At first glance, the words ‘staking’ and ‘farming’ could mean any number of things and newbies may be more likely to associate them with Dracula and tractors rather than cryptocurrency. But there’s a lot of lingo in any technical field and crypto is no different. It’s therefore important to understand key terms, and although there may be many different flavours of each one, we can fortunately explain the core meanings in simple terms.

This is a two-part series, and I’ll explain Staking in Part 1 and Farming in Part 2.

Stake your Claim

There are two main definitions of the verb ‘stake’ in the English language:

- To risk an amount of money

- To hold up and support something by fastening it to stakes

In addition, the phrase ‘to stake a claim’ means “you say or show that you have a right to it and that it should belong to you”.

In a way, all three of these definitions are relevant to crypto staking, which is all linked to the “Proof of Stake” (PoS) consensus mechanism used by some blockchains. The aim is to ensure that the nodes validating transactions are acting faithfully and “Proof of Stake” does this by asking them to lock up some of their own assets as a security deposit. If they misbehave, they may suffer what’s known as ‘slashing’, where they lose a portion of their ‘stake’ e.g. due to double signing.

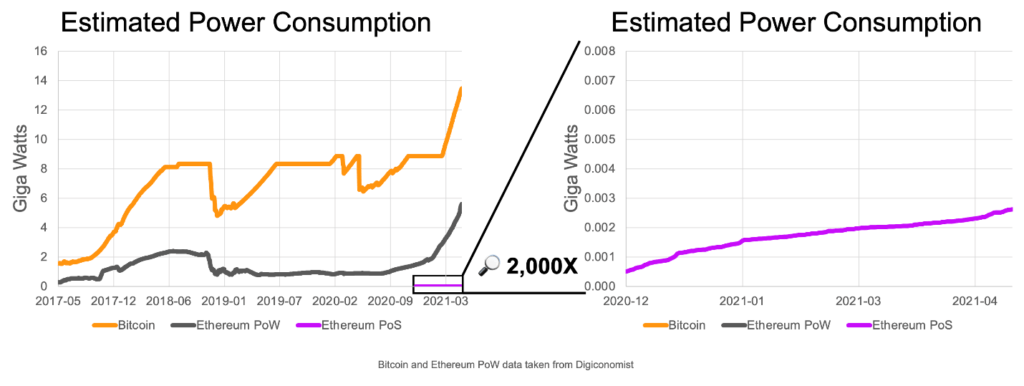

For your services acting as a validator you are rewarded with transaction fees, which act as a return on the value of the assets you have locked up. This is different to mining on a “Proof of Work” (PoW) blockchain, where validators use electricity and computer power to iteratively guess a mathematical solution, in a much more energy-intensive process, as shown by this Ethereum blog graph:

But I’m Not a Node and I’m Still Staking!

That could very well be the case, especially if you’re not familiar with the technical requirements to set up a node. There could be one of two things going on:

- You’re part of a staking pool or using a staking wallet

- You’re receiving rewards called ‘staking’ but it’s not technically staking

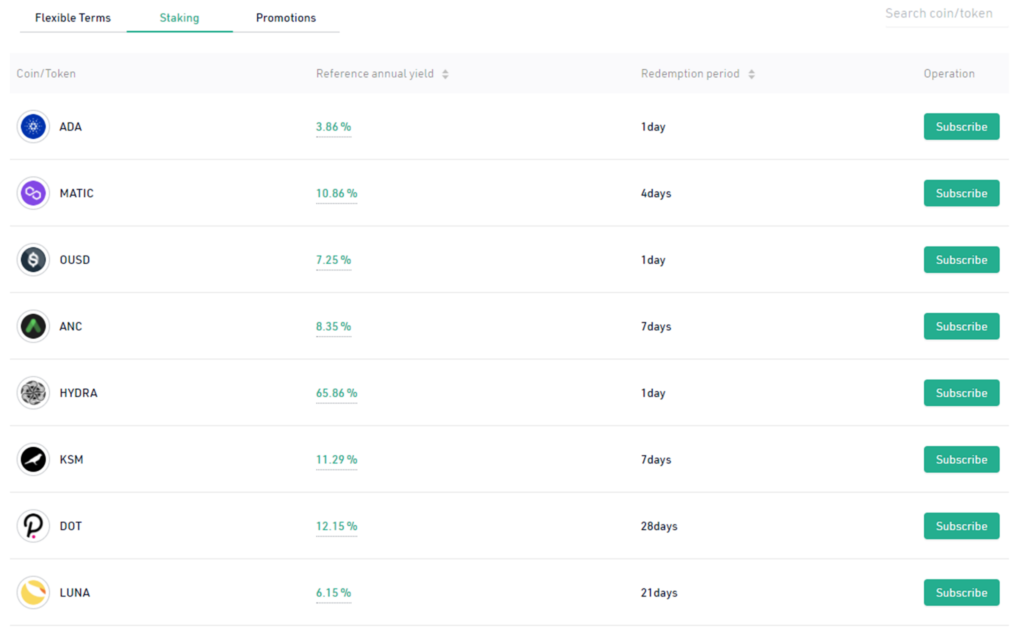

The first option is very common and is offered by exchanges or any independent third party that is prepared to run the node in the background. You just lend your assets and they provide you with a return over a specified time period. For example, users of KuCoin exchange may have seen the Pool-X feature, which is a linked platform designed to allow staking, as shown here:

