Recently in my tweets I talked about a strategy that is absolutely perfect for people who cannot commit to full-time trading.

Most of you have day jobs and/or families to take care of; yet you want to participate in this market as an active trader, not solely as an investor.

This swing trade strategy is what you are looking for.

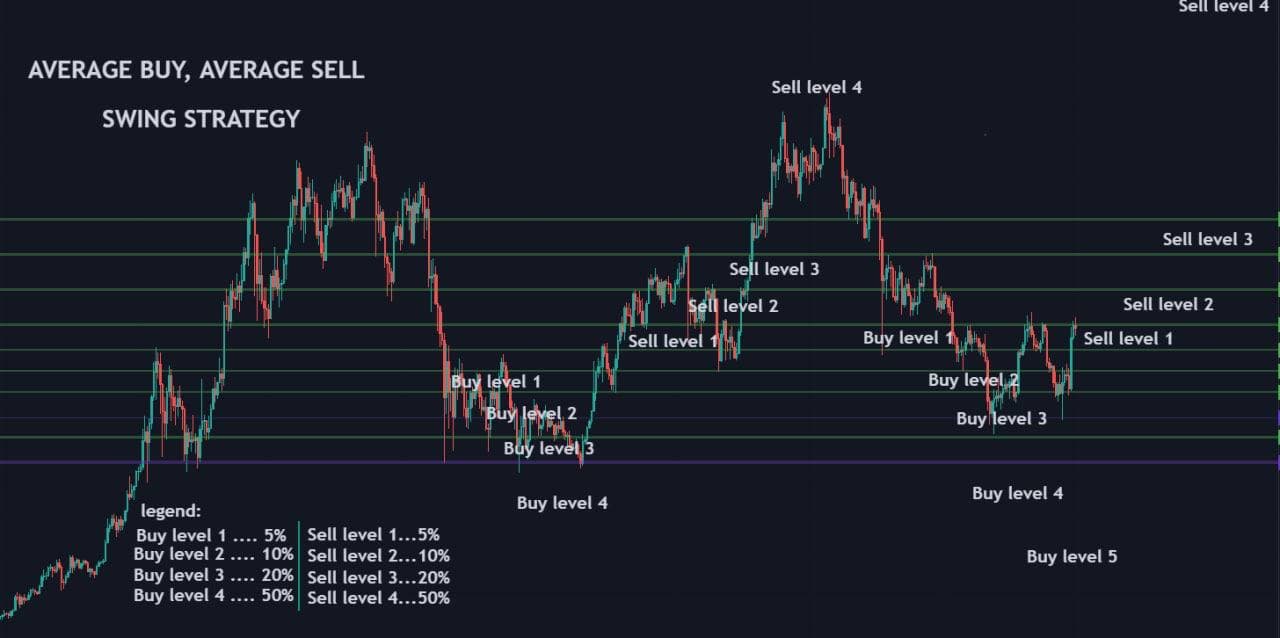

To put it simply, it is a strategy in which you basically determine and set points where you place bids (buy levels) and where you sell (TPs) based on pre-determined levels.

First example, just to demonstrate the plain strategy.

Here you can see a clear market structure with support and resistance levels. Based on this strategy, you will find the appropriate levels to enter, and to get out.

The chart presents a normal market movement. However, since we know the crypto market could be quite volatile, we need to set not one, but a few extreme points of Buy and Sell levels. Pay attention, as the market goes down, we accumulate, and as it goes up, we distribute. But not all in one target; in order to minimize the risk and optimize a long-term P&L, we buy and sell on different steps along the way.

To clarify, here is another example of a chart with more volatility.

As you can see, there are levels which might seem unrealistic and unreachable at first. However, more often than not, your orders will get filled at these levels.

This chart shows the reason I added “extreme” buy and sell levels. One wick down or up is enough to get our orders filled. Of course, we are not gamblers; so these are NOT our primary targets. But, we always keep enough to unload or buy big on these levels. Remember, you must always have at least 20-30% of cash in your portfolio for times like this.

Let’s put these two charts into perspective and see how the actual price action plays out.

We can clearly see that not all orders get filled. No one in the trading world has a 100% hit ratio of catching bottoms or tops. But, with this tactic, you can achieve the optimal averaging.

That is the reason why it is so important to set different levels and always stick to this style. Steady, and in few steps.

For instance, let’s say you have $1000, and you want to enter a trade. Most amateurs in the market are impatient and want to enter positions as soon as possible, and as many as possible. They go all in at one level and hope to exit at another. This euphoria to be a part of something that your good friend recommended to you, can cost you everything you own. It is far better to stick to this strategy from day one. Remember, slow but steady wins the race.

Set your entry and exit points before you even think about buying any asset. That will dramatically reduce your stress as well, especially if you are a beginner.

Now let’s see how exactly we can profit from this.

In this example, we took the average entry points and average exits. Not the best entry, nor the best exit. But simply “average”. You can clearly see that riding on these waves can be stress-free and yet very profitable. I use this strategy all the time with almost all coins with enough volume and enough data (new coins cannot be traded like that, since it is harder to detect valid, strong support/resistance lines).

On the chart below, I have explained some numbers, percentage, and the size with which you should enter at level 1 or level 2,3,4.

The chart is self-explanatory.

You might ask, why are some levels more distant than the others?

What would happen If you divided your entry in same portions?

The answer is simple: you will be overexposed to some maybe not so great levels, and also you will increase the likelihood of selling your asset way too soon.

Therefore, at levels that are more likely to happen, we put less of our trading capital.

As the level gets more obscene (still followed by TA logic, of course), you engage a bigger portion of your capital as an order.

This is in fact the best way to de-risk and make the most of any trade.

For instance, as you can see in the right corner of the chart, if our “buy level 5” was to get filled, and assuming we place 50% of our trading capital in it, and then sell it at level 1 to level 4, we would have a 145% return. That would be “the swing of the century”, right? Not really. If you do it this way, properly, then high returns are not a myth. They are common.

I hope you found this useful. I will try to prepare more content of this nature.

Love, Blood

thank you. i would like to try this strategy, but am unsure how to set the fib levels or resistance with confidence. is it on a daily/weekly i think i need to look at HH/HL etc. thanks for sharing.

Nice

I really appreciate what you are doing, this is clearly not for profit as the other big accounts (I could have used ” Other Influencers” instead of Big Accounts but I think this would be an insult as I do not have any respect for those who gain intentionally on others’ lost,… ) Only if I had access to the stuff you are teaching a year ago I would have in a better position at the moment.

Please keep up your good work

Wish you all the best 🙏🏻

Thanks so much,you are indeed God sent.

Nice guide. It’s pretty much for me: someone that can’t do crypto full time and want’s to do some active trading, but doesn’t have the time. I’ll sure as hell try this strategy.

Thanks for this. I saw my own mistakes very clearly after reading this. I need to sit down and make that plan and execute.

Yo bro ! Smart strategy! Recalculating my cash right now! Thanx 4share!

This content give me some insight. More grease to your elbow.