The Nuances of Correct Position Sizing

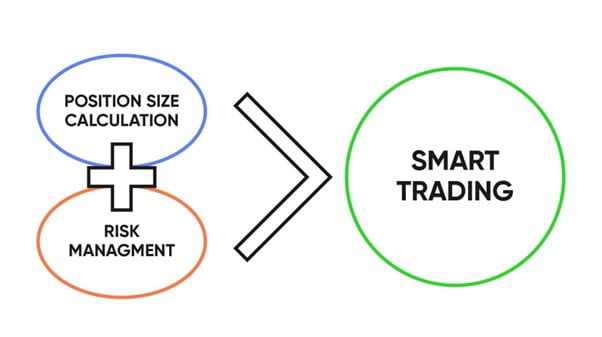

Correct position sizing is critical for a Trader’s success – too little risk won’t yield respectable returns whereas too much risk can lead to blowing up accounts. Position sizing in laments terms means the dollar value of the trade risked compared to the size of the portfolio. To successfully workout this, Risk Management concepts such as the 1% Rule can be used to determine a Position Size.

The concept behind Position Sizing may seem mind-numbing but it serves the trader well in the long run. It avoids traders from opening random sized positions that disregard Risk Management.

In essence, random trades with random position sizing completely disregards Risk Management. This promotes more capital to be at risk at any given time, leading to larger than necessary losses. Focusing on a set Position Size will psychologically place more emphases on the Risk Management aspect of the account. This is critical for Day Traders who can easily lose sight of how much risk is in play when multiple positions are open.

The 1% Rule

The 1% Rule is a profitable practice used by Trader’s to execute trades with the correct Risk and Position Size depending on their account balance. The concept behind this rule is that Traders only risk 1% of their total capital on any give trade. This is designed to help greatly when it comes to periods of drawdowns.

The rule is intended for traders to psychologically adhere to a Risk Management System that accounts for only a 1% drawdown on any trade. There are different strategies around this rule where it allows traders to either put on larger Position Size with tight stop-losses and or smaller Position Size with wider stop losses. It really depends on the Trade Plan; tighter stop losses are mainly for scalps whereas wider stop losses are for swing trades.

Applying the 1% Rule is quite simple as it is in direct influence with the size off an account. For example, a $10,000 account will only risk $100 on any given position. To do this successfully, traders need to calculate the trade risk, which is simply the difference between the Entry Price and the Stop-Loss price. It is important to note that the Stop-Loss placement is strategic, it needs to be identified first to work out the Position Size of the trade whilst risking only 1%.

There is an exception to the 1% Rule, once a trader finds confidence in a high probability trading setup, it is viable to risk up to 3-4 % on the trade. This allows the trader to scale their account with larger position sizing when the risk to reward is worthwhile.

It is important that traders understand the objective of each of their trades. Longer swing trades are great for larger position sizing by averaging in. Day Trading and Scalp Trading on the other hand is suitable with a fixed position size as multiple trades can then be taken.

Position sizing overall is directly influenced by the capital available in the trading account. Experienced and confident traders have the ability to increase their risk by increasing their position size when suitable.

Risk Analysis Process

A Risk Analysis process is predetermining the potential Risk associated with any trade and or investment. This helps Traders recognise and plan for the negative effects before committing to the position. The goal of a Risk Analysis Process is to ensure that Traders don’t get caught off guard when Trading Plans fall out of place. It helps to systematically manage losing positions with the aim of minimising loss as much as possible, this is in direct relation to

Position Sizing. The process of risk analysis includes the following,

- Identification of Risk

- Analysis of Risk

- Evaluations of Risk

- Risk Commitment

Identification of risk is the first step, here traders make Trading Plans that determines the maximum loss involved. It includes identifying invalidation levels where if reach, the trade is automatically closed. Identification of the risk should also be in relation to the overall Risk to Rewards Ratio. The Reward of the trade must outweigh the Risk, this makes the trade valid and worthwhile.

