- Introduction: What is hedging?

- Hedging: methods and strategies

- Futures

- Relative Value trading

- Options

- Tail risk (especially stablecoins)

- Conclusion

1. Introduction: What is hedging?

Hedging is a term that you’re probably familiar with, even if it’s just from random posts on Twitter. In any case—whether you’re just starting out with trading or if you’ve already got years of experience under your belt—this is an incredibly important topic to master in order to optimize your ability to trade in any market environment and, most importantly, to keep that profit when the market inevitably moves in ways that you’re not prepared for. Hedging definitely isn’t the sexiest concept in trading, especially because it has to do with mitigating losses rather than maximizing possible returns by YOLOing into 100x leverage. But, as any experienced trader will tell you, if you only think about profits and never stop to consider losses, it’s only a matter of time before you’re wiped out. If it could happen to so-called “gigabrain” multibillion dollar funds, then you better believe it can happen to you.

Now that you hopefully understand the importance of considering different scenarios and being prepared for moves that go against your positions, let’s get to what hedging is all about. Simply put, a hedge is an investment made with the purpose of reducing the risk of an existing position. Hedging is therefore never something you do in isolation: no trade is a hedge on its own, but only in relationship to another position or a whole portfolio. Essentially, the point is for the hedge to be inversely correlated to an existing position, so that if you lose money on a particular investment, those losses will be reduced because you’ll make some money from the hedge. If you’re long tech stocks, for example, then you’d hedge with something that functions like a short on those same assets.

The key thing to note is that hedging always has a cost: if your original position is in profit, then you will lose money on the hedge, meaning that your overall profit will also be lower than it would have been without any hedging. One way to look at this is to consider hedging like buying an insurance policy on a trade or a portfolio. Just like with an insurance policy on a house, you’re not buying it to make money—in fact, you typically hope that you won’t get a payout out of it—but you still want it to be there so that you’re not wiped out completely if something unexpected happens (for example a market crash or an earthquake, respectively).

This might sound like hedging is countertrading yourself, and you might be wondering why you’d ever do it instead of just opening a smaller position instead. The thing is, if you hedge properly, the hedge will be asymmetrical to your position, so that you will end up with more money at the end than if you had simply scaled down your position size. In the following we will look at all the different ways you can do that, along with one strategy—Relative Value (RV) trading—that’s closely related to hedging, but with the difference that you can make money on both the short and long side simultaneously. This is exactly why RV trading isn’t the same as hedging, but both strategies share many key concepts, which is why it makes sense to cover RV trading here as well.

2. Hedging: methods and strategies

a. Futures

Given the short intro above, it should already be obvious that futures are the simplest way to hedge. If you have a position in something, you can just short either the same asset or one that’s highly correlated to it. When it comes to shorting the same asset, this isn’t something you do at the same time as opening the position, because that would be nothing but effectively decreasing position size while paying unnecessary additional fees. Instead, you can short the same asset later, for example if it’s facing an important resistance level and selling the original position isn’t convenient for whatever reason.

Let’s say you buy 1 BTC spot at $20k and store it in a cold wallet. A few weeks later, you’re up 30% on your position, but the macro environment is looking shaky and BTC is right at a critical resistance level at $30k, which is why you want to derisk. Moving the BTC to an exchange and selling (some of) it is one way to do that, but maybe you don’t want to go through the hassle of doing that because you think that (1) the resistance is likely to get broken anyway or (2) even if it isn’t, you’d still rebuy a bit lower and don’t want to keep your funds on an exchange in the meantime. What you can do instead is short 1 BTC on futures, so that, if BTC drops back down to $20k, you will have made $10k on the short, and you’ll have $30k in total ($20k from your BTC and $10k profit from the short)—exactly as if you had sold the 1 BTC at $30k. This is because if you’ve got 1 BTC on spot and you’re also short 1 BTC, you’re 100% hedged (50% would be being short 0.5 BTC, for example), and the value of your portfolio—assuming for the sake of simplicity that that’s your only position—is “locked in” at that point, exactly as if you went all in USD. As long as the short is open, you will always have $30k, whether BTC goes to $100k or $0, as every $1 of profit on your spot position is offset by $1 of loss on the short, and vice versa.

