few things that seem settled in the plan is that customer claims will be paid out in USD value on bankruptcy date, so that’s bad news if you had something in your FTX account that’s gone up 10x since then, but overall it’s not surprising. What most people are interested in is the potential plan for FTX 2.0, i.e. restarting the exchange under different leadership. Unfortunately, the plan doesn’t commit to anything when it comes to this key question, but it does look fairly likely at this point, although it’s far from clear what that will look like. If the exchange does restart and if there’s a token that gets distributed to users—a scenario that many would like to see, since it could make creditors more than whole—it’s pretty much certain that it won’t be in the US and that US users won’t receive the tokens. If you’re one of those US creditors, that’s just one more thing that Gary and the SEC are “protecting” you from.