Bloodgang,

Welcome to the thirty-seventh issue of Bloodgood’s notes. The idea of this newsletter is to give you an overview of the previous week’s fundamentals and what happened on charts as well as to remind you of this week’s articles, secret TA tips, and trading calls. Basically, it’s about giving you all the key info in one place.

Table of contents

- Fundamental overview

- Bitcoin and Ethereum chart

- Blood’s content recap

- Concluding notes

As this community grows, I have a duty to give back to all of you that helped me and supported me to become what I am. This free newsletter is just another way to share my experiences and prepare you for the journey that’s ahead of you.

Love,

Blood

Fundamental overview

In a different market environment, I’d be talking about innovations in DeFi or exciting new layer 1 and layer 2 networks that could bring more adoption and scalability. Unfortunately, that’s not the environment we’re in—by far the biggest factor that’s driving narrative across all assets is and will remain to be the macro situation—so, of course, we need to talk about interest rates.

We’re still very much in the “good news = bad news” phase, with a strong labor market signaling that the Fed can be more aggressive with raising rates. Meanwhile, the hotter-than-expected CPI will only serve to force their hand in this direction even more, and the big event that everyone is waiting for is the FOMC meeting this Wednesday. Most are expecting a 75 basis point hike, although 100 bps is definitely on the table. If they decide to be a bit more macho and go with the 100, risk-on assets will react strongly, while 75 would probably just lead to more choppy price action.

Luckily, there’s a glimmer of hope for crypto in the current macro outlook: the EU is having more and more trouble with yield spreads growing between countries like Italy, Portugal and Spain on the one hand, and members like Germany on the other. Simply put, this means that borrowing money could become too expensive for economically less stable countries—with some of these (most notably Italy) already experiencing political problems of their own—so that it’s up to the European Central Bank to keep them in the Eurozone by bringing yields down. How do they do this? Well, they print money to buy these countries’ bonds (this is the recently unveiled “Transmission Protection Instrument”). As the age-old economic equation goes: printer go BRR = number go up.

Bitcoin

Bitcoin/Dollar Weekly chart

Bitcoin/Dollar Daily chart

Such a bullish week for Bitcoin, but a bearish weekly close.

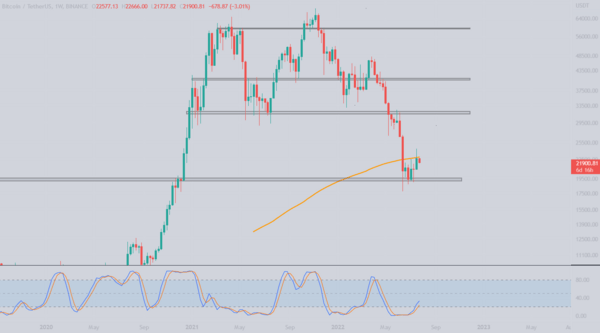

In the previous letter we discussed if this time was any different, when Bitcoin tested the weekly MA200 and it broke above as well as traded above for the whole week. We even made a high of $24,276 and many traders were caught longing late. In the end we got a weekly close below the weekly 200 moving average and so far it seems that this a bull trap. Technically speaking Bitcoin got rejected on a weekly level and currently there is more potential to the downside than to the upside, but let’s see what this weekly brings us.

On a daily level, we can also see that the retest of the ascending triangle did not hold and we are trading back in the triangle. If the daily candle closes inside the triangle, then the next technical level that makes sense is the uptrend line around $20,000. In case the daily candle closes above the resistance level, then we will consider this as a bear trap and a bullish continuation.

The Stoch RSI on a daily level is breaking out of the overbought area as we speak and the weekly level has broken out of the oversold area. The volume on the daily is decreasing, which could indicate that bulls are interested in buying Bitcoin at current levels, but are just waiting on the sidelines to see how this one will play out.

I am not entering any new positions right now as I will closely monitor what will happen on the daily timeframe and of course the weekly MA200.

Ethereum

Ethereum/Dollar Weekly chart

Ethereum/Bitcoin Daily chart

Ethereum stuck between $2k and the 2018 ATH.

Seems like the 2018 ATH was confirmed and ethereum pushed way higher if we compare it to last week’s letter. If you were patiently waiting for that weekly close to see if the structure holds, you are now safe to enter, HOWEVER, keep in mind that the first technical level which could be your entry is $1350 or somewhere around the 2018 ATH.

Entering here in the middle between support and resistance could liquidate you quickly, especially if you open the daily chart you will see that a bart pattern has formed, meaning we can dump to $1350 just as fast as we pumped. The daily Stoch RSI is still in the overbought area meaning it still needs to reset before making any sudden moves.

ETH/BTC is playing our levels, a quick push through 2 key levels led ETH to retest the 0.07 BTC level, but it got rejected and dropped to the 0.065 BTC support. Seems like ETH bulls are serious this time as in the last week we got another test of the 0.07 BTC resistance and at the time of writing we are trading right below it, lets see if this week ETH can push above this level.

Of course all eyes are set on the merge which is set to happen in the second half of September 2022.

Blood’s content recap

New article on Position Sizing

“Master Position Sizing in a few minutes

I dropped a new PDF in my Telegram channel where you will learn:

– How to calculate your position size

– Risk analysis process

– All about emotional control

Don’t get your account blown up right before the new leg up

Share with frens”

Telegram: Contact @bloodgoodbtc

This telegram channel is used for day trades that will not be shared on Twitter and for educational content. Twitter: https://twitter.com/bloodgoodBTC

KuCoin Insolvency situation explained

A thread about whether KuCoin is insolvent or not

Concluding notes

These market conditions throw a lot of instability into the mix, along with a hefty dose of FUD from all sides. Yes, of course some very big players turned out to be insolvent, but don’t let that fool you into thinking that every institution or project is done for. Remember the mindless euphoria at the top of the bull market, which seems so ridiculous in retrospect? Well, the same thing happens when bears get euphoric too. Do your best to stay rational, keep away from both greed and despair, and you’ll be fine.