When trading with or buying your cryptocurrency on an exchange (even if it is your first time), you should always observe the order book before placing your orders. »What even is an order book and why the hell should I care to look at it?« you may ask. Here I’ll explain everything you need to know in order to read the order book as well as any other savvy trader and use it to your advantage.

The order book is an electronic list of all buy and sell orders of a cryptocurrency, which are organized by their price. It’s dynamic, meaning it’s constantly updated in real time, which enables more informed trading decisions with a »behind the scenes« view into the live action supply and demand dance of the market. The layout of the order book may vary from one exchange to the other, but they all have the same function.

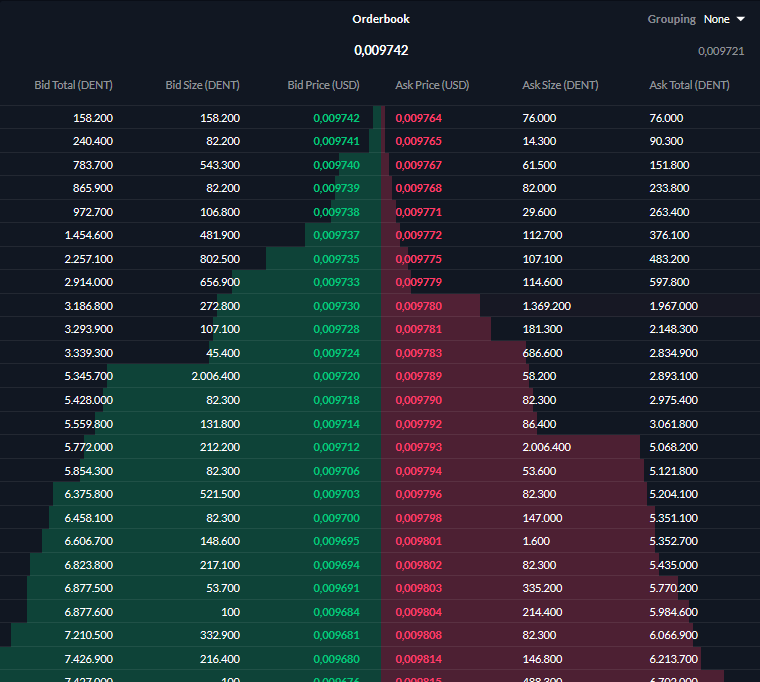

Here is an example of the orderbook:

With close observation of the order book, you can find imbalances of orders which can be used to your advantage, but we’ll explain more later on. Firstly, you have to understand the basic terms which are buy-side, bid, sell-side, ask, amount, price, spread, count and total, to be confident examining order books.

The buy side represents all open orders for buying the cryptocurrency below the last traded price and the offer, placed by the buyer is called the bid. It basically signals, that the person is interested in purchasing a specific amount of the token for a particular price.

On the flip side, we have the sell side, which represents all open sell orders of the token above the last traded price. This type of offer is called the ask and it represents an interest of a person, to sell a desired amount of the token, at a specified price.

The spread (in the order book) represents the gap between the highest bid and lowest ask order of the cryptocurrency. It also measures the liquidity of the token. If the liquidity is high, the spread will be lower.

The price and amount are fairly simple to understand and are relevant to both the buy and sell side. The amount defines how many coins are looking to be traded and the price shows for how much a trader is willing to sell or buy the amount. If there is more than one offer for an exact price, they are usually combined to one price level. The amount of offers combined is indicated by the count and the combined number of tokens is shown as the “total” value.

Now that you understand the basic terms, we can move on to the juicy part which will be useful when looking to enter a trade.

