Crypto is a game of diversification — the number of tokens you have, the types of tokens you have, some in stablecoins, some in NFTs etc. But diversification can come at a cost, especially if you have to transact on multiple blockchains or protocols multiple times. Not only do the fees add up, but the administrative headache of tracking each of your coins can get very tiring and eat up your valuable time.

That’s where Exchange Traded Funds, or ETFs, offer a simple solution. In broad terms, ETFs track a group of underlying assets for lower fees than if you bought them all individually. They do this by creating a single token that represents a known set of assets in known proportions.

Company ETFs

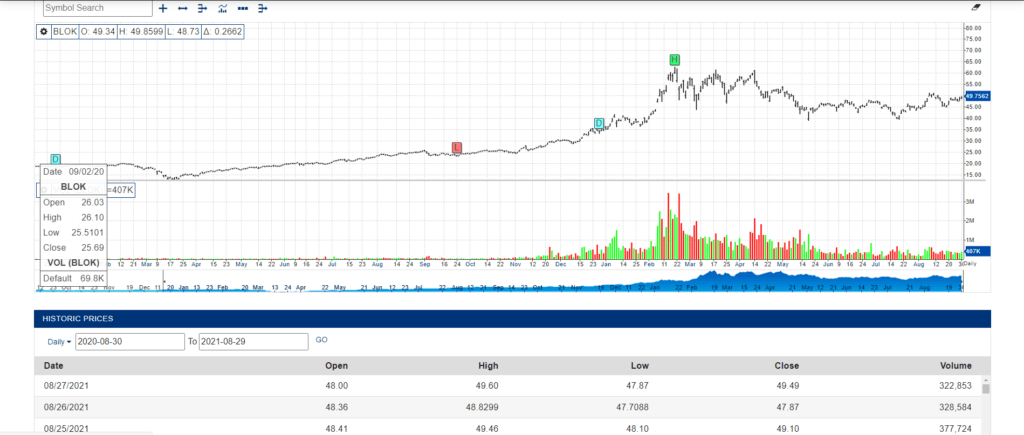

Let’s take a look at an example. Until recently, most ETFs linked to crypto tracked listed companies on the stock exchange as a way to get exposure to blockchain development. ETFs are considered securities in the U.S. and so this is a highly regulated space. In the last year the best performing blockchain ETF was BLOK, which had a performance of >110%.

So what companies did it invest in? Here are the top 3:

- MicroStrategy

- Square

- Hut 8 (Canadian mining company)

Grayscale Trust

So ETFs like this track a bunch of companies but not cryptocurrency. This is different to a trust, such as those Grayscale offers. If you invest in Grayscale’s trust for Bitcoin or Ethereum you get exposure to cryptocurrency via the stock market, but you don’t actually own any BTC or ETH. The trusts themselves have a lot of BTC and ETH, but this does not link directly to their share price. These trusts are also regulated by the SEC in the U.S. and Grayscale includes a 2% fee for management.

