If you’re primarily a trader, like me, then you’re probably used to buying and selling bitcoin, alts, stocks, commodities etc. What all those assets have in common is that they’re fungible. This means that any one unit of an asset is interchangeable with any other. One bitcoin is exactly the same as any other bitcoin, and the same goes for one share in a specific company or one ounce of gold.

Some assets, however, aren’t fungible, which means that they aren’t equivalent to other assets in the same class. So, while I wouldn’t mind if you took all my shares of TSLA and replaced them with the same number of your own TSLA shares, I definitely wouldn’t be cool with you taking the Rembrandt from my living room and replacing it with any other painting. NFTs — non-fungible tokens — as the name implies, are non-fungible, and in that sense they resemble paintings and artworks. Every NFT is unique, while its ownership can always be verified and traced on the blockchain, which means that these tokens have a ton of interesting use cases. They can be used to represent copyright claims (and they’re already being used that way in some countries), certificates, and everything else that needs to be unique and publicly verifiable.

What you’re interested in, I assume, are the NFTs that have become insanely popular lately and are fetching crazy prices, which primarily fall into the category of collectible NFTs that feature some sort of visual content. While these NFTs have taken off over the past year, they’re not a completely new phenomenon. In fact, the Ethereum-based game CryptoKitties got so popular in late 2017 that it congested the Ethereum network.

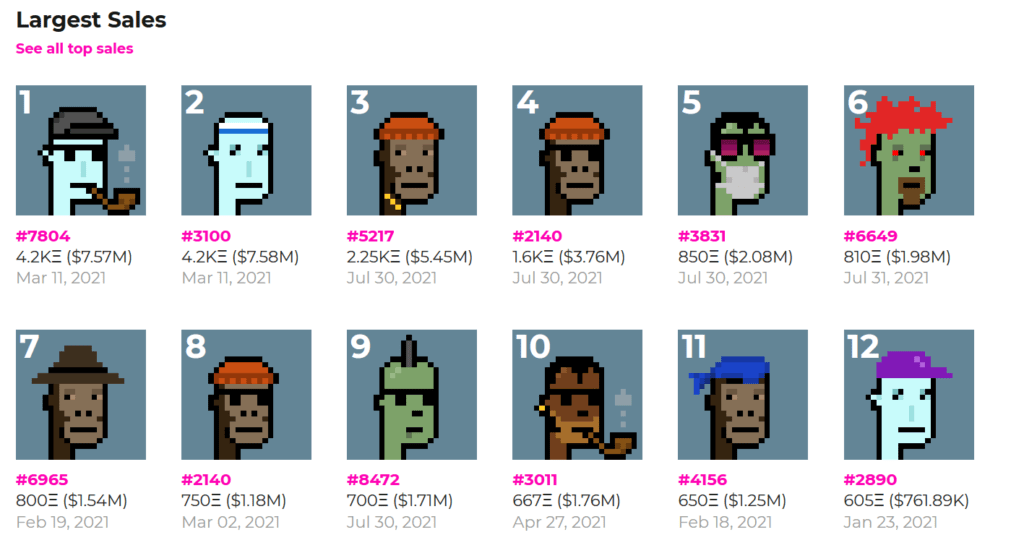

Even CryptoPunks, the best-known NFTs of today, with the lowest price for a punk being $85k, were launched in 2017. At the start, anyone could claim a punk for free with their Ethereum wallet — how’s that for a return on investment? The thing is, of course, that NFT projects don’t always enjoy the same sort of popularity, so that CryptoPunks, which were worthless at the beginning, can now fetch millions of dollars for the punks with the rarest attributes, while it’s also possible for an NFT project to lose popularity and, by consequence, all its value.

Also, it’s possible for a set of NFTs to be popular in a bull run, then lose essentially all of their value in the bear market, only to explode to new highs the next time they catch on. This is nothing strange for crypto — the same thing happens with all tokens — but it has some important consequences for traders. The main problem is that NFTs can become very illiquid when demand drops. Unlike for example Bitcoin, which you can always sell, even during a crash, you can only sell an NFT by listing it on a marketplace and waiting for someone to buy it. That’s why you can’t really have something like a stop loss with NFTs, as there’s no way to guarantee that someone will buy it. The only way you can be reasonably sure that you’ll sell it is to list it at an insanely low price, but then you’ll lose much more money.

So, the bottom line when flipping NFTs is not to risk too much money. Keep in mind that it’s a completely different ball game compared to trading liquid, fungible assets, and you can’t use the same methods that you’re used to in trading. The upside, however, can be extremely high, so it’s definitely a great idea if you find something that you think is underpriced. Don’t jump in at the top of the hype, though — buying the top is one danger that’s common to both fungible and non-fungible assets. The way to go is to find projects that you think will catch on soon. Here, you can forget about both TA and standard FA methods, what counts instead is the “meme value” of the NFTs. Are they easily recognizable? Do you think people will be using them as their profile pics on Twitter? Are they unique and something that meme-crazed Crypto Twitter could lose its mind about?

Then buy one early on, and you might get an insane return. Remember, even if you buy 10 NFTs from different sets for $1k each, and only one of them does a 20x while the others lose 50% of their value, that’s still a 2.5x return on your investment (yes, it’s still easier for all of them to lose value than it is for most of the fundamentally sound crypto assets out there, so don’t go aping into NFTs with half of your portfolio).