There are three big principals that will help you greatly:

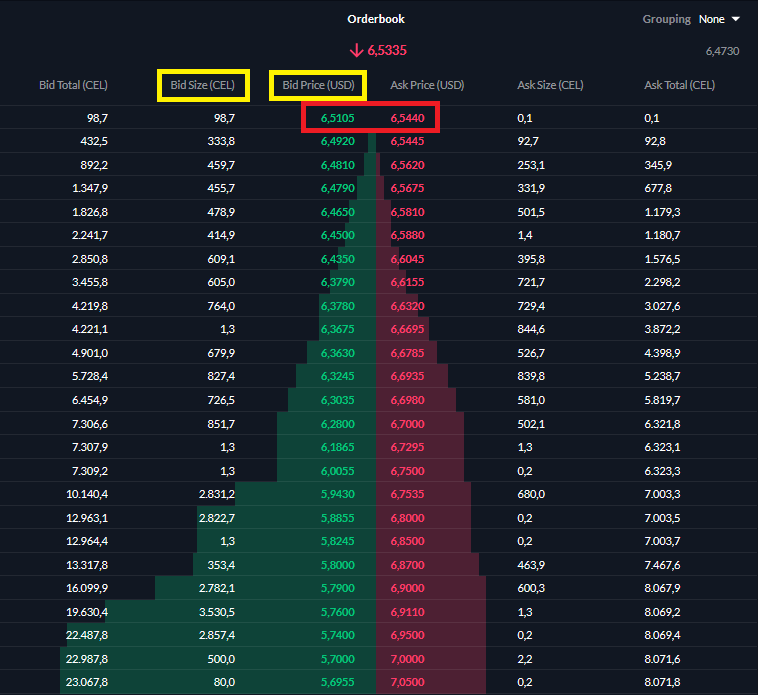

- An imbalance of buy and sell orders might indicate the price of the token will move up or down. If the buy orders are much more abundant than the sell orders, the price will probably move up as there is much more demand for buying then there is for selling. The same applies the other way around. When there are many more sell orders than buy orders, the price will probably fall. You can use this to your advantage; either buy quickly if there are too many buy orders or wait for the price to fall if there is an abundance of sell orders.

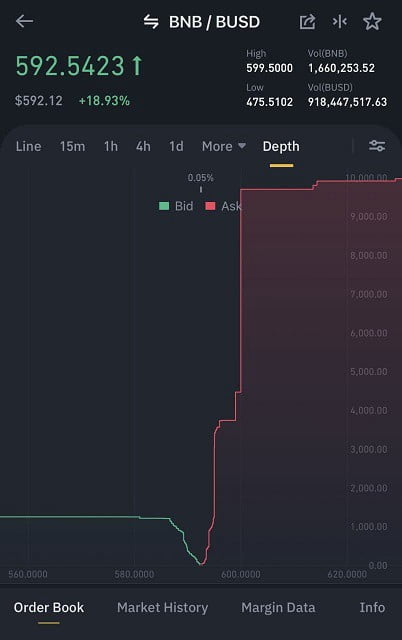

- The next thing you can look for is the buy or sell wall. The buy wall forms if there is a big amount of bids at a specific price. If the demand at this price point cannot be filled, the orders with a lower bid will not be filled as well. In this fashion, the buy wall acts as short term support as the price of the asset will not fall lower until the demand is filled. On the other hand, a sell wall is created if there are many sell orders at a specific price which are unlikely to be filled. This will act as short term resistance, not allowing the price to climb higher before the sell orders are filled.

As we mentioned before, the order book can signal low liquidity, which should be taken very seriously. If you place a large direct market buy order when there is low liquidity, your purchase will eat up a lot of sell orders on different price points, causing your average price per coin to be substantially higher than the mid-market price you were thinking you’ll get. This will not only screw up your entry point, it will also drive the price higher quickly, which the market will probably answer with a sell-off, pushing the price back down, setting you at a loss already. You can avoid this by setting up a bid for a specific price and wait for it to be filled.

Besides these three principals, the order book may reveal one more thing that can come in handy. An experienced trader might spot different kinds of market manipulations as the crypto market is less regulated and more prone to manipulation in comparison to the traditional markets. There are different kinds of market manipulation such as volume, price or order book manipulation. In a nutshell, they use different malicious tactics like spoofing, wash trading and order book manipulation, in order to give false signals to traders. To explain everything about market manipulation is out of the scope of this article, but I do recommend you read some additional resources as understanding this might save you quite a substantial amount of resources.

Pooof! Hard to understand it!