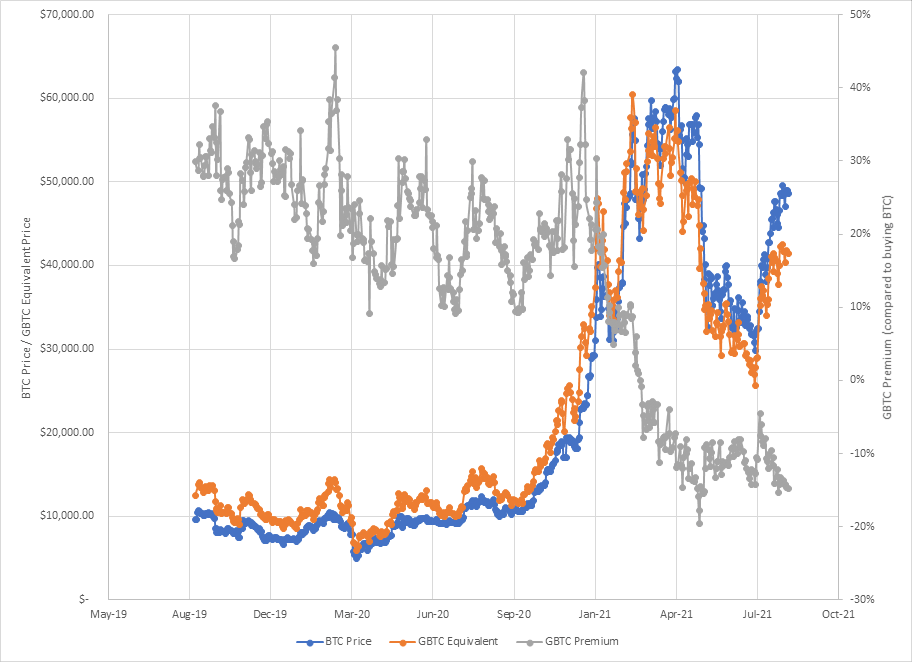

Grayscale states that each share in the trust is worth 0.000937606 BTC, so there are approximately 1000 shares per Bitcoin. You can work out an equivalent BTC price for Grayscale by multiplying their share price by this ratio to see whether Grayscale is trading at a premium or a discount compared to holding Bitcoin yourself.

Throughout the last bear market and in the bull run at the end of last year and beginning of this year, Grayscale shares were trading at a premium to the Bitcoin price, mostly in the 15–30% range. Why did people want to pay this premium? Well because they’re boomers and they want exposure but also want it regulated and can’t quite work out how to use a crypto wallet.

But interestingly, from March this year that premium turned into a discount and its been trading at around -10% since April. A couple of things likely contributed to this, including:

- The first major correction in the primary bull run, putting off new investors

- The arrival of Bitcoin ETFs in other countries (where you directly own the BTC)

Grayscale wants to convert the trusts to ETFs as well, and if successful, that could close the current gap and is an interesting play for anyone who wants to take that bet and buy into GBTC now.

Cryptocurrency ETFs

But the key point of this article is that ETFs can be made directly for cryptocurrencies, and they can be tailored to different asset classes, e.g. gaming tokens, DeFi tokens, exchange tokens etc. In fact, there already are some on the market.

