Access & Protection

As a trader you’ll hear me talk about risk management quite a lot – it’s not a sexy topic but it’s essential to protect your capital and steadily grow your stack. From a TA perspective this means assessing the risk-to-reward ratio, setting stop losses and knowing when to take (at least partial) profit. But beyond this day-to-day risk management per trade, there are also a number of fundamental aspects you should manage at a portfolio level. Or all that hard work could come crashing down at any moment.

Eclectic Tastes

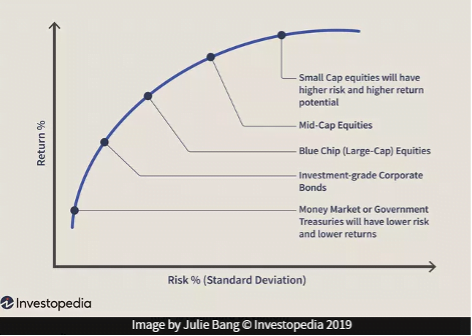

You may have heard the phrase “don’t put all your eggs in one basket”, which for trading or investing essentially means don’t put all your funds in one area, because if something goes wrong you could lose it all. The classic approach is to spread your money between stocks, bonds, cash and securities, which have a range of risk-to-return ratios.

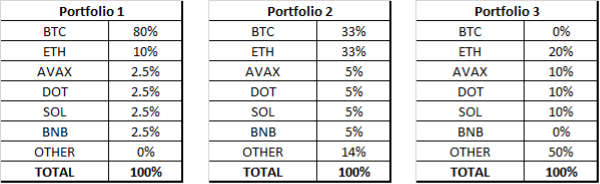

The world of crypto, however, presents a whole new curve, where it pays to know where your assets sit. Within crypto your portfolio mix may consider different asset classes, the phase of the market and how much risk you want to take. Consider the three examples below:

- If you have already made plenty of money you may pick a more conservative asset spread, such as Portfolio 1, and heavily load up on Bitcoin and Ethereum

- If you are young with a small amount of disposable income you may be prepared to take more risks and load up on altcoins, like in Portfolio 3.

And remember, whichever balance you choose, continue to re-evaluate the mix as the market heats up and cools down. Having a portion of your funds in stablecoins not only de-risks it, but gives you the opportunity to take advantage of any sudden market dips.

Safety Net

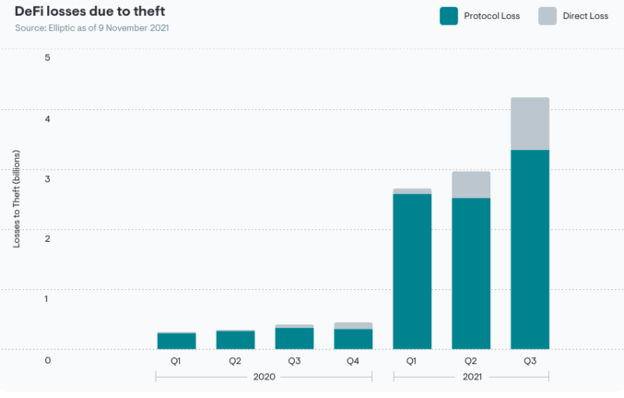

It’s not only market movements that can impact your net worth – with the rise of DeFi people have lost more than $10 billion this year through hacks, rugpulls and poor code. While I’m not necessarily a big fan of crypto insurance in its nascent state, I think it’s still responsible to tell you what options are out there. Some insurance policies are owned directly by a community (a ‘mutual’) and some work directly with protocols. Here’s a link that compares two mutual products out there.

The important thing to remember is that not everything is covered! If you lose your private keys, get phished or even suffer a rugpull, most of these insurances won’t cover you. The things that are typically included in coverage are related to exchange hacks, failure of smart contracts and stablecoins that lose their peg.

The crypto insurance narrative hasn’t had its bull run yet. I don’t know when it will happen, but it’s an area that also presents an opportunity for early entry into promising projects that may also come with the side benefit of effectively providing you free insurance through their native tokens.

Deadly Serious

Of course, worse than a rugpull is shuffling off this mortal coil. How on Earth are your family going to know where your crypto is or how to get it out? Some estimate that about 15% of all Bitcoin ever mined has been lost and can’t be accessed!

Again you can go down the insurance route here by working with a trust or inheritance specialist, but let’s face it, it’s mostly boomers spending their money on this. Bitcoin was created to be trustless, and I advise all of you to do a very simple thing: as well as having a list of your passwords and private keys, make a separate list of the websites required to access it with your usernames. It sounds tedious, but imagine the frustration if you were the one left looking for it…

This of course doesn’t guarantee that your relative will know how to extract the money! In my Discord I’ll talk a bit more about how I’ve set this up myself.

Ramp Down

Probably the most important thing to get to grips with is how you’re going to maximise the extraction of real world value from your stash. Although some people consider stacking sats a vocation, I’m someone that wants to know I’ll always be able to cash out if I need to, and that I won’t be giving up a large chunk of it to do so.

Tax regulation is different per country – for this reason, and the fact I’m not certified to provide financial advice, all I can say is: I do my taxes! But within the legal framework of each country there are things you may want to optimise on. In the U.S., if you have a significant amount of money you may consider a Charitable Remainder Trust, which can result in zero Capital Gains Tax (but is quite complicated to set up).

If you live in a crypto-friendly country you hopefully have a bank account that a) let’s you send money to crypto exchanges and b) more importantly let’s you send fiat back. Keep in mind that they may still have thresholds that trigger security checks (anti-money laundering), may ask for proof of source and may not insure deposits above a certain amount. So multiple bank accounts may be an option.

If you have a direct pathway to a bank consider next the fiat conversion fees. A big exchange like Coinbase will charge you up to 4% to convert to fiat and a further $25 to withdraw in the U.S., which could be a pretty sizeable amount in total. Crypto ‘banks’, such as BlockFi and Nexo can have lower conversion fees and are worth considering too.

However, some banks aren’t crypto friendly, and with some countries tightening regulation you may have to resort to some alternatives:

- For short term fund requirements – consider a crypto backed loan, where you borrow fiat against your crypto as collateral. If you can pay back the loan in a short period you didn’t need to convert any of your crypto in the process.

- For regular spending – consider a crypto debit or credit card. This is again country-specific in terms of access and taxes, but it does circumvent picky banks. Here’s a comparison of some of the popular cards out there.

- The most extreme move of course is to leave the country and take up residence in a low or zero-tax state! Portugal, Hong Kong, Puerto Rico and El Salvador’s future “Bitcoin City” are just a few of the options for this.

Know Your Funds

To summarise some of the key aspects we’ve covered in this article:

- Risk management applies to more than just TA

- Understanding your portfolio mix for each phase of the market is key

- Crypto insurance is a growing industry and may be a valuable service to some

- Plan for how your relatives will (or will not!) get access to your crypto when you’re gone

- Make sure you know your pathway to convert crypto to fiat and how to extract value from it

Staying in the game is the game.

Perfettoo top notch uncle Blood. Big thanks n Love,

Great advice. I immensely enjoyed the read. Thanks!

Very Informative. Fundamental puzzle pieces like this are hard to find in all of the ‘noise’. Thank You.

Looking forward to reading through all of the articles.

this is a critical component that very few talk about on Twitter etc the noise is deafening around “the next big thing” and how to get rich in 1 year. and yet asset management and protection is vital. Would love more content and a deeper dive into these areas. Thank you kindly for you time and energy and expertise.