In reality, of course, the value of your portfolio won’t be absolutely identical if you hedge 100% instead of selling 100% on spot, because of funding rates and something called the futures premium. In fact, these small price differences can provide opportunities for very lucrative forms of market-neutral trading, where you can make (almost completely) passive income regardless of how the market moves. This isn’t the topic of this article, but I’ve covered it in depth here if you’re interested.

Now, let’s consider a different scenario: you’re long 1 BTC and you want to hedge, but let’s say you’re convinced that, in the event of a market crash, ETH will go down much more than BTC. What you can do in this case is short 1 BTC worth of ETH: if the whole market nukes and it turns out that you were right about ETH being weaker, dropping 30% while BTC only dropped 20%, the profit on the hedge will be larger than the loss on your original position, meaning that you’ve got more money in the end than if you had simply sold BTC.

The idea here is simple: instead of hedging by shorting the same asset that you’re already holding, you short something that’s likely to drop lower. While this has many advantages, it also creates a risk that you didn’t have previously: it’s possible that (1) BTC could nuke more than ETH or (2) that BTC could stay put while ETH suddenly rallies. This is why hedging with different assets requires more planning and a much more active approach to monitoring your trades. In any case, the asset you’re shorting needs to be highly correlated to the position that you’re hedging while being typically more volatile or just looking more bearish.

b. Relative Value trading

This brings us to RV (Relative Value) trading, a strategy that’s closely related to hedging. Let’s say that you’re uncertain which way the market is going to move overall, but you’re very confident that BNB is going to outperform ETH, for example. In that case you basically want to go long BNB/ETH, but there’s no direct futures contract to do that in one trade. However, you can still long BNB/ETH by opening two separate trades: going long BNB/USDT and short ETH/USDT.

It sounds simple, and indeed it is. RV trading is just longing something that you believe is undervalued and simultaneously shorting something overvalued. This kind of an approach is done very often in TradFi for longer-term positions, but it’s also extremely useful in crypto. As you’ve probably already noticed, the entire crypto market is highly correlated, meaning that when BTC dumps. almost everything else will dump as well, and vice versa. So, if you’ve got a thesis about the relative value of two different assets, but don’t want to get rekt by a random nuke if you only long the one that’s undervalued, RV trading is the way to go. One final consideration here—which also applies to the case of hedging with correlated assets that we mentioned above—is that you need to take into account the volatility of each of the two assets. In our example, if we suppose that BNB is twice as volatile as ETH (so that it will move on average twice as much in either direction), your position size for BNB should be half that of ETH if you want to be maximally market-neutral.

c. Options

Now we’re getting to the derivatives instrument that most people immediately think about when they hear the word “hedging”: options contracts. This is an area that’s a bit complex—if you don’t feel like diving into it just yet, you can still use other methods of hedging—but there’s a good reason that it’s considered a very popular way to hedge. With options, PnL works differently from futures or spot. In simple terms, an option is a contract that gives you the option, but not the obligation, to buy or sell a specific asset at a set price at a specific future time. Contracts for buying an asset are calls, while those for selling are puts. For our purposes, puts are the most important here, as they’re used to hedge long positions, but the same can be applied for calls when hedging short positions.

Because they’re a bit more complex, you’ll notice that options contracts contain much more info in their individual names than just the ticker. For example, let’s take the contract BTC-29DEC23-20000-P: the asset in question is BTC, the expiry date is 29 December 2023, and it gives you the right to sell (P = put) BTC at that date for $20,000 (the strike price). Suppose that the price of one contract is $2.5k. If you buy one put contract, you’ll pay $2.5k, and the advantage of options is that you can never lose more than the contract cost, in this case $2.5k, no matter what happens to the price of BTC.

Now let’s say that it’s 29 December 2023: what will your PnL look like? If BTC is at or above $20k, the contract will expire worthless, so that your total PnL will be -$2,500 (the cost you paid upfront for the contract). For every dollar below the strike price, you will profit $1, so that if BTC is at $17.5k, you will be at breakeven overall ($2.5k profit minus $2.5k that you paid to buy the contract). If BTC is at $10k, your total profit is $7.5k, if BTC is at $5k then you’re up $12.5k etc. The key thing is that you only risked $2.5k, whereas you can profit much more than that if BTC drops by a lot, and you don’t have to worry about getting stopped out or liquidated in the meantime, even if it hits $100k before dropping below $17.5 by the expiration date.