These are quite short lock-up periods, but on other platforms with other coins it could extend out to a full year. The more assets staked by independent validators the more secure and decentralised it is. The more popular a blockchain is, the more revenue it generates through transaction fees.

They key thing to note here though is that it is typically a blockchain’s native token that is staked to secure a network. For example, you can stake Ethereum now (to help secure the Beacon Chain and eventually the mainnet when it migrates over in 2022) and get a return. But the return on a staked asset depends very much on how many tokens are staked in total and how many validators there are, as this chart from Ethereum Launchpad shows:

So newer blockchains or blockchains that have only just started staking rewards may offer higher returns, but remember that comes with the risk of them being less secure. In general though, staking can earn you passive income on your locked-up assets anywhere from about 5% up to 20%. And, as we defined earlier, by staking you risk money, support something and have a claim to your assets when the lock-up period expires.

So How Am I Staking A Non-Native Token?

When you stake a blockchain native token, you receive interest in the form of that native token back. And that’s because the transaction fees are paid in the native token. Simple.

But there are a number of other cryptocurrencies that you might see offering staking even though they don’t support a blockchain network. So where does the interest come from? Well it could come from many places, but I try to make a distinction between sustainable revenue and a finite treasury.

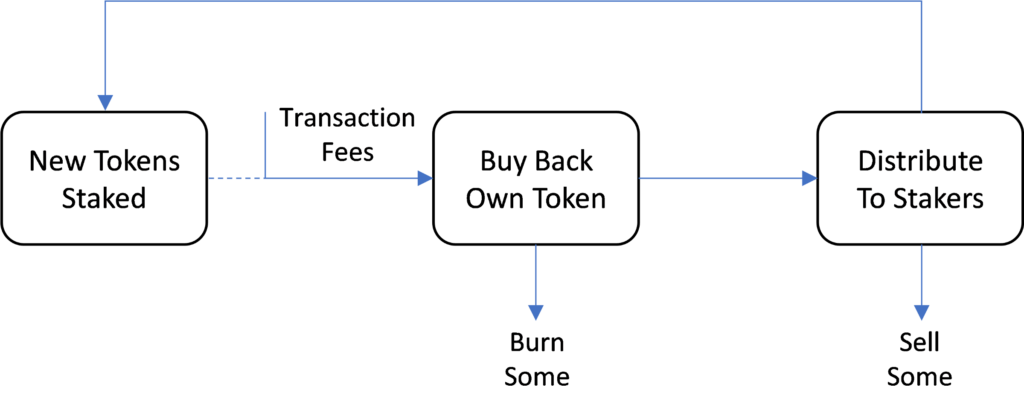

Imagine a dApp that offers a service on an independent blockchain. If that service is popular it might generate revenue in the form of transaction fees, either in it’s own token or a stablecoin — the advantage of the latter is that they may get more users with a popular stablecoin, which they could then use to buy their own token back off the market and distribute to “stakers”, as shown below:

Stakers in this example are not securing a blockchain network, but instead are supporting the dApp and it’s own token by removing supply from circulation and creating buying pressure until price reaches a new equilibrium.

Look for Sustainable Revenue

Where you should be more careful is if a project does not currently have any sustainable revenue model. It is quite common for new projects to allocate a certain portion of total token supply to a treasury or community/project development pot. These tokens are often used to kick-start interest in a project, whether through airdrops, advertisements, meme-contests, or even a “staking” campaign.

The return rates on these early interest staking initiatives can be very high, but realise that the rewards are coming from a finite pot that will one day cease to be available. There are some legitimate projects launching like this, but remember that you are taking on both asset price risk while it is locked-up and the risk of loss due to an exit scam. You may wish to consider a shorter lock-up period if possible that gives you more opportunity to re-assess the situation as time passes.

Key Takeaway

The main thing to remember is that staking is about taking assets out of circulation in order to support a network or dApp. These assets don’t do anything, but the mere fact that they are locked away grants you a right to a portion of a system’s revenue, much like stock investors receive dividends for continuing to hold their assets in their portfolios. You can earn single-digit to low double-digit returns, but just make sure you understand the time period and reputation of the service before you dive in.