In this uncertain crypto market you can save yourself a huge amount of stress and money if you know how to properly set stop-losses. While this sounds like a no-brainer, many people just ignore it or sometimes set them up incorrectly, actually making them sell at suboptimal timings. Here we’ll take a look at what exactly stop-losses are, how to set them up correctly and what common mistakes you should avoid.

Stop-losses are predefined orders that execute automatically either for selling or buying a cryptocurrency. It’s designed to limit a trader’s loss for their open positions. Simply said, it’s like a safety net for when the markets turn against you. Optimally, they’re predetermined and set up immediately after entering a position. By correctly setting it up you pre-define your risk in terms of potential money lost. For example, if you buy $100 worth of Bitcoin at the $10k mark, guessing the price will soon go up, you can set up a stop-loss at the $9k price point. If your prediction is wrong and the price takes a huge dump, the stop-loss will sell your position immediately after the price reaches $9k, setting you only at 10% loss, even if the price would then fall much lower. Of course, such an event is unwanted but it helps you keep peace of mind, knowing you can’t lose much more than 10% (if the price moves really quickly, the loss might be a bit bigger). This method is also applicable for when you’re shorting a cryptocurrency — if the price would climb up, the stop-loss can buy back the tokens before they reach a price point that would set you up for a substantial loss.

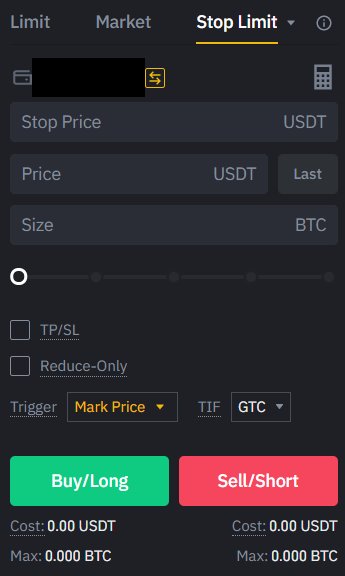

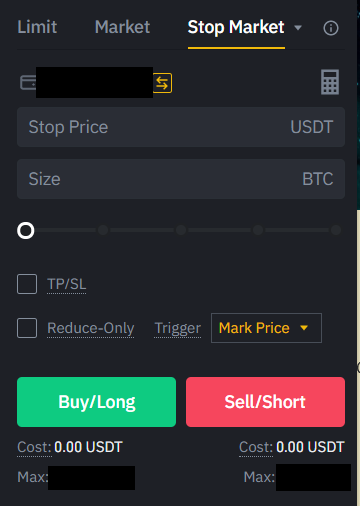

Some exchanges offer different types of stop-losses. For instance, you can set up a direct “stop market” that will sell the tokens at market price (and you’ll be the taker), but the price in the trade might be lower if the market moves quickly. On the other hand, a “stop limit” will create an offer to sell your tokens at a specified price if the tokens fall to a predetermined range — the main difference here is that you’ll be the maker and your coins will be sold at an exact price point, but your offer might not go through if the price is moving too quickly. To avoid losing money because of a misunderstanding of the tools an exchange is offering, make sure you read instructions and test these options before actually using them.

Now let’s take a look at some of the most common errors traders make setting up stop-losses. When setting up a stop-loss, you need to make sure it’s set up at the point of invalidation — where it’s proven that your trade idea is wrong. If it’s set up higher than that point, your position might get closed when the price creeps near the point of invalidation before realizing the gains you predicted. If the stop-loss is set up lower than the point of invalidation, you might record an additional amount of losses you could’ve avoided by setting up your stop-loss exactly where the price confirms you were wrong. The key here is to set up the stop-loss at such a point to allow daily price fluctuations but limit the losses as much as possible.

The next mistake is moving your stop-loss to your entry point as soon as possible. While the price might reach your goal, it could bounce down below your entry point and back up after that, causing you to sell prematurely for no reason.

Of course, there are times when it makes sense to move your stop loss and never moving it is also a mistake. When the price is moving close to the target price or there’s no real reason for the price to go back down and the technical analysis confirms it or the point of invalidation shifts, it is wise to move your stop-loss to guarantee a good risk/reward ratio.

Never place your stop-loss based on some arbitrary number or percentage below your entry point. While it may sound reasonable to pick a specific amount of risk you’re willing to take, the stop-loss should always be determined based on technical analysis of the market.

Lastly, you should always determine the stop-losses before entering the trade. When you’re already in, you’ll likely make emotional decisions and screw up you stop-losses, either by setting them too low, convincing yourself that you don’t have to take a loss yet or setting them too high from the influence of price going down without actually invalidating your trade idea.

To sum it up, always use a stop-loss so that you don’t risk too much, place it on the point of invalidation of your trading idea and move it once the invalidation point shifts. I hope this has been helpful and stay tuned for the next crypto lesson!

Thank you for all this!! Love how you explain in simple and understandable terms! Love it!!

How can I get your book?

Perfetto uncle BloodG!