The second step is the Analysis of the Risk, this is more related towards the trade idea. The analysis process will surface the probability of the trade playing out. Ideally, Traders will aim to take High Probability Trading Setups. This allows them to adjust risk accordingly such as having wider stop-loss placements.

Evaluation of the Risk is the third step, this is an important part of the process where Traders finalise their plans. Levels are solidified and marked and cannot be changed after this stage. It essentially finalizes the Trading Plan before the trade and or investment goes live.

The final step is the Risk Commitment, here the Trader and or Investors puts on Real-Risk in accordance with their Trading Plans and Position Sizing. They adhere to the risk process so that if the trade was to go against them, they know they’re exact invalidation point. Commitment towards the risk is important as this helps reduce any Emotional Tilt when the trade is live.

Trading a proven strategy

A trading system needs to be profitable over the long run, this can only be achieved through back testing and accumulation of statistics. Once a strategy has been developed, Traders must adhere and execute on it religiously. This ultimately helps avoid suboptimal trades which can lead to unnecessary losses.

The main goal of trading a proven strategy is that it will adhere to a Probability Model which will play out over the course of time. Essentially this means that a string of losses will always be followed by a series of winning trades. If a trader trades with no Proven Strategy, then there is essentially no Probability Model in place.

It is important to remember that as Traders, results will be random, with proper Risk Management and Position Sizing, detrimental loses can be avoided. Overall, trading is purely a probability game, having a proven system will account for the Risk, the Rewards will naturally be greater overtime.

Emotional Control

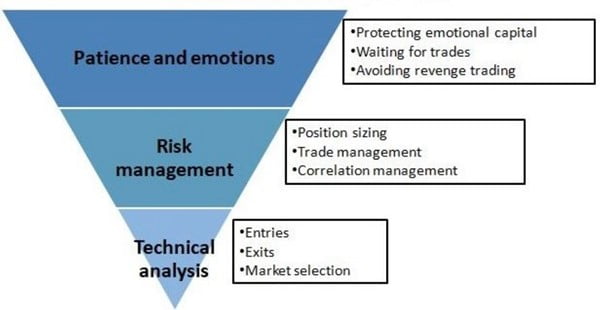

Emotional control can be mastered but requires a lot of self-understanding by the trader. As trading is a probability game, there will be strings of losses that can affect the performance of a trader. Once on TILT, traders become prone to making irrational decisions that tend to disregard Risk, leading to account damage.

Position Sizing can have a direct impact on the Emotions of a Trader, for example, a larger size might put the Trader on TILT. This can cause them to make decision that are not part of their trading process or plans.

Day trading in general requires a lot of focus which can be mentally taxing. Some of the more common strategies to help with emotional discipline include taking regular breaks. This is quite helpful especially after a stressful encounter with the markets. This simple act clears the traders mind and brings them back into an equilibrium. This will allow Traders to focus on their proven strategies with correct Position Sizing executions.

Overall, the goal for traders and investors is to stay within an equilibrium with the market. That is, to not perceive themselves above and or below the market, but to stay levelled. This will ensure that the decisions made are well informed and in accordance to Trading Plans and processes. It takes skill to understand when to stop trading because of this imbalance, however, this can be mastered through self-awareness – the Trading Hierarchy above shows to importance of Emotional Control in relation to Position Sizing.

Final Notes

To summarise some of the key aspects of Position Sizing in this article

- Position sizing in laments terms means the dollar value of the trade risked compared to the size of the portfolio Crypto insurance is a growing industry and may be a valuable service to some

- The 1% Rule is a profitable practice used by trading to execute trade with the correct risk and position size Make sure you know your pathway to convert crypto to fiat and how to extract value from it

- A Risk Analysis Process is predetermining the potential risk associated with any trade and or investment, this includes the calculation of Position Sizing.

- Position Sizing can have a direct impact on the Emotions of a Trader, if Positions are not Sized properly, it can lead to Emotional TILT

Remember, trading is about survival in over the long term!

Excellent Blood 🩸👌 and thank you 🙏