This is exactly why puts are a very popular way to hedge, as they function just like an insurance policy: you pay a set cost upfront and, if there’s an overall market nuke, the profit from the put will help make up for the losses on long positions or your spot portfolio. What’s more, you can never lose more than the initial cost on an option, so that you don’t have to worry about actively managing your hedge positions at all. Of course, options are an incredibly complex financial instrument, and I might prepare some more detailed content on them in the future if there’s interest, but now you probably understand the key principles behind using them to hedge.

d. Tail risk

Another important topic to mention when it comes to hedging is the concept of tail risk. It’s not a way of hedging or a strategy per se, but it’s a key concept in trading in general. So, what is it?

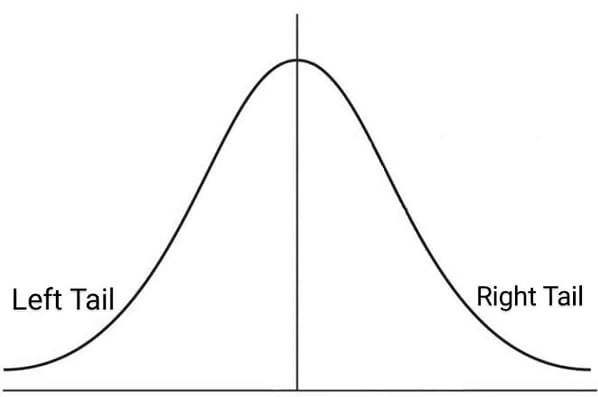

You’ve probably heard of something called the bell curve or the normal distribution. This curve describes the probabilities of different scenarios, for example the price of a given asset at a particular time in the future.

The most likely outcomes are represented in the center of the curve, while more extreme and less likely scenarios are at either end. Those are called tails, and the one we’re especially interested in here is the left tail, as it represents the probability that the price will be way lower than most people expect. Technically, tail risk refers to the price moving more than three standard deviations from the mean, but you don’t need to know the math here: what matters (and the way the word is typically used in crypto) is that tail risk covers those things that are very unlikely but that could have a huge impact if they do happen.

One noteworthy form of tail risk in crypto relates to stablecoins. If you’ve been around long enough, chances are you’ve seen a few stablecoins collapse completely. In fact, if we’re talking about high-risk algorithmic stablecoins, a collapse can hardly be seen as a tail risk since it’s not really all that unlikely. The point, however, is that there’s always some risk even with well-established stablecoins, and that’s something you should keep in mind. There are three main ways to hedge against this kind of risk in general: (1) diversification, (2) directly hedging specific stablecoins and (3) insurance.

The easiest way is simply not to have all of your money in a single stablecoin. No matter how safe you believe it is, there’s always some measure of risk involved, which is why the best move is to diversify into multiple (maybe just 2 or 3) reliable stablecoins with different risk profiles. In other words, don’t diversify out of USDC into an on-chain collateralized stablecoin that has USDC as most of its collateral – that way you’re not really reducing risk.

The second option is to directly short a stablecoin that you’re particularly worried about; this can be done either on a centralized exchange (through futures) or on a DeFi lending/borrowing protocol by looping borrows to create a leveraged short position. In any case, this is something you’d do only if you have a very good reason to be worried about that stablecoin, since the funding fees and interest rates would otherwise be too high to be practical. Finally, the ideal way to deal with this—and the way it works in TradFi—would be to have insurance, and there are some DeFi protocols that are offering insurance on stablecoins. The problem is that this is an extremely new and very risky area of DeFi, which is why some insurance protocols can carry a lot of risk themselves. As crypto continues to evolve and some insurance protocols achieve the kind of blue-chip reputation that the biggest lending/borrowing protocols enjoy, this will become a much more viable option, but for now, it’s far from ideal.

3. Conclusion

In this article, we went through everything from the background of what hedging is and why you would do it to the practical details of how different methods of hedging work. Now, you should be ready to implement this know-how in order to better protect your capital and take advantage of new opportunities such as RV trades. At any rate, the key thing to keep in mind is that everything above is just a framework; when it comes down to the actual execution of any strategy, that bit is up to you. There are plenty of options for each of the methods mentioned above: whether to choose a centralized or decentralized exchange, how to manage collateral for futures, how actively to monitor your positions etc. At the end of the day, you’re the one pulling the trigger and pressing either the green or the red button (or both at the same time), and the key is to take all the info that you can—such as everything that’s presented above—and use it to find and execute your own approach, whatever that happens to be.

Great article