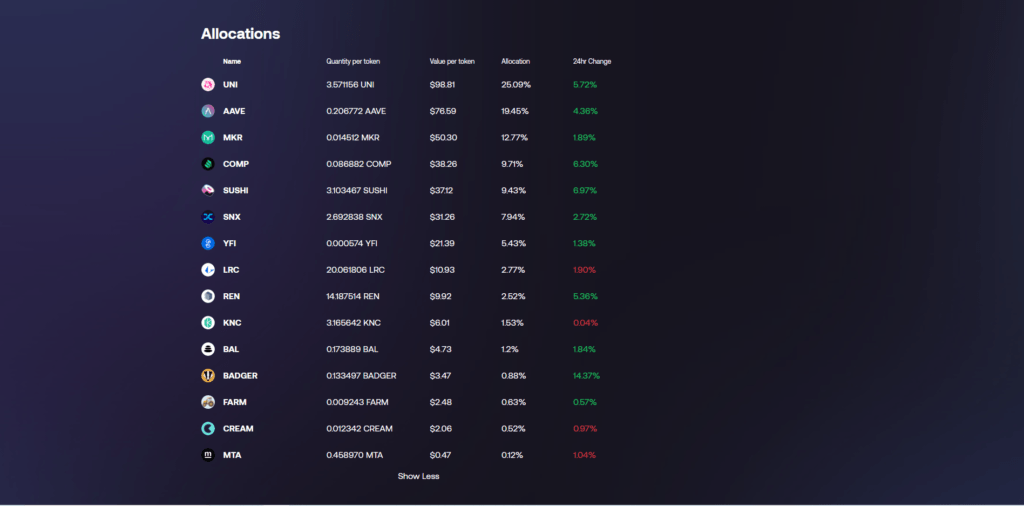

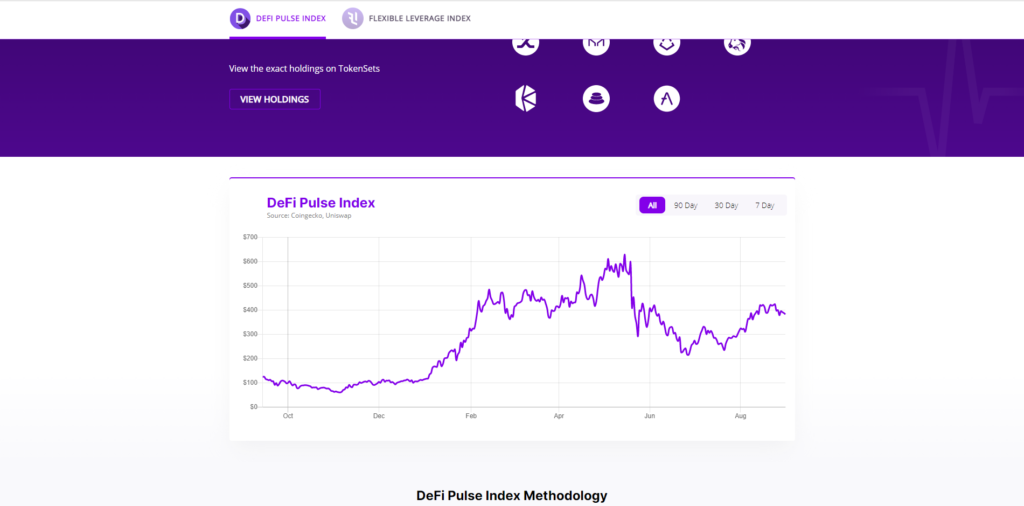

Let’s look at DeFi first, which has been a hot topic since last summer. One of the first to launch (last year) was the DeFi Pulse Index (token $DPI). It currently tracks about 15 DeFi projects, including some of the most well-known ones like: UNI, AAVE, MKR, COMP, SUSHI, SNX and YFI. The amount of each token in the index is determined by proportionally weighting them using their market capitalisation.

You can read all about it at Pulse.inc, or The Index Coop website, which shows the current allocations:

Every month the index re-checks all the market caps and re-balances the index accordingly via smart contract. There are also a list of criteria for token inclusion but as this is only semi-quantitative there is a DAO behind the whole thing (The Index Coop), which consists of ‘experts’ in the field to vote on what can go in (or must come out).

And it’s not just DeFi. More and more cryptocurrency ETFs are coming out all the time, including the Metaverse Index ($MVI), which is looking to capitalise on all the gaming hype and tracks AXS, ILV, AUDIO, ENJ, MANA and REVV among several others. Note that this is also launched by The Index Coop.

Pros and Cons

So what are the pros and cons?

Well, ease of access and less personal admin are clear advantages. You can either buy via websites such as Indexcoop.com or TokenSets.com, or you can also find them on exchanges such as Kucoin, UniSwap, SushiSwap etc. But one of the key advantages is access to a diversified portfolio that should lower your risk if one of the individual projects suffers an exploit or slowly dies out over a few months. As you can see below, the DeFi Pulse Index has roughly quadrupled in a year, which is much better than having your money in the bank or spending it on high gas fees.

Talking of high gas fees, it’s interesting to note that most of the key ETFs so far are on Ethereum using ERC-20 tokens (as well as some BTC-only ETFs). I’m sure other blockchain ETFs are on the way and even cross-chain ETFs.

But whichever blockchain it’s on, remember these points:

- If a hot narrative dies down, a category-specific ETF could tank too

- Governance may still be via panel of experts (centralised) or via smart contracts (decentralised). This is a question of trust versus security, and being comfortable with the outcome.

- And you never know what regulators are going to do, so don’t go all in!

Bear in mind that these ETF tokens may also have some other uses, such as staking or yield farming, but we’ll save that for another day.